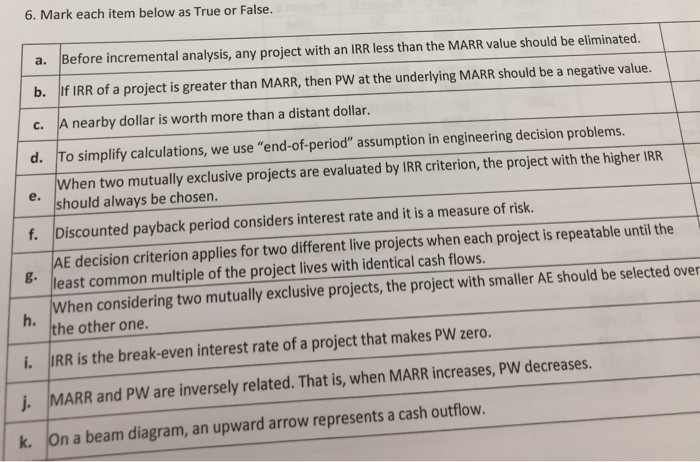

Question: Mark each item below as True or False. Before incremental analysis, any project with an IRR less than the MARR value should be eliminated. If

Mark each item below as True or False. Before incremental analysis, any project with an IRR less than the MARR value should be eliminated. If IRR of a project is greater than MARR, then PW at the underlying MARR should be a negative value. A nearby dollar is worth more than a distant dollar. To simplify calculations, we use "end-of-period" assumption in engineering decision problems. When mutually exclusive projects are evaluated by IRR criterion, the project with the higher IRR should always be chosen. Discounted payback period considers interest rate and it is a measure of risk. AE decision criterion applies for two different live projects when each project is repeatable until the over least common multiple of the project lives with identical cash flows. When considering two mutually exclusive projects with smaller AE should be selected over the other one. IRR is the break-even interest rate of a project that makes PW zero. MARR and PW are inversely related. That is, when MARR increases, PW decreases. On a beam diagram, an upward arrow represents a cash outflow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts