Question: Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of the following problerns a. Find the required return

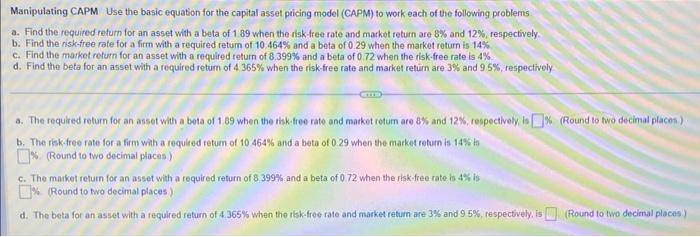

Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of the following problerns a. Find the required return for an asset with a beta of 1.89 when the risk-free rate and markot return are 8% and 12%, respectively. b. Find the nisk-free rate for a firm with a required retum of 10.464% and a beta of 0.29 when the market return is 14% c. Find the market refurn for an asset with a required return of 8.399% and a beta of 0.72 when the risk.free rate is 4%. d. Find the beta for an asset with a required retum of 4.365% when the risk-free rate and market return are 3% and 9.5%, respectively a. The requied return for an asset with a beta of 1.89 when the thk-free rate and matket retum are 8% and 12%, respectively is \%. (Round to two decinal placos) b. The risk-free rate for a firm with a required retum of 10.464% and a beta of 0.29 when the market return is 14%s is 5. (Round to two decimat places ) c. The market return for an asset with a required return of 8.399% and a beta of 072 when the risk free rate is 4% is \%. (Round to two decimal places) d. The beta for an asset with a feguired return of 4.365% when the tiskefree rate and market retuin are 3% and 95%, respectively. is (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts