Question: Problem 2 (Three-step binomial model for American option). (12 pts) In a three-step model with U = 0.1, D=-0.1, R=0.03, the initial stock price is

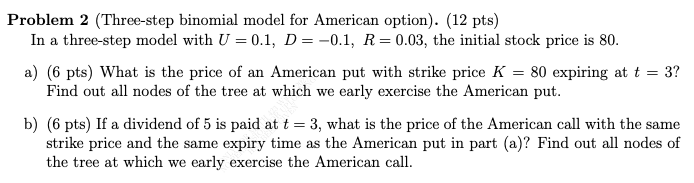

Problem 2 (Three-step binomial model for American option). (12 pts) In a three-step model with U = 0.1, D=-0.1, R=0.03, the initial stock price is 80. a) (6 pts) What is the price of an American put with strike price K = 80 expiring at t = 3? Find out all nodes of the tree at which we early exercise the American put. b) (6 pts) If a dividend of 5 is paid at t = 3, what is the price of the American call with the same strike price and the same expiry time as the American put in part (a)? Find out all nodes of the tree at which we early exercise the American call. Problem 2 (Three-step binomial model for American option). (12 pts) In a three-step model with U = 0.1, D=-0.1, R=0.03, the initial stock price is 80. a) (6 pts) What is the price of an American put with strike price K = 80 expiring at t = 3? Find out all nodes of the tree at which we early exercise the American put. b) (6 pts) If a dividend of 5 is paid at t = 3, what is the price of the American call with the same strike price and the same expiry time as the American put in part (a)? Find out all nodes of the tree at which we early exercise the American call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts