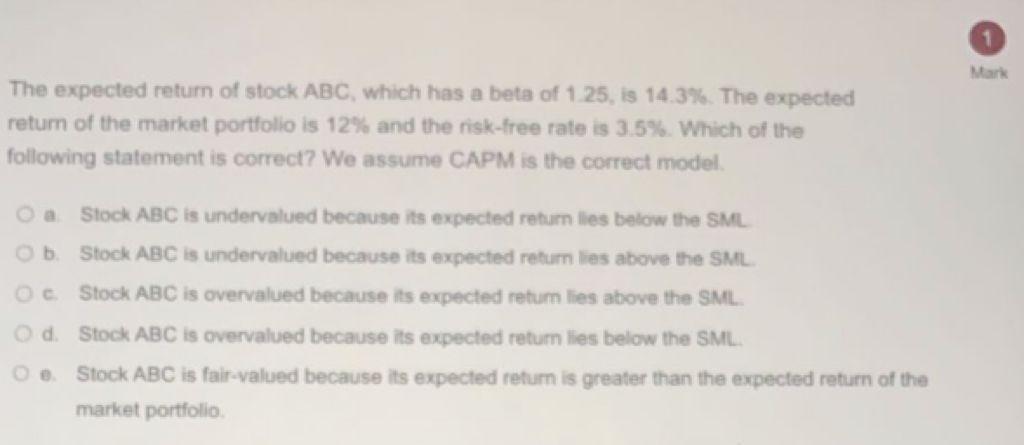

Question: Mark The expected return of stock ABC, which has a beta of 1.25, is 14.3%. The expected return of the market portfolio is 12% and

Mark The expected return of stock ABC, which has a beta of 1.25, is 14.3%. The expected return of the market portfolio is 12% and the risk-free rate is 3.5%. Which of the following statement is correct? We assume CAPM is the correct model. O a Stock ABC is undervalued because its expected return lies below the SML Ob Stock ABC is undervalued because its expected retur lies above the SML Oc Stock ABC is overvalued because its expected retum lies above the SML. Od Stock ABC is overvalued because its expected retur lies below the SML Stock ABC is fair valued because its expected return is greater than the expected return of the market portfolio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock