Question: Marco - A CASE STUDY Chapters 1 through 7 Your childhood friend Marco has asked you help him with his finances now that he's heard

Marco A CASE STUDY

Chapters through

Your childhood friend Marco has asked you help him with his finances now that he's heard

you've taken a personal finance course. He is years old, single, and employed as a junior

lawyer in Kelowna BC His annual salary is $ After taxes, retirement savings withholdings

of $ per month, CPP and El deductions, his monthly take home pay is $

Marco recently moved from a onebedroom apartment in the suburbs that cost $ a month

to a two bedroom condo downtown for $ per month so he could be closer to work and

reduce his time commuting. Plus he likes the big city amenities.

Marco is not married and doesn't have children. He does however have a serious girlfriend,

Jane. He plans to marry Jane in the next year or two and mentioned he'd like to start having

kids no later than years old. Marco and jane would like to have a big wedding.

Monthly costs

Marcos has provided you with a list of what he thinks are his monthly costs:

Credit cards

Marco has two credit cards with combined balances of $ balance. The balance seems to

be growing each month even though he makes more than the minimum payment each month.

The credit card company is charging nominal interest of per annum per month

Marco has also been applying for multiple additional credit cards and has been surprised to

have been declined. He would like to start reducing the credit card as he is close to his credit

limit and he needs the room to book a vacation to Mexico with his Jane this winter.

Marco has started using the credit card for living expenses when he runs out of cash at the end

of the month. He doesn't understand this as he says when he adds up his expenses above plus

rent, he should have enough.

Student Loan

Marco graduated from University in and took out some student loans to cover the costs.

The remaining balance on the loan is $ and Marco has more years to pay off. The loan

is now interest free. Marco has mentioned he'd like to pay the loan off as it just reminds him

how much school cost.

Savings

Marco has been having $ a month withheld from his monthly paycheque for the past

months. The money is to be used for retirement savings, but has been deposited into a non

registered not a TFSA or RRSP investment account. He is confused where he should put these

savings RRSPs or TFSA's. He asks, Is there even a difference? Don't you just put money in and

take it out when you need it Marco asks for your recommendation on which would be better

for him and why.

Marco has provided you with a list of what he thinks are all his current assets and liabilities:

Gift from Aunt

Marco received an inheritance from his Aunt Jane. Hs excited to use the money next summer

to buy a boat but is worried about tax that might be owing on the inheritance.

Taxes

Marco has always had his parents do his tax returns but he feels it's time he should take on that

responsibility. He asks you if there's anything he can "writeoff" on his taxes so he can get a

refund.

Banking

Marco has noticed his bank service charges seem to be going up and up Last month they were

$ Other than a few purchases on his credit card, Marco primarily uses his debit card and

etransfers.

As Marco has been a long time customer at the bank, they have offered him a $

unsecured line of credit at Marco is considering using this credit line to fund the wedding

for him and Jane.

Vehicle

Marco is also considering upgrading his car, he feels a Toyota Corolla is "unbecoming" of a

lawyer. He is interested in purchasing a used Toyota Runner for $ He still owes

$ on his Corolla, but the dealership has offered him $ in trade in value. The

dealership would pay out his $ loan on his behalf and use the remaining as a down

payment on the Runner. Marco will finance the difference, with added tax not, which is not

included in the $ purchase price. The dealership has provided two options to purchase

the Runner:

A monthly loan for years at annually, compounded semi annually.

A year lease at annually with monthly payments of $ Residual value owing at

the end of the year lease of $

Home

Marco would also like to purchase the condo he is living in in the next year or two. He loves the

downtown location close to all the hust

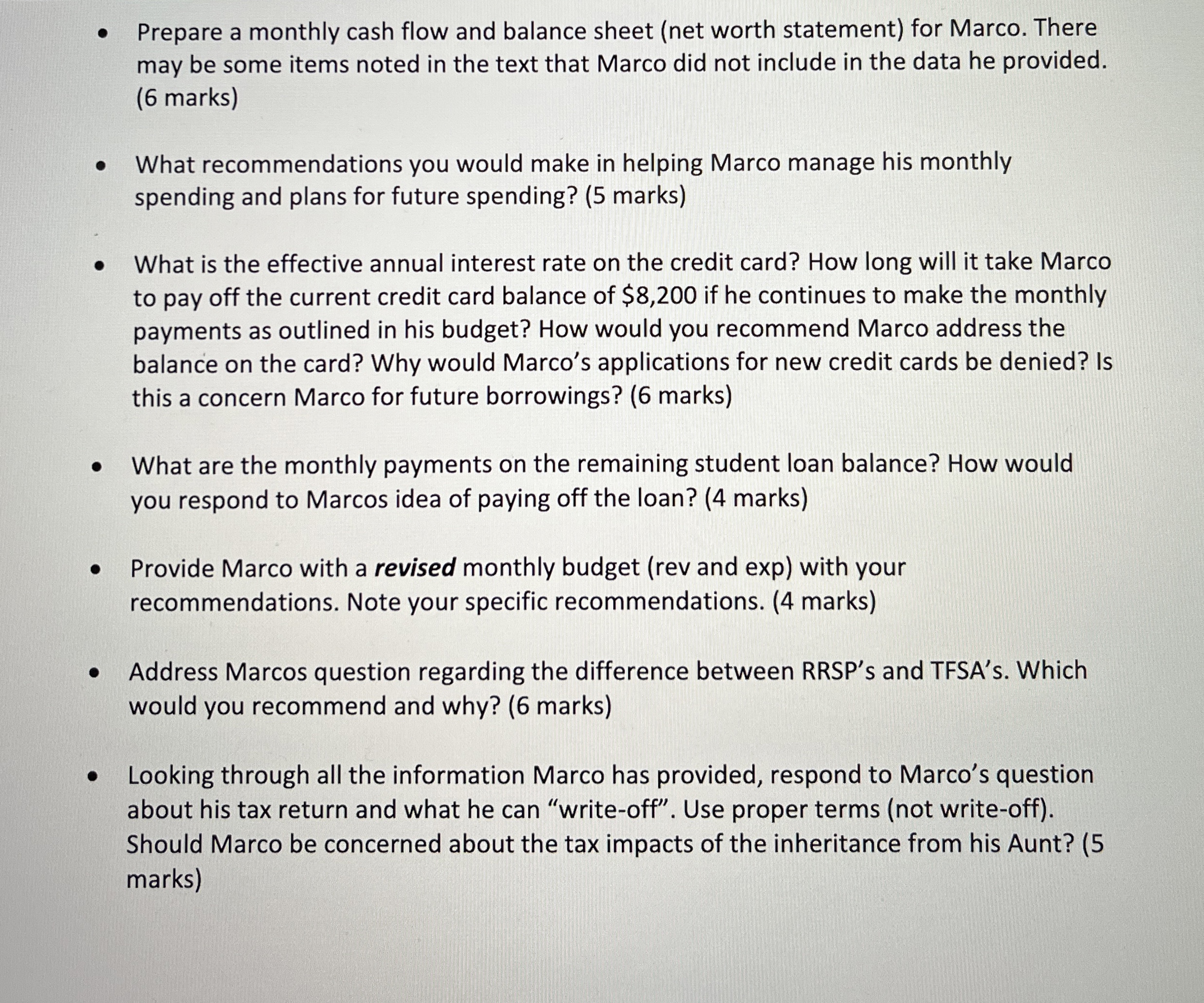

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock