Question: MANAGERIAL ACCOUNTING - (FALL SEMESTER 2017) ASSESSMENT NUMBER 4 PERFORMANCE EVALUATION OF INVESTMENT CENTERS Viola Holloway is the division manager of the Instruments Division of

MANAGERIAL ACCOUNTING - (FALL SEMESTER 2017)

ASSESSMENT NUMBER 4

PERFORMANCE EVALUATION OF INVESTMENT CENTERS

Viola Holloway is the division manager of the Instruments Division of Forrow Aerodynamic Company. Viola Holloway is evaluating whether to acquire a new product for the Instruments Division. The Budgeted Income (Net Operating Income) for next year for the Instruments Division is presently $750,000 with Average Operating Assets of $3,000,000. The proposed investment in the new product would add projected Net Income (Net Operating Income) of $360,000 and would require an additional investment in Equipment (Average Operating Assets) of $2,000,000. Forrow Aerodynamic Company requires a Minimum Required Rate Of Return on its investment of twelve percent (12%).

Required

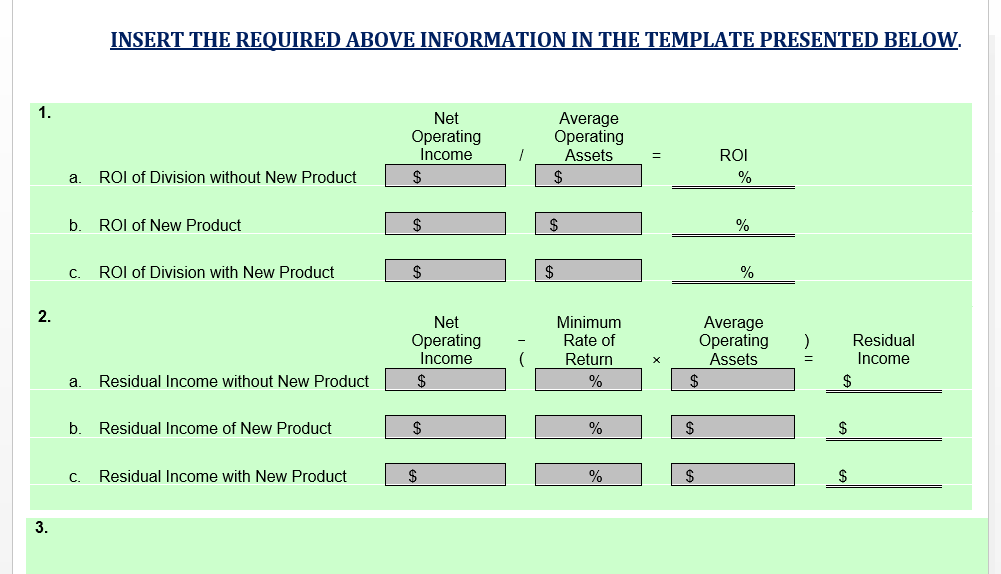

1. Compute the Return On Investment (ROI) for the Instruments Division of Forrow Aerodynamic Company under the following scenarios:

a. If the new product is not acquired.

b. Of the new product only (assuming it is acquired).

c. If the new product is acquired.

2. Compute the Residual Income for the Instruments Division of Forrow Aerodynamic Company under the following scenarios:

a. If the new product is not acquired.

b. Of the new product only (assuming it is acquired).

c. If the new product is acquired.

3. Will Viola Holloway acquire or not acquire the new product if Forrow Aerodynamic Company evaluates performance of its Investments Centers under the:

a. Return On Investment (ROI) Formula.

b. Residual Income Approach.

INSERT THE REQUIRED A BOVE INFORMATION IN THE TEMPLATE PRESENTED BELow Net Operating Income Average Operating Assets - ROl a. ROI of Division without New Product b. ROl of New Product C. ROI of Division with New Product 2 Net Operating Minimum Rate of Average OperatingResidual Income IncomeReturnx Assets | S )'' a. Residual Income without New Product b. Residual Income of New Product C. Residual Income with New Product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts