Question: Managerial Finance Managerial Finance: Assignment 3 Name: Grade: Problem 1: P9.4 Page 420 C, D, E (30 points) Cost of debt using the approximation formula;

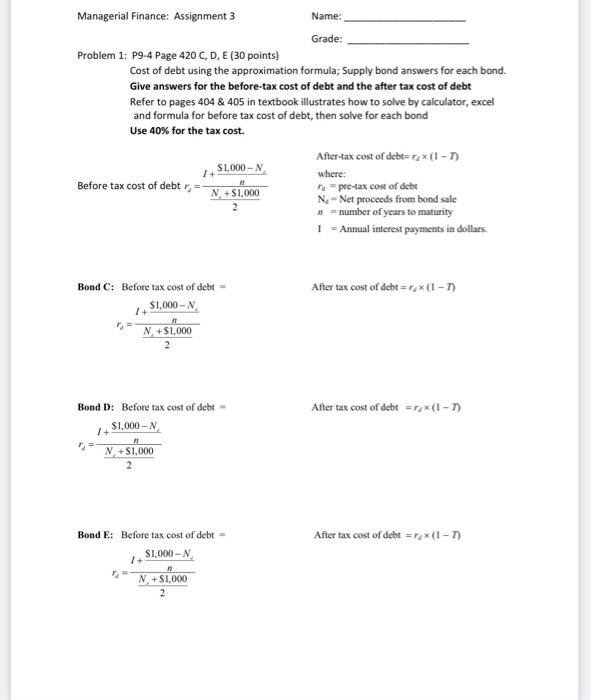

Managerial Finance: Assignment 3 Name: Grade: Problem 1: P9.4 Page 420 C, D, E (30 points) Cost of debt using the approximation formula; Supply bond answers for each bond. Give answers for the before-tax cost of debt and the after tax cost of debt Refer to pages 404 & 405 in textbook illustrates how to solve by calculator, excel and formula for before tax cost of debt, then solve for each bond Use 40% for the tax cost. After-tax cost of debt=12*(1-1) S1,000- where: Before tax cost of debt r, N +$1,000 pre-tax cost of debt N-Net proceeds from bond sale 2 = number of years to maturity 1 - Annual interest payments in dollars. Afler tax cost of debt = r *(1-1) Bond C: Before tax cost of debt = $1,000 - N 1+ N +$1,000 After tax cost of debt == *(1-1) Bond D: Before tax cost of debt - 1+ $1,000-N 11 N +S1,000 2 Bond E: Before tax cost of debt = After tax cost of debt = *(1-1) $1,000 - N+S1.000 2 Managerial Finance: Assignment 3 Name: Grade: Problem 1: P9.4 Page 420 C, D, E (30 points) Cost of debt using the approximation formula; Supply bond answers for each bond. Give answers for the before-tax cost of debt and the after tax cost of debt Refer to pages 404 & 405 in textbook illustrates how to solve by calculator, excel and formula for before tax cost of debt, then solve for each bond Use 40% for the tax cost. After-tax cost of debt=12*(1-1) S1,000- where: Before tax cost of debt r, N +$1,000 pre-tax cost of debt N-Net proceeds from bond sale 2 = number of years to maturity 1 - Annual interest payments in dollars. Afler tax cost of debt = r *(1-1) Bond C: Before tax cost of debt = $1,000 - N 1+ N +$1,000 After tax cost of debt == *(1-1) Bond D: Before tax cost of debt - 1+ $1,000-N 11 N +S1,000 2 Bond E: Before tax cost of debt = After tax cost of debt = *(1-1) $1,000 - N+S1.000 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts