Question: Managerial Finance: part 2 Instructions: Use the Document Financial Report 2018 of Starbucks Company. All the required information can be found there. Use the following

Managerial Finance: part 2

Instructions:

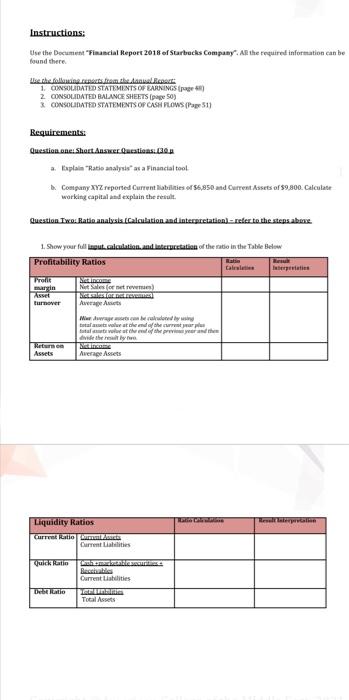

Use the Document Financial Report 2018 of Starbucks Company. All the required information can be found there.

Use the following reports from the Annual Report:

1. CONSOLIDATED STATEMENTS OF EARNINGS (page 48)

2. CONSOLIDATED BALANCE SHEETS (page 50)

3. CONSOLIDATED STATEMENTS OF CASH FLOWS (Page 51)

Part 2

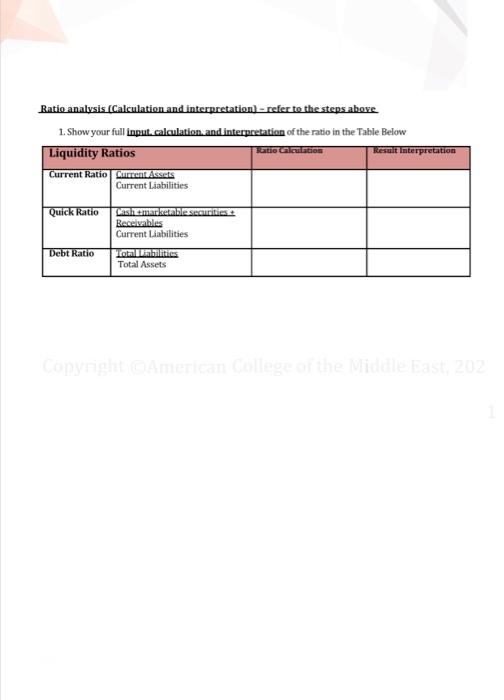

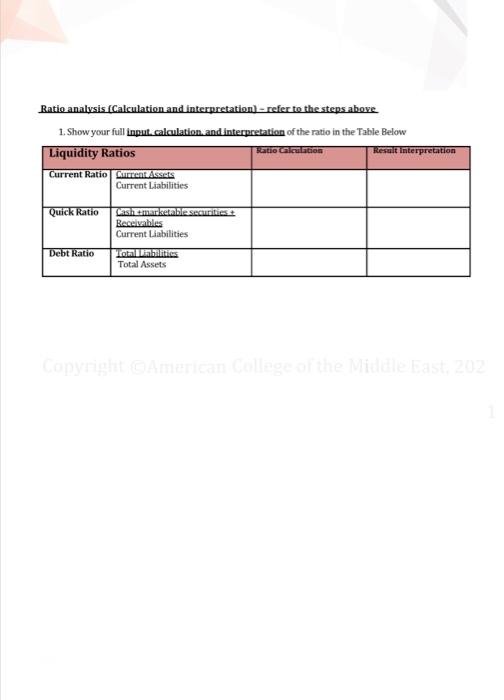

Ratio analysis (Calculation and interpretation) - refer to the steps above 1. Show your full input. calculation and interpretation of the ratio in the Table Below Liquidity Ratios Ratio Glculation Result interpretation Current Ratio Current Assets Current Liabilities Quick Ratio Cashemarketable securities Receivables Current Liabilities Debt Ratio Tomas Total Assets Copyright GATTI College of the Mill SE, ZU Ratio analysis (Calculation and interpretation) - refer to the steps above 1. Show your full input. calculation and interpretation of the ratio in the Table Below Liquidity Ratios Ratio Glculation Result interpretation Current Ratio Current Assets Current Liabilities Quick Ratio Cashemarketable securities Receivables Current Liabilities Debt Ratio Tomas Total Assets Copyright GATTI College of the Mill SE, ZU Instructions: Use the Document Financial Report 2018 of Starbucks Company. All the required information can be found there thethehinimanmanates 1. CONSOLIDATED STATEMENTS OF EARNINGS 2 CONSOLIDATED BALANCE SHEETS (Page 50) X CONSOLIDATED STATEMENTS OF CASH FLOWS (Page 11 Requirements: Question.one: Short.Anster Questions. On a. Explain "Ratio analysis as a Financial tool Company XYZ reported Current liabilities of 56,850 and Current Assets of 59.800. Calculate working capital and explain the result Guestion Two: Ratio analysis (Calculation and interpretation) refer to the steps above 1. Show your full utcalculation, and interpretation of the nation in the Table Below Profitability Ratios talle SELLELE margin No net reves) Asset turnover Aware Medy utalvaluate of the year tural color of the lower the debe really Return NIE Assets Average Assets Reseller Liquidity Ratios Current Ratio ramos Current Lilities Quick Gatinh.marta secure Bechas Current sites Debat EL Total Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts