Question: MANAGERIAL ACCOUNTING HANDOUT PROBLEM 7 Score Name Section Problem (10 points). Triangle Corporation manufactures two way radios. It has the following data for its operations

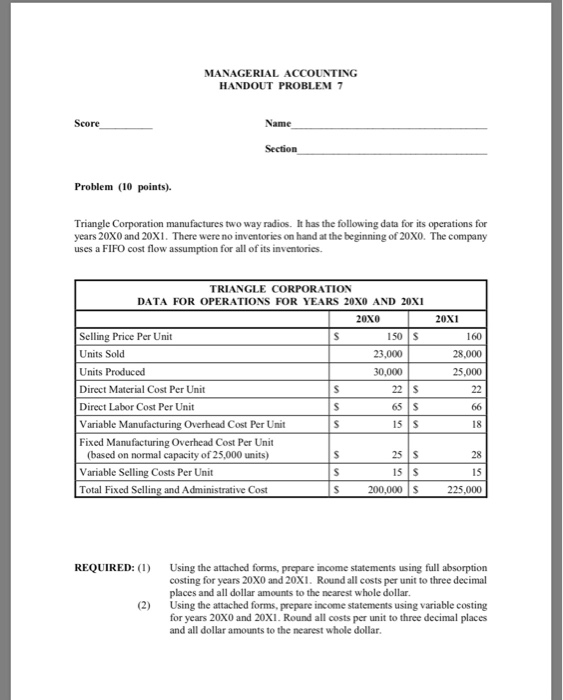

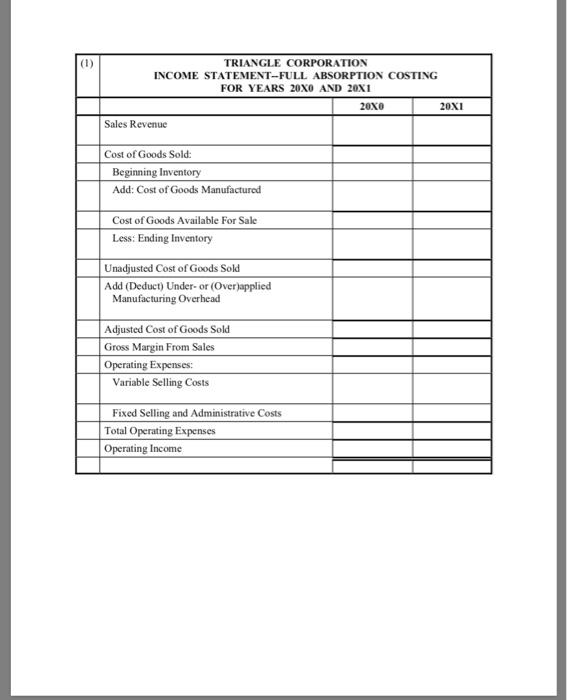

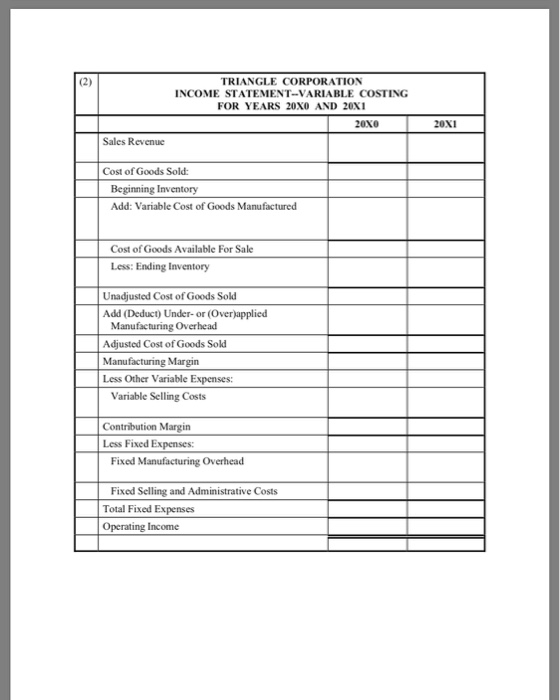

MANAGERIAL ACCOUNTING HANDOUT PROBLEM 7 Score Name Section Problem (10 points). Triangle Corporation manufactures two way radios. It has the following data for its operations for years 20X0 and 20X1. There were no inventories on hand at the beginning of 20X0. The company uses a FIFO cost flow assumption for all of its inventories. TRIANGLE CORPORATION DATA FOR OPERATIONS FOR YEARS 20X0 AND 20XI 20X0 20X1 150 S Selling Price Per Unit 160 Units Sold 23,000 28,000 Units Produced 30,000 25,000 S 22 S Direct Material Cost Per Unit 22 Direct Labor Cost Per Unit 65 S 66 15 S Variable Manufacturing Overhead Cost Per Unit S 18 Fixed Manufacturing Overhead Cost Per Unit (based on normal capacity of 25,000 units) Variable Selling Costs Per Unit Total Fixed Selling and Administrative Cost 25 S 28 S 15 S 15 200,000 S 225,000 Using the attached forms, prepare income statements using full absorption costing for years 20X0 and 20X1. Round all costs per unit to three decimal places and all dollar amounts to the nearest whole dollar. Using the attached forms, prepare income statements using variable costing for years 20X0 and 20X1. Round all costs per unit to three decimal places and all dollar amounts to the nearest whole dollar REQUIRED: (1) (2) (1) TRIANGLE CORPORATION INCOME STATEMENT-FULL ABSORPTION COSTING FOR YEARS 20x0 AND 20X1 20x0 20X1 Sales Revenue Cost of Goods Sold: Beginning Inventory Add: Cost of Goods Manufactured Cost of Goods Available For Sale Less: Ending Inventory Unadjusted Cost of Goods Sold Add (Deduct) Under- or (Over)applied Manufacturing Overhead Adjusted Cost of Goods Sold Gross Margin From Sales |Operating Expenses Variable Selling Costs Fixed Selling and Administrative Costs Total Operating Expenses Operating Income TRIANGLE CORPORATION (2) INCOME STATEMENT-VARIABLE COSTING FOR YEARS 20X0 AND 20X1 20x0 20X1 Sales Revenue Cost of Goods Sold: Beginning Inventory Add: Variable Cost of Goods Manufactured Cost of Goods Available For Sale Less: Ending Inventory Unadjusted Cost of Goods Sold Add (Deduct) Under- or (Over)applied Manufacturing Overhead Adjusted Cost of Goods Sold Manufacturing Margin Less Other Variable Expenses: Variable Selling Costs Contribution Margin Less Fixed Expenses: Fixed Manufacturing Overhead Fixed Selling and Administrative Costs Total Fixed Expenses Operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts