Question: Managerial Costing Please note: this section must necessarily be carried out in one or more foolscaps other than the one or ones containing the previous

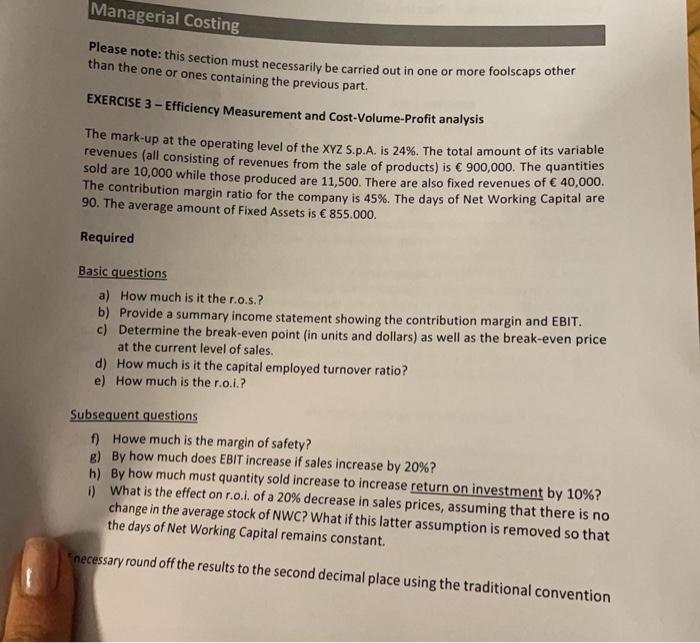

Managerial Costing Please note: this section must necessarily be carried out in one or more foolscaps other than the one or ones containing the previous part. EXERCISE 3 - Efficiency Measurement and Cost-Volume-Profit analysis The mark-up at the operating level of the XYZ S.p.A. is 24%. The total amount of its variable revenues (all consisting of revenues from the sale of products) is 900,000. The quantities sold are 10,000 while those produced are 11,500. There are also fixed revenues of 40,000. The contribution margin ratio for the company is 45%. The days of Net Working Capital are 90. The average amount of Fixed Assets is 855.000. Required Basic questions a) How much is it the r.o.s.? b) Provide a summary income statement showing the contribution margin and EBIT. c) Determine the break-even point (in units and dollars) as well as the break-even price at the current level of sales. d) How much is it the capital employed turnover ratio? e) How much is the r.o.i.? Subsequent questions f) Howe much is the margin of safety? g) By how much does EBIT increase if sales increase by 20%? h) By how much must quantity sold increase to increase return on investment by 10%? 1) What is the effect on r.o.i. of a 20% decrease in sales prices, assuming that there is no change in the average stock of NWC? What if this latter assumption is removed so that the days of Net Working Capital remains constant. necessary round off the results to the second decimal place using the traditional convention Managerial Costing Please note: this section must necessarily be carried out in one or more foolscaps other than the one or ones containing the previous part. EXERCISE 3 - Efficiency Measurement and Cost-Volume-Profit analysis The mark-up at the operating level of the XYZ S.p.A. is 24%. The total amount of its variable revenues (all consisting of revenues from the sale of products) is 900,000. The quantities sold are 10,000 while those produced are 11,500. There are also fixed revenues of 40,000. The contribution margin ratio for the company is 45%. The days of Net Working Capital are 90. The average amount of Fixed Assets is 855.000. Required Basic questions a) How much is it the r.o.s.? b) Provide a summary income statement showing the contribution margin and EBIT. c) Determine the break-even point (in units and dollars) as well as the break-even price at the current level of sales. d) How much is it the capital employed turnover ratio? e) How much is the r.o.i.? Subsequent questions f) Howe much is the margin of safety? g) By how much does EBIT increase if sales increase by 20%? h) By how much must quantity sold increase to increase return on investment by 10%? 1) What is the effect on r.o.i. of a 20% decrease in sales prices, assuming that there is no change in the average stock of NWC? What if this latter assumption is removed so that the days of Net Working Capital remains constant. necessary round off the results to the second decimal place using the traditional convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts