Question: Mark Turney owns Creative Corners, He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll

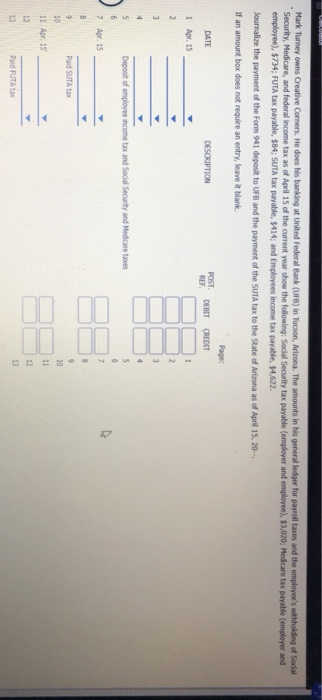

Mark Turney owns Creative Corners, He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medcare tax payable (employer and employee), $734; FUTA tax payable, $84; SUTA tax payable, $414, and Employees income tax payable, 622. of Social Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20 leave it blank. DATE 1Apr. 15 Deposit of employee income tax and Social Security and Medcare taxes 7 Apr. 15 Paid SUTA tax 10 11 Apr. 15 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts