Question: Marius ( Pty ) Ltd ( Marius ) is based in Johannesburg, South Africa. The company was established in 2 0 1 7 to supply

Marius Pty Ltd Marius is based in Johannesburg, South Africa. The company was established in to supply electricity to township residents in Gauteng. The company reached an agreement with Ekom to help it with load management by supplying electricity to all townships in Gauteng, eliminating the need for Ekom to implement load reduction measures in these townships. The features of the agreement between Ekom and Marius are as follows:

Electricity must be generated using alternative energy sources, specifically solar and wind energy. Marius is responsible for acquiring its own electricity storage facilities. Electricity will be distributed from Marius's storage to residents via Ekom's distribution channels. Marius will pay Ekom a monthly distribution fee based on the kilowatt hours of electricity distributed. Prepaid meters will be installed in each household in the townships, with all electricity purchases from these meters deposited into Ekoms account. Payment to Marius for electricity supplied will only occur after deducting the distribution fees based on agreed payment terms with Ekom.

Marius has over the last five years invested heavily in capital assets with the objective of accruing the necessary solar and wind energy generation and storage. The bulk of the capital assets was spent on electricity storage facilities.

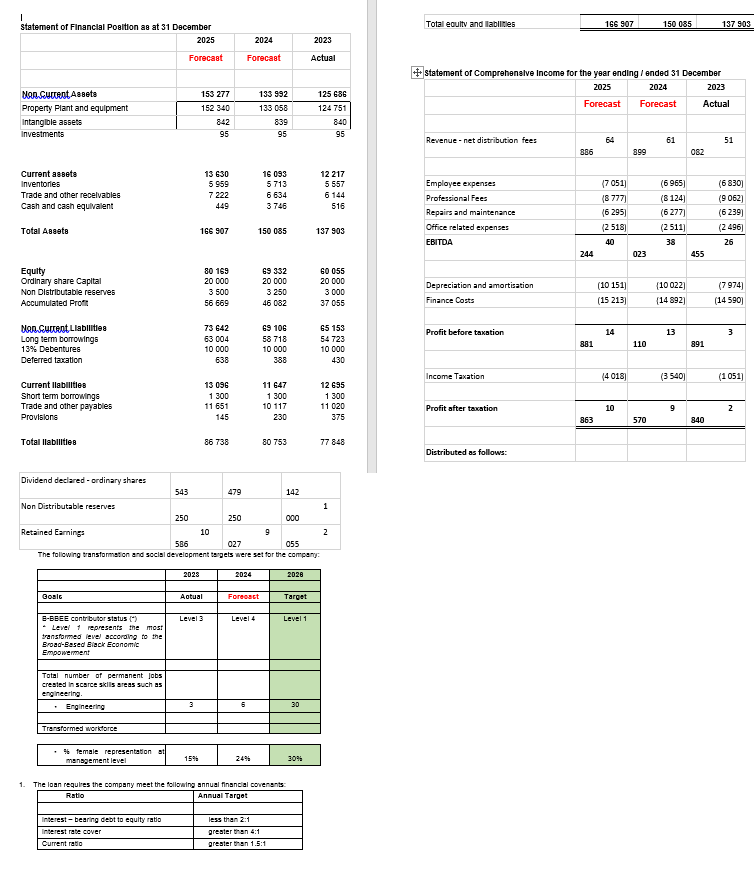

As part of the capital investment Marius has acquired a loan from the Brics Bank which could potential be repaid at a discount if certain conditions are met. To keep track of Mariuss progress against the conditions set by Brics Bank, management of Marius has presented information extracted from both the financial statements and management accounts.

The amounts represent actual numbers extracted from the financial statement whilst both the and amounts represent the forecasted amounts. Management is confident that reliance can be placed on the forecast amount as the company has very advanced forecast models. Additional Information: A $ million longterm borrowing was acquired from a Brics bank on December The loan was provided as part of the project funding initiative for emerging markets by the Bank. Funding under this initiative is available to emerging market companies with a solid development plan; repayment terms that are delayed, and interest rates are low. The loan was issued at an interest rate of and the market rate for similar loans at December is Interest on the loan is deductible annual when accrued for tax purposes. Both the interest and the loan are repayable after four years as a single bullet payment. The capital repayment will be discounted by if the funded project as measured in meets all its transformation and social development targets. If any of the covenants are breached do not comply with the set targets the company must take appropriate steps to remedy the situation within a year from the end of the financial year in which the covenants did not comply.

Additional information: The marginal tax rate is The companys target capital structure is : debt and equity The current exchange rate to is $R and is expected to remain at this level for the next four years Wear and tear allowance on Property plant and equipment and on intangible assets equals to the depreciation amounts for the forecast periods. Clearly show all your calculations in detail; Where necessary, indicate irrelevant amountsadjustments with a Rnilvalue; and round all your workings to two decimals a Prepare a memo to the board of Marius Pty Ltd where you assess the performance the company against the transformation and social development targets for December Your report must address the company's current performance for December against the set targets for and also assess whether the company is on track to achieve or miss its target set for December based on the December forecasted amounts. b Calculate the future value of the loan from Brics Bank at December assuming that Marais Pty Ltd misses its transformation and social development targets set for December

c

Calculate the present value of the loan from Brics Bank at December if Marais Pty Ltd meets its transformation and social development targets set for December

d Calculate the present value of the cost to Marais Pty Ltd as at December of missing the transformation and social development targets set for December

e Assess the performance of Marais Pty Ltd against the financial covenants in the loan agreement with Brics Bank as at December using the forecasted amounts. Your assessment must only be limited to the December ratios.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock