Question: Maple Construction Corp. has a defined benefit pension plan. Information concerning the 20X7 and 20X8 fiscal years is presented below: From the Plan Actuary: Current

Maple Construction Corp. has a defined benefit pension plan. Information concerning the 20X7 and 20X8 fiscal years is presented below:

From the Plan Actuary:

Current service cost in 20X7 is $446,000 and in 20X8 is $528,000.

Defined benefit obligation is $5,055,000 at the beginning of 20X7.

New past service cost in 20X8 is $53,000, a reduction in benefits at the beginning of the year.

Accumulated OCI amounts are losses at the beginning of 20X7, amounting to $795,000.

Benefits paid to retirees—at end of year, $243,000 in 20X7, and $303,000 in 20X8.

Actuarial revaluation in 20X7 showed a $414,000 increase in the obligation due to changes in mortality. Revaluations take place every four years.

From the Plan Trustee:

Plan assets at market value at the beginning of 20X7 were $3,745,000.

20X7 contributions at end of year were $518,000 and in 20X8, $541,000.

Actual earnings were $292,000 in 20X7 and $88,000 in 20X8.

Other Information:

Yield on long-term debt, stable in 20X7 and 20X8, 6%.

The opening net defined benefit liability on the SFP is the opening net amount of the defined benefit obligation and opening fund assets.

Required:

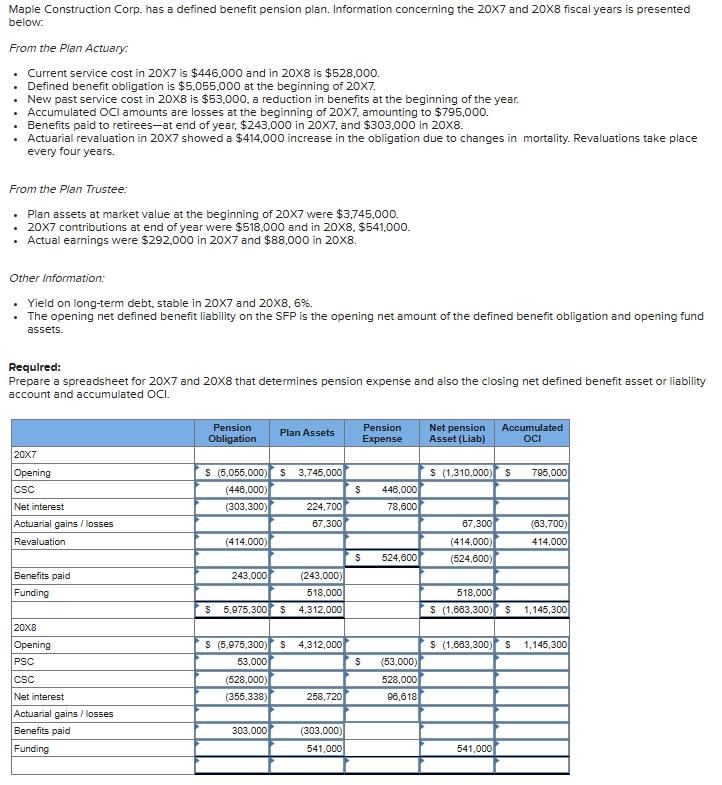

Prepare a spreadsheet for 20X7 and 20X8 that determines pension expense and also the closing net defined benefit asset or liability account and accumulated OCI.

Step by Step Solution

There are 3 Steps involved in it

Let me carefully analyze the image and extract the relevant information for your question I will calculate the required details for the pension expens... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

20250529_181640.xlsx

300 KBs Excel File