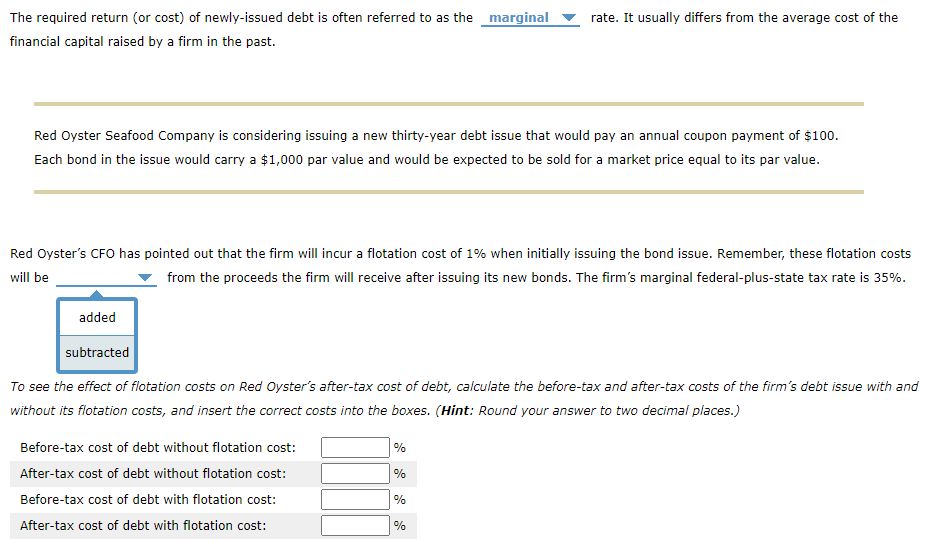

Question: marginal rate. It usually differs from the average cost of the The required return (or cost) of newly-issued debt is often referred to as the

marginal rate. It usually differs from the average cost of the The required return (or cost) of newly-issued debt is often referred to as the financial capital raised by a firm in the past. Red Oyster Seafood Company is considering issuing a new thirty-year debt issue that would pay an annual coupon payment of $100. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a market price equal to its par value. Red Oyster's CFO has pointed out that the firm will incur a flotation cost of 1% when initially issuing the bond issue. Remember, these flotation costs will be from the proceeds the firm will receive after issuing its new bonds. The firm's marginal federal-plus-state tax rate is 35%. added subtracted To see the effect of flotation costs on Red Oyster's after-tax cost of debt, calculate the before-tax and after-tax costs of the firm's debt issue with and without its flotation costs, and insert the correct costs into the boxes. (Hint: Round your answer to two decimal places.) % % Before-tax cost of debt without flotation cost: After-tax cost of debt without flotation cost: Before-tax cost of debt with flotation cost: After-tax cost of debt with flotation cost: % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts