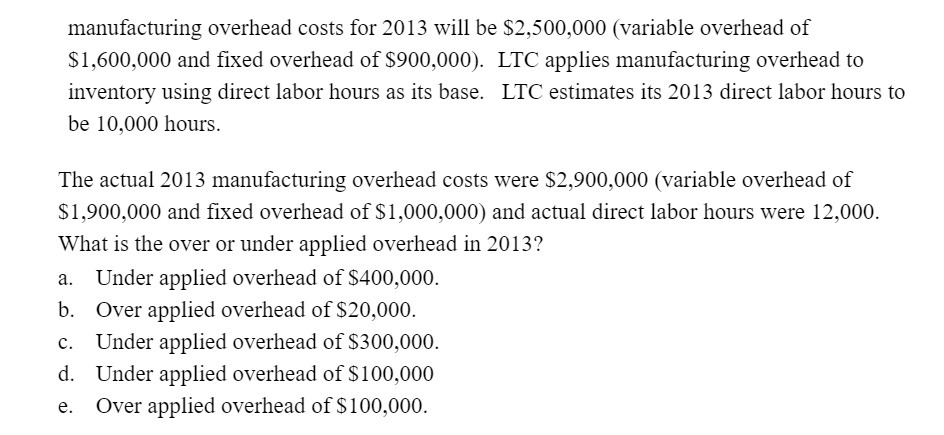

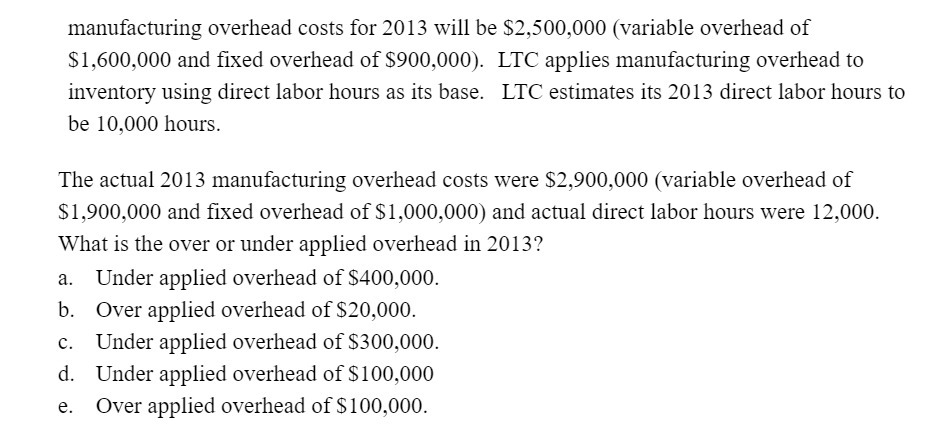

Question: manufacturing overhead costs for 2013 will be $2,500,000 (variable overhead of $1,600,000 and fixed overhead of $900,000). LTC applies manufacturing overhead to inventory using direct

manufacturing overhead costs for 2013 will be $2,500,000 (variable overhead of $1,600,000 and fixed overhead of $900,000). LTC applies manufacturing overhead to inventory using direct labor hours as its base. LTC estimates its 2013 direct labor hours to be 10.000 hours. The actual 2013 manufacturing overhead costs were $2,900,000 (variable overhead of $1,900,000 and fixed overhead of $1,000,000) and actual direct labor hours were 12,000. What is the over or under applied overhead in 2013? a. Under applied overhead of $400,000. b. Over applied overhead of $20,000. c. Under applied overhead of $300,000. d. Under applied overhead of $100,000 e. Over applied overhead of $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts