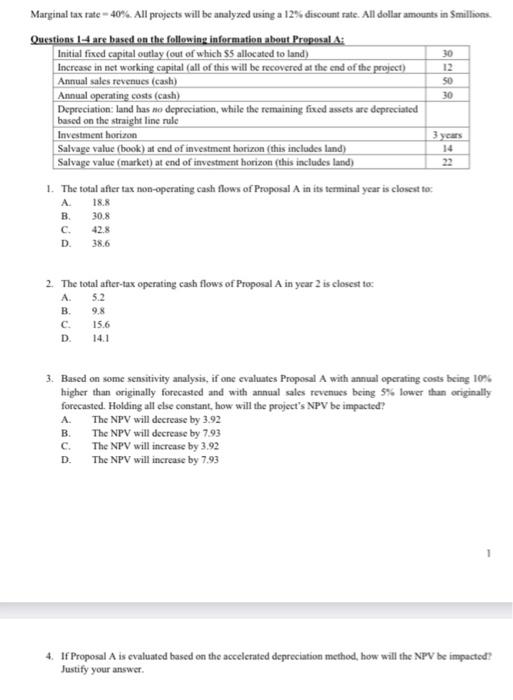

Question: Marginal tax rate =40%. All projects will be analyzed wsing a 12% discount rate. All dollar amounts in $millions. 1. The total after tax non-operating

Marginal tax rate =40%. All projects will be analyzed wsing a 12% discount rate. All dollar amounts in $millions. 1. The total after tax non-operating cash flows of Proposal A in its terminal year is closen to: A. 18.8 B. 30.8 C. 42.8 D. 38.6 2. The total after-tax operating cash flows of Proposal A in year 2 is closest to: A. 5.2 B. 9.8 C. 15.6 D. 14.1 3. Based on some sensitivity analysis, if one evaluates Proposal A with annual operating costs being 10\%s higher than originally forecasted and with annsal sales revenues being 5% lower than originally forecasted. Holding all else constant, how will the project's NPV be impacted? A. The NPV will decrease by 3.92. B. The NPV will decrease by 7.93 C. The NPV will increase by 3.92 D. The NPV will increase by 7.93 4. If Proposal A is evaluated based on the accelcrated depreciation method, how will the NPV be impacted? Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts