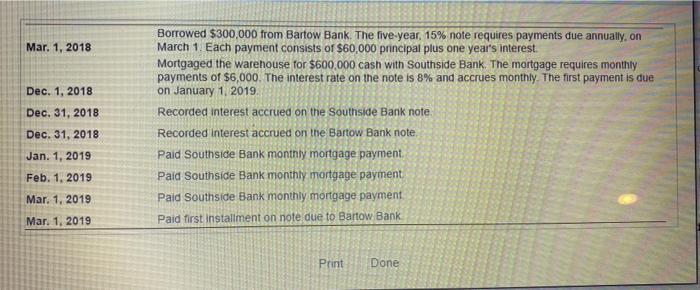

Question: Mar. 1, 2018 Dec. 1. 2018 Dec. 31, 2018 Borrowed $300,000 from Bartow Bank. The five-year, 15% note requires payments due annually, on March 1.

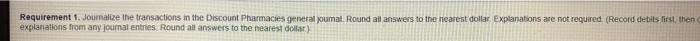

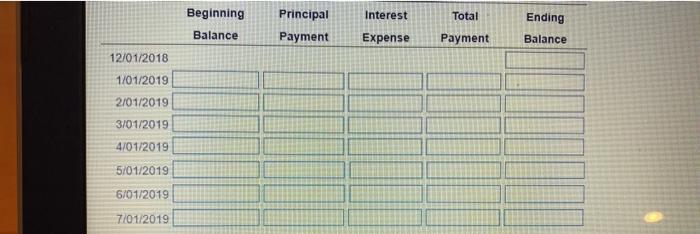

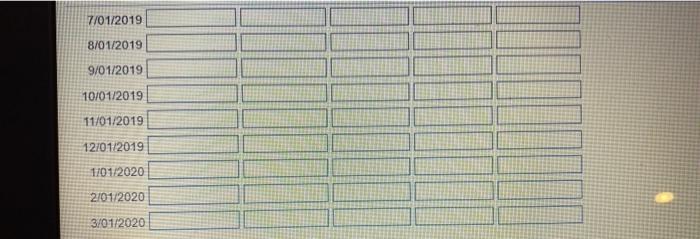

Mar. 1, 2018 Dec. 1. 2018 Dec. 31, 2018 Borrowed $300,000 from Bartow Bank. The five-year, 15% note requires payments due annually, on March 1. Each payment consists of $60,000 principal plus one year's interest. Mortgaged the warehouse for $600,000 cash with Southside Bank. The mortgage requires monthly payments of $6,000. The interest rate on the note is 8% and accrues monthly. The first payment is due on January 1, 2019 Recorded interest accrued on the Southside Bank note Recorded interest accrued on the Bartow Bank note, Paid Southside Bank monthly mortgage payment Paid Southside Bank monthly mortgage payment Paid Southside Bank monthly mortgage payment Dec. 31, 2018 Jan. 1, 2019 Feb. 1. 2019 Mar. 1, 2019 Mar. 1, 2019 Paid first installment on note due to Bartow Bank Print Done Requirement 1. Joumalize the transactions in the Discount Pharmacies general oumat. Round all answers to the nearest dollar Explanations are not required (Record debits first, then explanations from any Journal entries. Round all answers to the nearest dollar) Interest Beginning Balance Principal Payment Total Payment Ending Balance Expense 12/01/2018 1/01/2019 2/01/2019 3/01/2019 4/01/2019 5/01/2019 6/01/2019 7/01/2019 7/01/2019 8/01/2019 9/01/2019 10/01/2019 11/01/2019 12/01/2019 1/01/2020 2/01/2020 3/01/2020 Liabilities MI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts