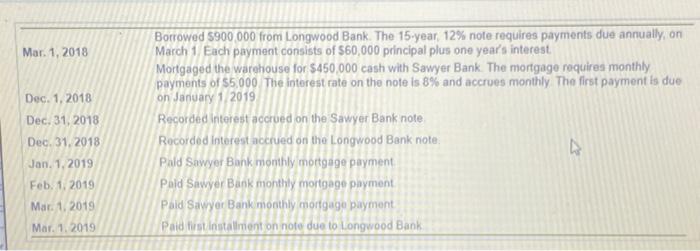

Question: Mar. 1. 2018 Dec. 1. 2018 Dec 31, 2018 Dec 31, 2018 Borrowed 5900 000 from Longwood Bank. The 15-year, 12% note requires payments due

Mar. 1. 2018 Dec. 1. 2018 Dec 31, 2018 Dec 31, 2018 Borrowed 5900 000 from Longwood Bank. The 15-year, 12% note requires payments due annually, on March 1 Each payment consists of $60,000 principal plus one year's interest Mortgaged the warehouse for $450,000 cash with Sawyer Bank. The mortgage requires monthly payments of $5,000 The interest rate on the note is 8% and accrues monthly. The first payment is due on January 1 2019 Recorded interest accrued on the Sawyer Bank note Recorded interest accrued on the Longwood Bank note: Pald Sawyer Bank monthly mortgage payment Paid Sawyer Bank monthly mortgage payment Paid Sawyer Bank monthly mortgage payment Paid instalimenton note due to Longwood Bank Jan. 1.2019 Feb. 1. 2019 Mar. 1. 2019 Mar. 1. 2019 Mar. 1. 2018 Dec. 1. 2018 Dec 31, 2018 Dec 31, 2018 Borrowed 5900 000 from Longwood Bank. The 15-year, 12% note requires payments due annually, on March 1 Each payment consists of $60,000 principal plus one year's interest Mortgaged the warehouse for $450,000 cash with Sawyer Bank. The mortgage requires monthly payments of $5,000 The interest rate on the note is 8% and accrues monthly. The first payment is due on January 1 2019 Recorded interest accrued on the Sawyer Bank note Recorded interest accrued on the Longwood Bank note: Pald Sawyer Bank monthly mortgage payment Paid Sawyer Bank monthly mortgage payment Paid Sawyer Bank monthly mortgage payment Paid instalimenton note due to Longwood Bank Jan. 1.2019 Feb. 1. 2019 Mar. 1. 2019 Mar. 1. 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts