Question: MANAGERIAL ACCOUNTING HANDOUT PROBLEM 12 Score Name Section Problem (10 points). SAPODILLA CORPORATION TIME VALUE OF MONEY SITUATIONS FOR ANALYSIS (1) Sapodilla Corporation has decided

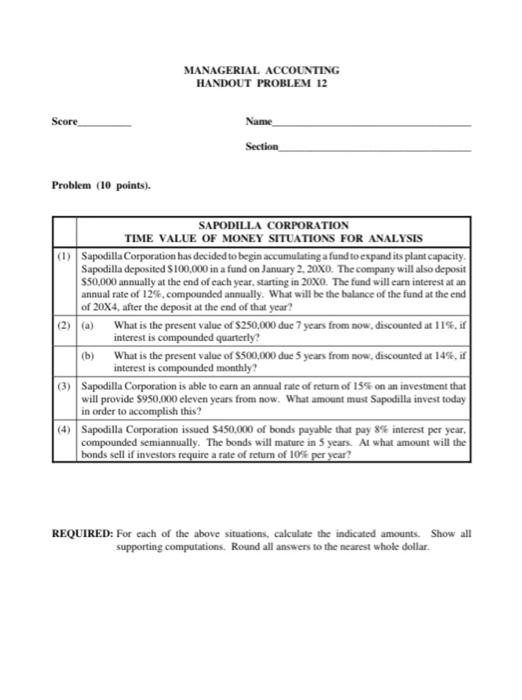

MANAGERIAL ACCOUNTING HANDOUT PROBLEM 12 Score Name Section Problem (10 points). SAPODILLA CORPORATION TIME VALUE OF MONEY SITUATIONS FOR ANALYSIS (1) Sapodilla Corporation has decided to begin accumulating a fund to expand its plant capacity Sapodilla deposited S100,000 in a fund on January 2, 20X0. The company will also deposit $50,000 annually at the end of each year, starting in 2030. The fund will earn interest at an annual rate of 12%.compounded annually. What will be the balance of the fund at the end of 20X4, after the deposit at the end of that year? (2) @ What is the present value of $250,000 due 7 years from now, discounted at 11%, if interest is compounded quarterly! (b) What is the present value of $500.000 due 5 years from now.discounted at 14%, if interest is compounded monthly (3) Sapodilla Corporation is able to carn an annual rate of return of 15% on an investment that will provide $950,000 eleven years from now. What amount must Sapodilla invest today in order to accomplish this? (4) Sapodilla Corporation issued $450,000 of bonds payable that pay 8% interest per year, compounded semiannually. The bonds will mature in 5 years. At what amount will the bonds sell if investors require a rate of retum of 10% per year? REQUIRED: For each of the above situations, calculate the indicated amounts. Show all supporting computations. Round all answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts