Question: Marginal costing and decision making Multiple choice Introduction to Management Accounting (ACC2008) UNIT 6: MARGINAL COSTING AND DECISION MAKING TUTORIAL QUESTIONS 3. Assume Galaxy Industries

Marginal costing and decision making

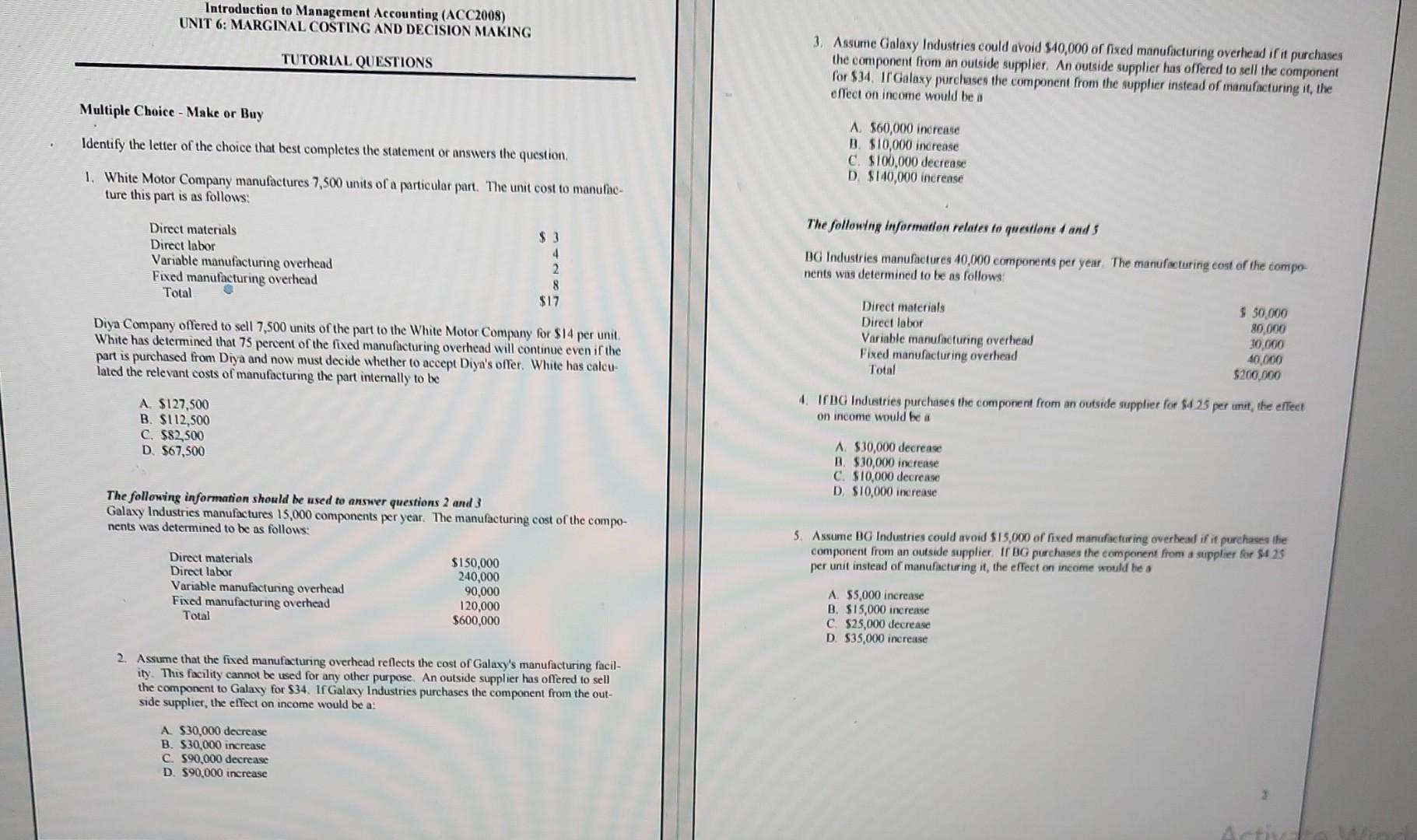

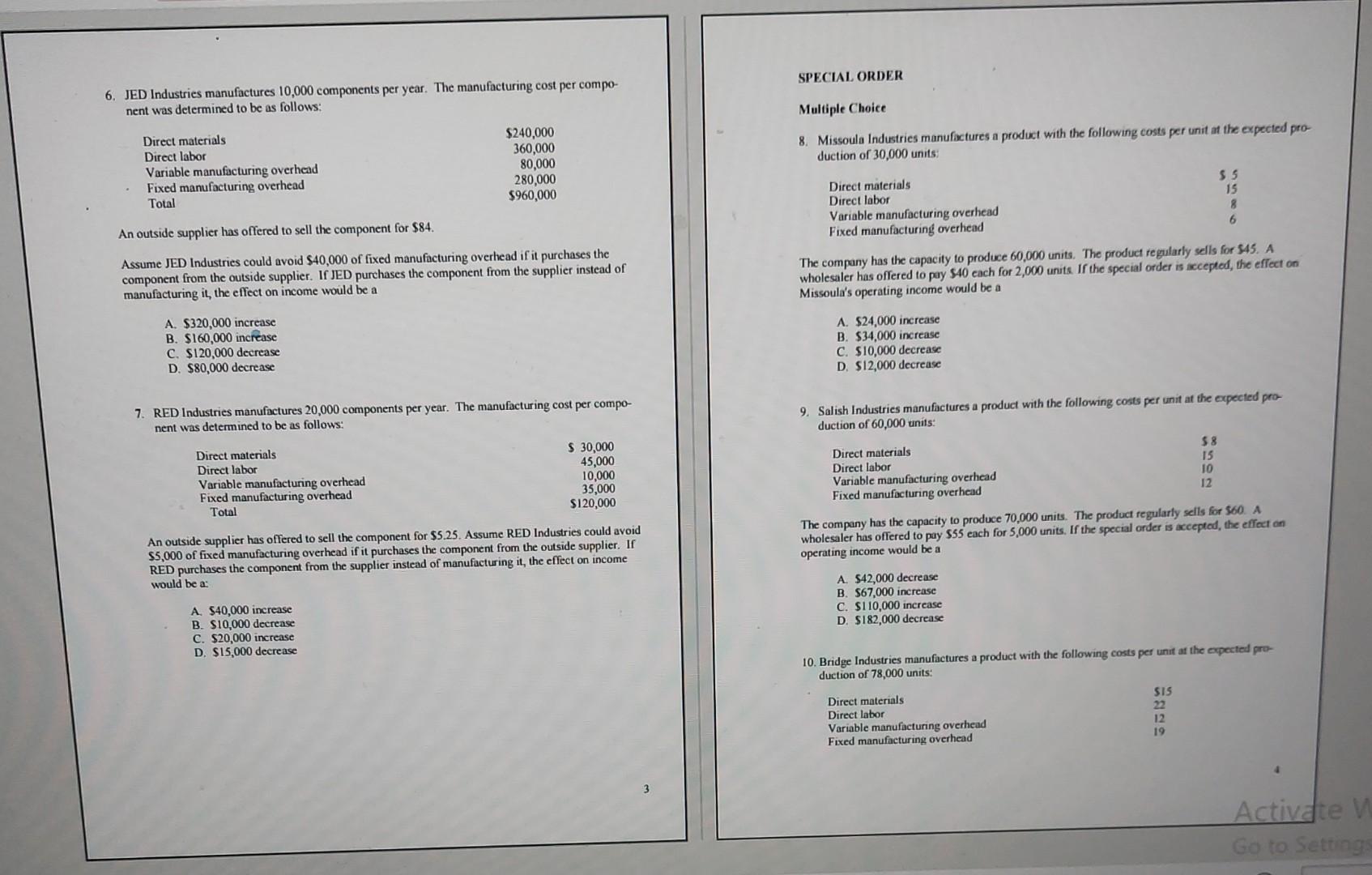

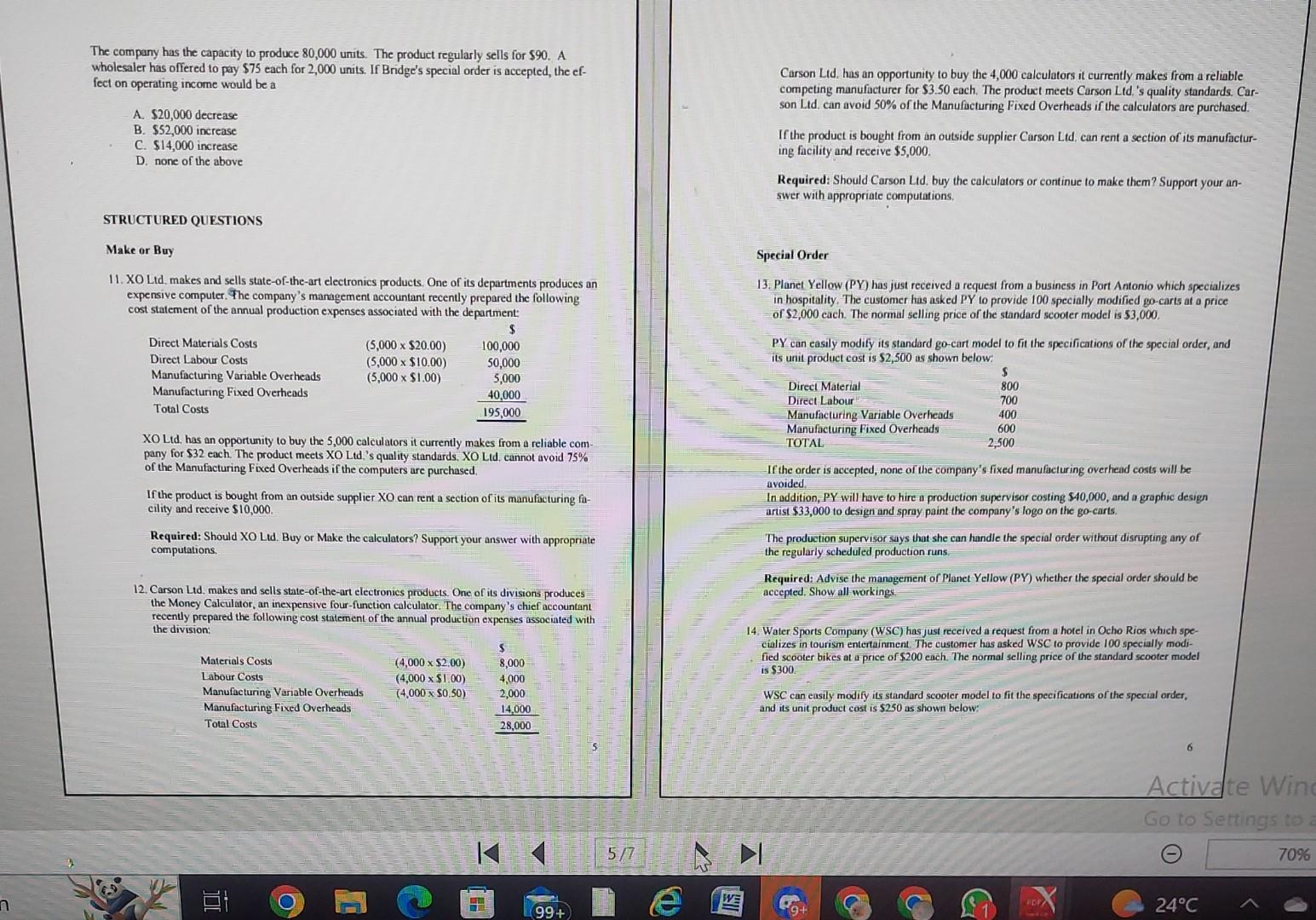

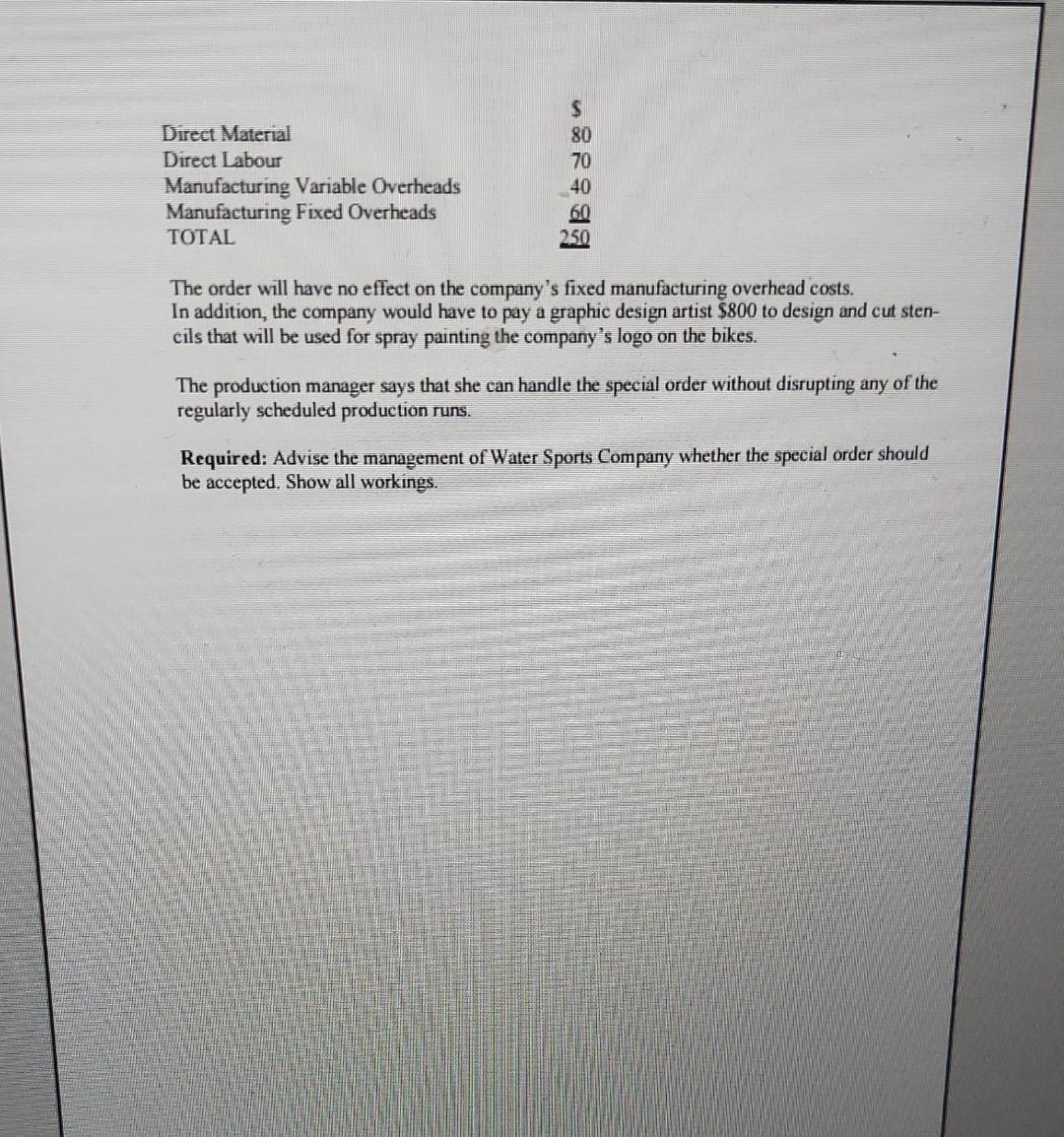

Multiple choice

Introduction to Management Accounting (ACC2008) UNIT 6: MARGINAL COSTING AND DECISION MAKING TUTORIAL QUESTIONS 3. Assume Galaxy Industries could avoid $40,000 of fixed manuficturing overhend if it purchases the component from an outside supplier. An outside supplier has offered to sell the component for \$34. If Galaxy purehases the component from the supplier instead of manuficturing it, the offect on income would be a Multiple Choice - Make or Buy A. 560,000 increase Identify the letter of the choice that best completes the statement or answers the question. B. $10,000 increase C. $100,000 decrease 1. White Motor Company manufactures 7,500 units of a particular part. The unit cost to manufic- D. $140,000 increase ture this part is as follows: The following information relates to questions a and 5 BG Industries manufactures 40,000 components per year. The manufarturing cost of the components was determined to be as follows: Diya Company offered to sell 7,500 units of the part to the White Motor Company for $14 per unit. White has determined that 75 percent of the fixed manufacturing overhead will continue even if the part is purchased from Diya and now must decide whether to accept Diyn's offer. White has calculated the relevant costs of manufacturing the part intermally to be A. $127,500 B. $112,500 C. $82,500 D. $67,500 The following information should be used to answer questions 2 and 3 Galaxy Industries manufactures 15,000 components per year. The manufacturing cost of the compo- 5. Assume BG Industries could avoid s15,000 of fixed manuficturing overhesd if it purchases ithe component from an outside supplier. If BG purchases the component from a supplier for $4.25 per unit instead of manufecturing it, the effect on income would be a A. $5,000 increase B. $15,000 increase C. $25,000 decrease D. $35,000 increase 2. Assume that the fived manufacturing overhead reflects the cost of Galaxy's manufacturing ficility. This facility cannot be used for any other purpose. An outside supplier has offered to sell the component to Galaxy for $34. If Galaxy Industries purchases the component from the outside supplier, the effect on income would be a: A. $30,000 decrease B. $30,000 increase C. 590,000 decrease D. $90,000 increase 6. JED Industries manufactures 10,000 components per year. The manufacturing cost per component was determined to be as follows: Multiple Choice 8. Missoula Industries manufactures a product with the following costs per unit at the expected production of 30,000 units: Direct materials Direct labor Variable manufacturing overhead An outside supplier has offered to sell the component for $84. Fixed manufacturing overhead Assume JED Industries could avoid $40,000 of fixed manufacturing overhead if it purchases the component from the outside supplier. If JED purchases the component from the supplier instead of The company has the capacity to produce 60,000 units. The product regularly sells for 545 . A wholesaler has offered to pay $40 each for 2,000 units. If the special order is accepted, the effect on manufacturing it, the effect on income would be a Missoula's operating income would be a A. $320,000 increase A. $24,000 increase B. $160,000 increase B. $34,000 increase C. $120,000 decrease C. $10,000 decrease D. $80,000 decrease D. S12,000 decrease 7. RED Industries manufactures 20,000 components per year. The manufacturing cost per compo- 9. Salish Industries manufactures a product with the following costs per unit at the expected pronent was determined to be as follows: duction of 60,000 units: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead An outside supplier has offered to sell the component for $5.25. Assume RED Industries could avoid The company has the capacity to produce 70,000 units. The product regularly sells for 560.A $5,000 of fixed manufacturing overhead if it purchases the component from the outside supplier. If wholesaler has offered to pay $55 each for 5,000 units. If the special order is accepted, the effact on RED purchases the component from the supplier instead of manufacturing it, the effect on income operating income would be a would be a: A. $42,000 decrease B. $67,000 increase A. $40,000 increase C. $110,000 increase B. $10,000 decrease D. $182,000 decrease C. $20,000 increase D. $15,000 decrease 10. Bridge Industries manufactures a product with the following costs per unit at the expected production of 78,000 units: Direct materials Direct labor Variable manufacturing overhead Fixed manuficturing overhead The company has the capacity to produce 80,000 units. The product regularly sells for $90. A wholesaler has offered to pay $75 each for 2,000 units. If Bridge's special order is accepted, the ef- Carson Lid, has an opportunity to buy the 4,000 calculators it currently makes from a reliable fect on operating income would be a competing manufacturer for $3.50 each. The product meets Carson Lid, 's quality standards. Car- A. $20,000 decrease son Lid. can avoid 50% of the Manufacturing Fixed Overheads if the calculators are purchased. B. $52,000 increase C. $14,000 increase If the product is bought from in outside supplier Carson Ltd, can rent a section of its manufacturing facility and receive $5,000. D. none of the above Required: Should Carson Lid. buy the calculators or continue to make them? Support your answer with appropriate computations. STRUCTURED QUESTIONS Make or Buy Special Order 11. XO Ltd. makes and sells state-of-the-art electronics products. One of its departments produces an 13. Planet Yellow (PV) has just received a request from a business in Port Antonio which specializes expensive computer. The company's management accountant recently prepared the following in hospitality. The customer has asked PY to provide 100 specially modified go-carts at a price cost statement of the annual production expenses associated with the department: of $2,000cach. The normal selling price of the standard scooter model is 53,000 . PY can easily modify its standard go-cart model to fit the specifications of the special order, and its unit product cost is $2,500 as shown below: XO Lid, has an opportunity to buy the 5,000 calculators it currently makes from a reliable company for $32 each. The product meets XO Ltd,'s quality standards. XO Lid. cannot avoid 75% of the Manufacturing Fixed Overheads if the computers are purchased. If the order is accepted, none of the company's fixed manuffeturing overhead costs will be avoided. In addition, PY will have to hire a production supervisor costing $40,000, and a graphic design artist \$ $3,000 to design and spray paint the company's logo on the go-carts. The production supervisor says that she can handle the special order without distupting any of the regularly scheduled production runs. Required: Advise the management of Planet Yellow (PY) whether the special order should be 12. Carson Ltd, makes and sells state-of-the-art electronics products Onc of its divisions produces accepted, Show all workings. the Money Calculator, an inexpensive four-function calculator. The company's chief accountant recently prepared the following eost statement of the annual production expenses associated with the division: 14. Water Sports Compuny (WSC) has just received a request from a hotel in Ocho Rios which specializes in tourism entertainment. The customer has asked WSC to provide 100 specially modified scooter bikes at a price of $200 each. The normal selling price of the standard scooter model is 5300 . WSC can easily modify its standard scooter model to fit the specifications of the special order, and its unit product cost is $250 as shown below: The order will have no effect on the company's fixed manufacturing overhead costs. In addition, the company would have to pay a graphic design artist $800 to design and cut stencils that will be used for spray painting the company's logo on the bikes. The production manager says that she can handle the special order without disrupting any of the regularly scheduled production runs. Required: Advise the management of Water Sports Company whether the special order should be accepted. Show all workings. Introduction to Management Accounting (ACC2008) UNIT 6: MARGINAL COSTING AND DECISION MAKING TUTORIAL QUESTIONS 3. Assume Galaxy Industries could avoid $40,000 of fixed manuficturing overhend if it purchases the component from an outside supplier. An outside supplier has offered to sell the component for \$34. If Galaxy purehases the component from the supplier instead of manuficturing it, the offect on income would be a Multiple Choice - Make or Buy A. 560,000 increase Identify the letter of the choice that best completes the statement or answers the question. B. $10,000 increase C. $100,000 decrease 1. White Motor Company manufactures 7,500 units of a particular part. The unit cost to manufic- D. $140,000 increase ture this part is as follows: The following information relates to questions a and 5 BG Industries manufactures 40,000 components per year. The manufarturing cost of the components was determined to be as follows: Diya Company offered to sell 7,500 units of the part to the White Motor Company for $14 per unit. White has determined that 75 percent of the fixed manufacturing overhead will continue even if the part is purchased from Diya and now must decide whether to accept Diyn's offer. White has calculated the relevant costs of manufacturing the part intermally to be A. $127,500 B. $112,500 C. $82,500 D. $67,500 The following information should be used to answer questions 2 and 3 Galaxy Industries manufactures 15,000 components per year. The manufacturing cost of the compo- 5. Assume BG Industries could avoid s15,000 of fixed manuficturing overhesd if it purchases ithe component from an outside supplier. If BG purchases the component from a supplier for $4.25 per unit instead of manufecturing it, the effect on income would be a A. $5,000 increase B. $15,000 increase C. $25,000 decrease D. $35,000 increase 2. Assume that the fived manufacturing overhead reflects the cost of Galaxy's manufacturing ficility. This facility cannot be used for any other purpose. An outside supplier has offered to sell the component to Galaxy for $34. If Galaxy Industries purchases the component from the outside supplier, the effect on income would be a: A. $30,000 decrease B. $30,000 increase C. 590,000 decrease D. $90,000 increase 6. JED Industries manufactures 10,000 components per year. The manufacturing cost per component was determined to be as follows: Multiple Choice 8. Missoula Industries manufactures a product with the following costs per unit at the expected production of 30,000 units: Direct materials Direct labor Variable manufacturing overhead An outside supplier has offered to sell the component for $84. Fixed manufacturing overhead Assume JED Industries could avoid $40,000 of fixed manufacturing overhead if it purchases the component from the outside supplier. If JED purchases the component from the supplier instead of The company has the capacity to produce 60,000 units. The product regularly sells for 545 . A wholesaler has offered to pay $40 each for 2,000 units. If the special order is accepted, the effect on manufacturing it, the effect on income would be a Missoula's operating income would be a A. $320,000 increase A. $24,000 increase B. $160,000 increase B. $34,000 increase C. $120,000 decrease C. $10,000 decrease D. $80,000 decrease D. S12,000 decrease 7. RED Industries manufactures 20,000 components per year. The manufacturing cost per compo- 9. Salish Industries manufactures a product with the following costs per unit at the expected pronent was determined to be as follows: duction of 60,000 units: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead An outside supplier has offered to sell the component for $5.25. Assume RED Industries could avoid The company has the capacity to produce 70,000 units. The product regularly sells for 560.A $5,000 of fixed manufacturing overhead if it purchases the component from the outside supplier. If wholesaler has offered to pay $55 each for 5,000 units. If the special order is accepted, the effact on RED purchases the component from the supplier instead of manufacturing it, the effect on income operating income would be a would be a: A. $42,000 decrease B. $67,000 increase A. $40,000 increase C. $110,000 increase B. $10,000 decrease D. $182,000 decrease C. $20,000 increase D. $15,000 decrease 10. Bridge Industries manufactures a product with the following costs per unit at the expected production of 78,000 units: Direct materials Direct labor Variable manufacturing overhead Fixed manuficturing overhead The company has the capacity to produce 80,000 units. The product regularly sells for $90. A wholesaler has offered to pay $75 each for 2,000 units. If Bridge's special order is accepted, the ef- Carson Lid, has an opportunity to buy the 4,000 calculators it currently makes from a reliable fect on operating income would be a competing manufacturer for $3.50 each. The product meets Carson Lid, 's quality standards. Car- A. $20,000 decrease son Lid. can avoid 50% of the Manufacturing Fixed Overheads if the calculators are purchased. B. $52,000 increase C. $14,000 increase If the product is bought from in outside supplier Carson Ltd, can rent a section of its manufacturing facility and receive $5,000. D. none of the above Required: Should Carson Lid. buy the calculators or continue to make them? Support your answer with appropriate computations. STRUCTURED QUESTIONS Make or Buy Special Order 11. XO Ltd. makes and sells state-of-the-art electronics products. One of its departments produces an 13. Planet Yellow (PV) has just received a request from a business in Port Antonio which specializes expensive computer. The company's management accountant recently prepared the following in hospitality. The customer has asked PY to provide 100 specially modified go-carts at a price cost statement of the annual production expenses associated with the department: of $2,000cach. The normal selling price of the standard scooter model is 53,000 . PY can easily modify its standard go-cart model to fit the specifications of the special order, and its unit product cost is $2,500 as shown below: XO Lid, has an opportunity to buy the 5,000 calculators it currently makes from a reliable company for $32 each. The product meets XO Ltd,'s quality standards. XO Lid. cannot avoid 75% of the Manufacturing Fixed Overheads if the computers are purchased. If the order is accepted, none of the company's fixed manuffeturing overhead costs will be avoided. In addition, PY will have to hire a production supervisor costing $40,000, and a graphic design artist \$ $3,000 to design and spray paint the company's logo on the go-carts. The production supervisor says that she can handle the special order without distupting any of the regularly scheduled production runs. Required: Advise the management of Planet Yellow (PY) whether the special order should be 12. Carson Ltd, makes and sells state-of-the-art electronics products Onc of its divisions produces accepted, Show all workings. the Money Calculator, an inexpensive four-function calculator. The company's chief accountant recently prepared the following eost statement of the annual production expenses associated with the division: 14. Water Sports Compuny (WSC) has just received a request from a hotel in Ocho Rios which specializes in tourism entertainment. The customer has asked WSC to provide 100 specially modified scooter bikes at a price of $200 each. The normal selling price of the standard scooter model is 5300 . WSC can easily modify its standard scooter model to fit the specifications of the special order, and its unit product cost is $250 as shown below: The order will have no effect on the company's fixed manufacturing overhead costs. In addition, the company would have to pay a graphic design artist $800 to design and cut stencils that will be used for spray painting the company's logo on the bikes. The production manager says that she can handle the special order without disrupting any of the regularly scheduled production runs. Required: Advise the management of Water Sports Company whether the special order should be accepted. Show all workings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts