Question: Acct 110 Chapters 10 & 11 Homework Handout 6 Problem 2 Mark Turney owns Creative Corners. The amounts in his general ledger for payroll taxes

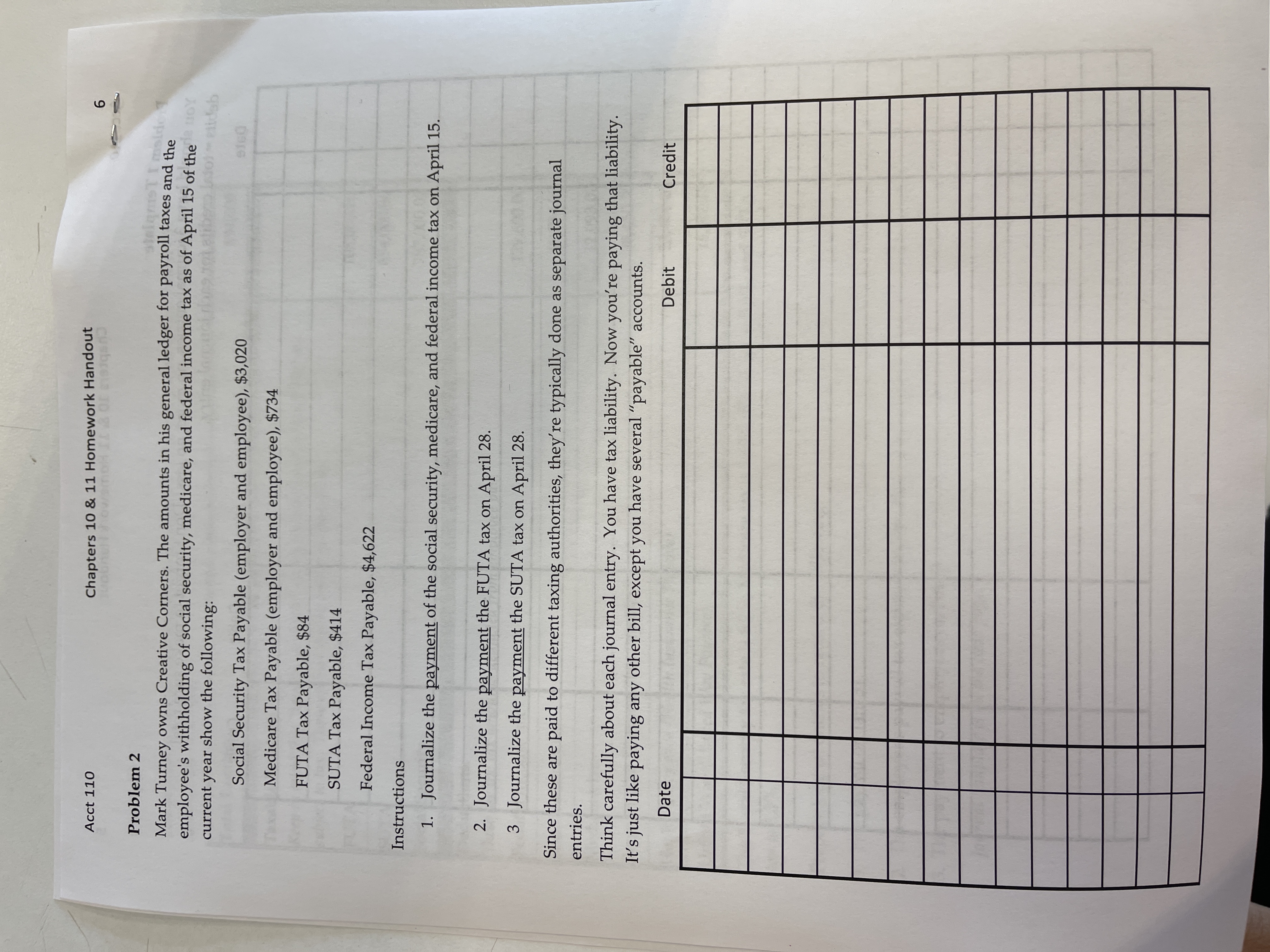

Acct 110 Chapters 10 & 11 Homework Handout 6 Problem 2 Mark Turney owns Creative Corners. The amounts in his general ledger for payroll taxes and the employee's withholding of social security, medicare, and federal income tax as of April 15 of the current year show the following: o plidab Social Security Tax Payable (employer and employee), $3,020 Medicare Tax Payable (employer and employee), $734 FUTA Tax Payable, $84 SUTA Tax Payable, $414 Federal Income Tax Payable, $4,622 Instructions 1. Journalize the payment of the social security, medicare, and federal income tax on April 15. 2. Journalize the payment the FUTA tax on April 28. 3 Journalize the payment the SUTA tax on April 28. Since these are paid to different taxing authorities, they're typically done as separate journal entries. Think carefully about each journal entry. You have tax liability. Now you're paying that liability. It's just like paying any other bill, except you have several "payable" accounts. Date Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts