Question: Mark receives a proportionate current (nonliquidating) distribution. At the beginning of the partnership year, the basis of his partnership interest is $100,000. During the

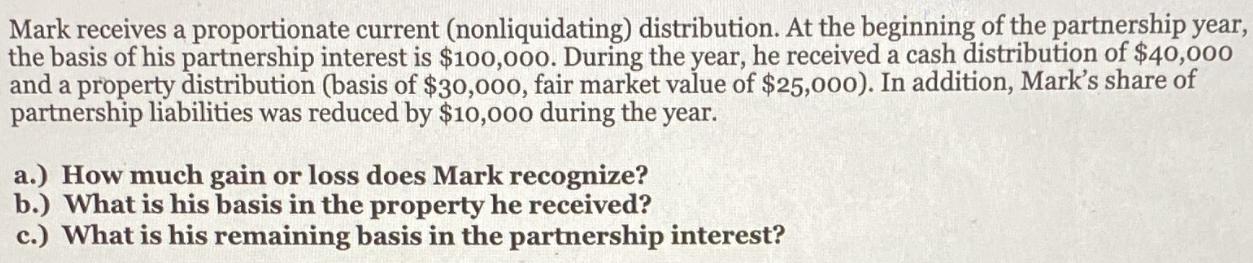

Mark receives a proportionate current (nonliquidating) distribution. At the beginning of the partnership year, the basis of his partnership interest is $100,000. During the year, he received a cash distribution of $40,000 and a property distribution (basis of $30,000, fair market value of $25,000). In addition, Mark's share of partnership liabilities was reduced by $10,000 during the year. a.) How much gain or loss does Mark recognize? b.) What is his basis in the property he received? c.) What is his remaining basis in the partnership interest?

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

a To determine the gain or loss Mark recognizes we need to compare the total value of the distributi... View full answer

Get step-by-step solutions from verified subject matter experts