Question: Mark received 5 ISOS at the time he started working for Hendricks Corporation five years ago, when Hendricks's price was $5 per share (each

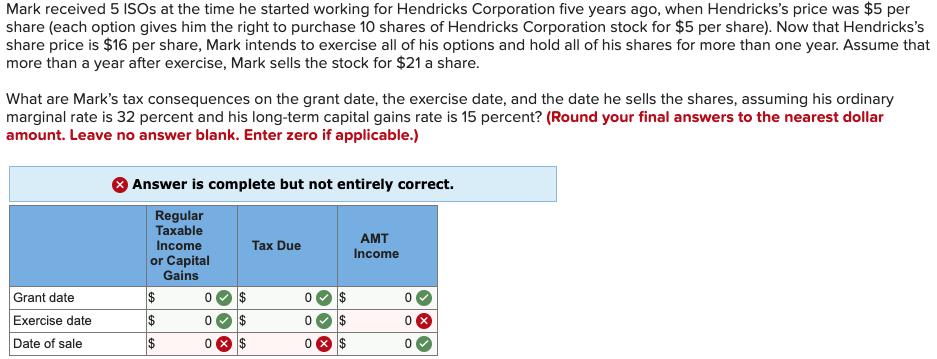

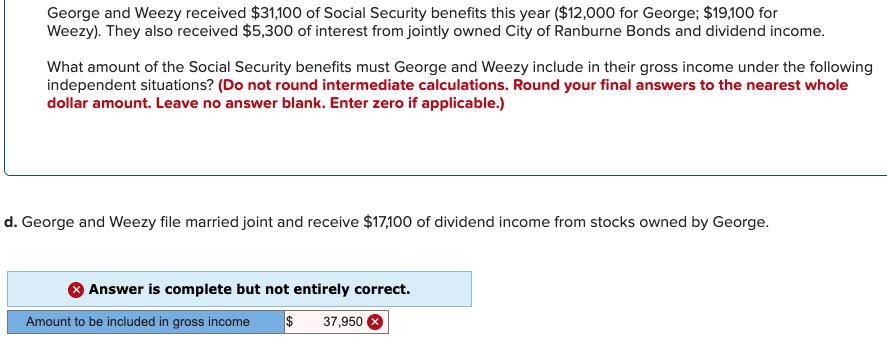

Mark received 5 ISOS at the time he started working for Hendricks Corporation five years ago, when Hendricks's price was $5 per share (each option gives him the right to purchase 10 shares of Hendricks Corporation stock for $5 per share). Now that Hendricks's share price is $16 per share, Mark intends to exercise all of his options and hold all of his shares for more than one year. Assume that more than a year after exercise, Mark sells the stock for $21 a share. What are Mark's tax consequences on the grant date, the exercise date, and the date he sells the shares, assuming his ordinary marginal rate is 32 percent and his long-term capital gains rate is 15 percent? (Round your final answers to the nearest dollar amount. Leave no answer blank. Enter zero if applicable.) Answer is complete but not entirely correct. Regular able AMT Income Income or Capital Gains Tax Due Grant date Exercise date Date of sale 2$ $ 0 X $ George and Weezy received $31,100 of Social Security benefits this year ($12,000 for George; $19,100 for Weezy). They also received $5,300 of interest from jointly owned City of Ranburne Bonds and dividend income. What amount of the Social Security benefits must George and Weezy include in their gross income under the following independent situations? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) d. George and Weezy file married joint and receive $17,100 of dividend income from stocks owned by George. OAnswer is complete but not entirely correct. Amount to be included in gross income $ 37,950

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Solut... View full answer

Get step-by-step solutions from verified subject matter experts