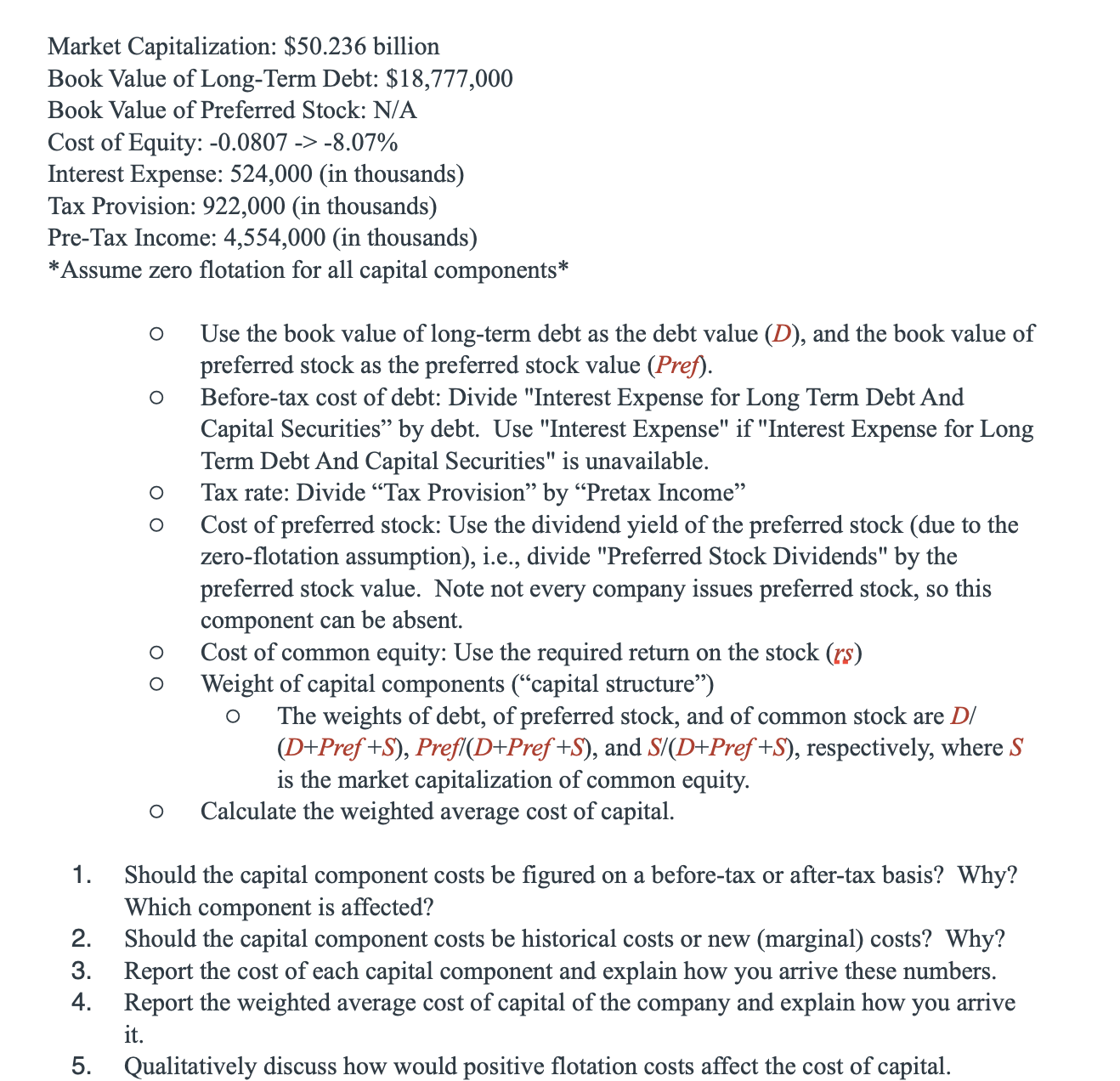

Question: Market Capitalization: $ 5 0 . 2 3 6 billion Book Value of Long - Term Debt: $ 1 8 , 7 7 7 ,

Market Capitalization: $ billion

Book Value of LongTerm Debt: $

Book Value of Preferred Stock: NA

Cost of Equity:

Interest Expense: in thousands

Tax Provision: in thousands

PreTax Income: in thousands

O Use the book value of longterm debt as the debt value and the book value of

preferred stock as the preferred stock value Pref

Beforetax cost of debt: Divide "Interest Expense for Long Term Debt And

Capital Securities" by debt. Use "Interest Expense" if "Interest Expense for Long

Term Debt And Capital Securities" is unavailable.

Tax rate: Divide "Tax Provision" by "Pretax Income"

Cost of preferred stock: Use the dividend yield of the preferred stock due to the

zeroflotation assumption ie divide "Preferred Stock Dividends" by the

preferred stock value. Note not every company issues preferred stock, so this

component can be absent

Cost of common equity: Use the required return on the stock

Weight of capital components capital structure"

The weights of debt, of preferred stock, and of common stock are

Pref Prefl Pref and Pref respectively, where

is the market capitalization of common equity.

Calculate the weighted average cost of capital.

Should the capital component costs be figured on a beforetax or aftertax basis? Why?

Which component is affected?

Should the capital component costs be historical costs or new marginal costs? Why?

Report the cost of each capital component and explain how you arrive these numbers.

Report the weighted average cost of capital of the company and explain how you arrive

it

Qualitatively discuss how would positive flotation costs affect the cost of capital.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock