Question: Marketing management Make a marking plan Only number 3 required I am happy to announce that you, as a group, have been selected as our

Marketing management

Make a marking plan

Only number 3 required

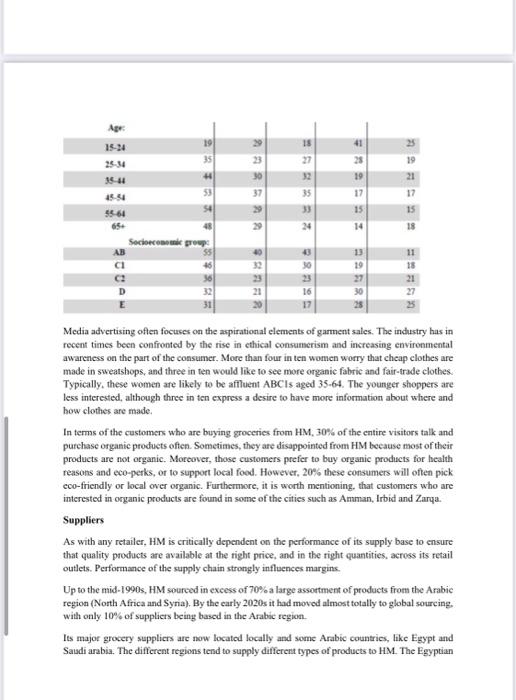

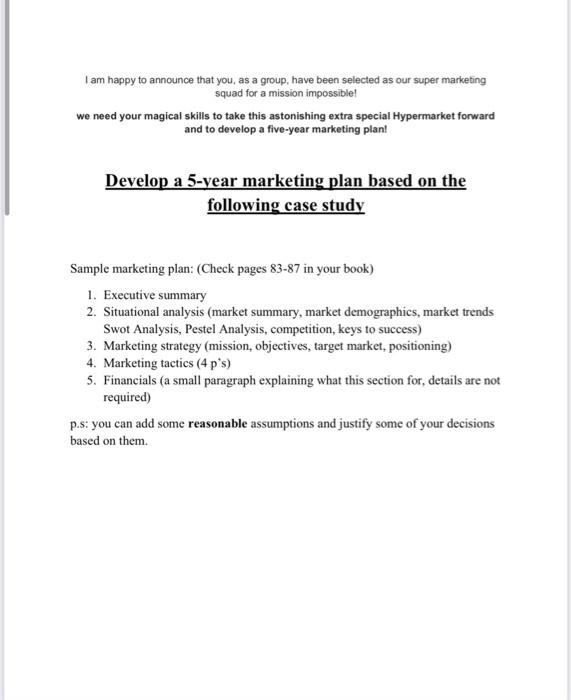

I am happy to announce that you, as a group, have been selected as our super marketing squad for a mission impossible! we need your magical skills to take this astonishing extra special Hypermarket forward and to develop a five-year marketing plan! Develop a 5-year marketing plan based on the following case study Sample marketing plan: (Check pages 83-87 in your book) 1. Executive summary 2. Situational analysis (market summary, market demographics, market trends Swot Analysis, Pestel Analysis, competition, keys to success) 3. Marketing strategy (mission, objectives, target market, positioning) 4. Marketing tactics (4 p's) 5. Financials (a small paragraph explaining what this section for details are not required) p.s: you can add some reasonable assumptions and justify some of your decisions based on them. Happy Mart Case Study Happy Mart (HM), a Jordan-based company, has been operating for almost 50 years. During this time, it has undergone significant and frequent change; "we embrace change and we love it" are in fact the opening words of their culture statement. Changeable is one way to describe their movements over the last 30 years, lack of focus and vision might be another. Historically the organisation was owned by Haddad family - prominent business owners in the area with strong links to the local govemment. However, in 2018, the company was acquired through a private equity buy-out by the Well Spent consortium led by Mohammad Younis, a leading venture capitalist. The Chairman and the Board have recently appointed a new management team to take the company forward and to develop a five-year marketing plan for strategic change. It is possible that the private equity fund, Well Spent Ventures Group (WSVG), may look to float HM on the stock market at some stage, so the owners are keen to increase the reputation of HM and begin producing reports and communications that might match shareholder expectations. Company Overview For the past decade, HM has emphasised a continued commitment to delivering a great shopping experience through a wide range of products under one roof, including full grocery lines (for example: cheese, milk, dates, cleaning items, butter) and general merchandise (for example stylish fashion ranges, homeware, food services), all at outstanding value. However, profits have been decreasing. How much of this is attributable to the failing economy, and how much to an unclear, changeable and reactive strategy - as opposed to a proactive strategy - is open to debate across the industry. The stores currently sell full grocery lines, men and women's clothing, shoes and accessories, furnishings, appliances, and home accessories that include novelty items and toys. Their principal activities are groceries and women's clothing, although other elements have played a greater role at previous stages of their growth. Designing the Future? 2008-2013 HM announced major store developments in 2008, opening new stores and refurbishing existing ones. During the refurbishment programme, 33 of the 70 stores were completed. Predictably the year saw a modest drop in profits, but this was enough to trigger some product attention. The then CEO commented that, "We are doing poorly because we do not sell the right products. Sales are down, the product is off the boil... basically, the product is poor and when you get the product wrong, you get punished. I have not been engaging with HM. I have been distracted when the market is a lot tougher. I am happy to take ownership of it." Accepting some degree of responsibility for the downtum, HM changed key staff and recruited buying directors for appliances, women's wear and children's wear. Continuing to pay for their lack of focus, the year ending March 2010 brought a 33% fall in profits. Of course, this could be at least partially attributed to a severely troubled market. With 6500 employees, 2 million customers, and 70 stores (of which 70% are owned and 20% leased), HM's former CEO said: "The market is challenging, but we are not a doom-monger (a person who predicts disaster.). Are there underlying concems? Yes. Is the world going to end? Of course not. It will be about old-fashioned traders. There will be no more financial engineering, it will be about sourcing cheaper product." In March 2011, HM slipped outside of the top ten Jordanian Hypermarkets, dropping from 8th to 11h because people are buying more online and Jordanians are purchasing their stuff from specialized stores The year ending March 2013 saw a welcome increase in profits for HM, although much of the increase could be attributed to a lowering of the cost base. This unfortunately coincided with unwelcome media activity drawing attention to the company's supply chain with an Indian worker at Chartered Market Technician (CMT) who makes clothes for HM saying she had to work 12-hour days for 64 JOD a month". This also served to highlight the company's refusal to join the Ethical Trading Initiative, which would have meant HM signing up to a simple code of conduct. Amidst all the difficulties, HM still seemed to be saying the right things: "This market is about being world-class at back and front of house. Every business needs newness and fresh products, but we've also got to work closer, be cleverer, and the supply chain has got to be lean and efficient". 2018 Employees As of 2018, the company employ 6500 staff - most of which work in HM's 70 stores, with the exception of the 300 employees based in the Amman Head Office. On average, the smaller stores employ 20 members of staff each, the medium stores employ 42, and the flagship stores employ 13. As with most large retailers in Jordan, the majority of employees are women (65%). Women are well represented at section head and other junior managerial positions, but badly represented at store manager and more senior head office positions. The Board is male dominated. There is a high proportion of part-time staff working at the sales assistant level (25% of the total workforce), and many of these workers are students. Whilst this enables the organisation to adjust its labour force to seasonal patterns of demand-particularly in the run-up to Adha and Feter Eid - it also contributes to high levels of staff turnover at 22% per annum. This is significantly down from 35% in 2000, but still well above the national average (loss of talent in the workforce over time). While high turnover is especially concentrated amongst part-time staff - who are evenly distributed across the country - there are some significant regional differences. In the North and the South of Jordan, the 2015 staff turnover rates are over the national retail average at about 30%. In the Amman Head Office region, staff turnover rates are well below the national average at about 18% This high turnover of staff is due primarily to three key reasons. Firstly, and perhaps of most concern, turnover is high amongst regional store management who feel that communication with HM Head Office is poor and their local empowerment limited. The recent focus on brand consistency and attempted improvements to the product portfolio has led to the majority of decisions being managed centrally and sales being uniformly forecasted across the portfolio However, the lack of a clear vision has led to diminished morale in staff who have been known to suggest that the company has a limited concern for employee welfare (The efforts to make like worth living for workmen. According to Todd "employee welfare means anything done for the comfort and improvement intellectual or social of the employmes over and above the wages paid which is not a necessity of the industow Secondly, and as noted above, turnover is exacerbated by students who comprise a high proportion of part-timers in the stores. Finally, retailing work is seen as little more than a stop-gap while more attractive jobs are sought. One of the consequences of high numbers of students being employed on a casual basis is the reinforcement of the poor image of retail work amongst graduates. It tends to be seen as being low-skilled, badly paid and monotonous with poor job security. Despite the fact that, for graduates, promotion and significant responsibility can come very quickly, HM finds it very difficult to recruit graduates to its key store management positions (challenge). Pay at HM is close to the average for large retail groups, but the history of family ownership means that working hours and holiday entitlements for employees who have been with the organisation prior to 2008 are somewhat better than its competitors. The Amman Head Office still offers a subsidised canteen for staff. Customers Although HM stocks a broad range of products, its principle attraction to shoppers is as a women's clothing retailer and groceries. Footfall - or the number of people visiting a store or a chain of stores in a period of time - is generated primarily by women purchasing groceries and looking for clothing. The majority of other products are sold incidentally as a consequence of these initial visits. HM appears to attract a higher proportion of older shoppers (45+) from lower socio-economic groups (C2,D and E) than competitors. Figure 1: Hypermarket visitor profile 15 27 29 23 30 37 19 21 15-24 19 35 35-4 40 15.54 53 58 64 54 48 Socioecon group AB C1 41 25 19 17 15 14 17 15 18 29 24 40 192 11 18 # 13 19 27 30 25 32 21 27 16 17 Media advertising often focuses on the aspirational elements of garment sales. The industry has in recent times been confronted by the rise in ethical consumerism and increasing environmental awareness on the part of the consumer. More than four in ten women worry that cheap clothes are made in sweatshops, and three in en would like to see more organic fabric and fair-trade clothes. Typically, these women are likely to be affluent ABCls aged 35-64. The younger shoppers are less interested, although three in den express a desire to have more information about where and how clothes are made In terms of the customers who are buying groceries from HM, 30% of the entire visitors talk and purchase organic products often. Sometimes, they are disappointed from HM because most of their products are not organic. Moreover, those customers prefer to buy organic products for health reasons and eco-perks, or to support local food. However, 20% these consumers will often pick eco-friendly or local over organic. Furthermore, it is worth mentioning, that customers who are interested in organic products are found in some of the cities such as Amman, Irbid and Zarya. Suppliers As with any retailer, HM is critically dependent on the performance of its supply base to ensure that quality products are available at the right price, and in the right quantities, across its retail outlets. Performance of the supply chain strongly influences margins. Up to the mid-1990s, HM sourced in excess of 70% a large assortment of products from the Arabic region (North Africa and Syria). By the early 2020s it had moved almost totally to global sourcing. with only 10% of suppliers being based in the Arabic region. Its major grocery suppliers are now located locally and some Arabic countries, like Egypt and Saudi arabia. The different regions tend to supply different types of products to HM. The Egyptian suppliers tend to specialize in cleaning items and grocery items while Jordanian suppliers provide different assortments of seeds, nuts, fruits and vegetables, while Saudi arabia suppliers provide milk related products such as cheese, milk, dates and butter. Its major clothing suppliers are now located in Turkey, India, and Vietnam as each of these countries tend to supply different types of garments to HM. The Turkish suppliers tend to specialise in higher end garments such as the more expensive outerwear clothing - egjeans, trousers, jackets and knitted outerwear. These are viewed to some extent as local suppliers for WW. Jordan has significant capabilities in the more expensively designed ladies" underwear ranges sold by WW. The Indian and Vietnamese supply bases have tended to provide staple garments in high volumes such as standard vests, boxer shorts, socks and many of the shirt ranges. Although it sources many of its manufactured products - such as furnishings and home appliances from various regions in China, it has tended not to use the Chinese clothing supply base because of the arrangements, both informal and formal, that have developed with its existing clothing suppliers. However, capabilities change and HM is always looking for suppliers that appear to have cheaper capabilities, wherever they may be located. HM works directly with many of its major suppliers but also works through buying agents (people or companies that offer to buy goods or property on behalf of another party), particularly for their in-house private brands named Happy mart. HM does have significant in-house buying and merchandising capabilities. The merchandisers for determining and negotiating price points different assortments of products that they see as potentially selling well. In placing orders, HM tries to keep its contracts and relationships as flexible as possible. For its core "local suppliers, it makes sure minimum order volumes but expects flexibility and proper replenishment operation from suppliers for low stock items, however actual orders placed may deviate significantly from required HM has three major Regional Distribution Centres (RDCs) in Jordan that supply its retail network -namely at Irbid, Karak, and Amman. HM using Third Party Logistics providers. They are also the specified logistics providers for their other countries suppliers. Issues going forward include whether HM really need three RDCs and whether their long-term logistics contracts are performing well. Concems have been raised about the rising cost and efficiency of transportation from different areas of the world, which tends to be small batch and reliant on airfreight and road transport The industry itself is characterised by short product lifecycles, high stock volatility, low predictability and high impulse purchasing. There is increasing competition from new market entrants, and consumers want an ever-increasing array of choice. With globalisation comes increased competition, and a move towards a global supply chain impacts lead times and overall supply chain management. The successful retailers are seemingly those that balance price, inventory, agility, adaptability and cost cutting, Forecasting is clearly cracial, often undertaken in conjunction with the supply chain. The stores that seem to be the most effective are those that successfully differentiate between products where demand can be accurately predicted and those where demand is difficult to forecast In terms of quality systems, HM agrees specifications with their major suppliers and checks samples from initial production according to government regulation and food administration laws. However, it does not carry out routine quality inspections Suppliers are made to cover the cost of all returns due to poor quality or not according to standards required and are further charged a premium for the inconvenience caused to HM. It does penalise suppliers heavily if there are persistent problems with products line and may terminate a contract abruptly in such circumstances. Finally, (un)ethical supply chains have been the focus of much negative media attention over recent years. The issues are complex, far-reaching and difficult to pinpoint. However, under recent management HM has remained relatively quiet about ethical issues across its chain. Communities and Environment As a long-standing fordanian company, HM has a proud tradition of involvement in the community. Historically this has included support of universities and charities, social activities for its employees, and promoting healthy eating habits and lifestyle campaigns. However, all these efforts were not highlighted to the public The tradition of being a good community member has continued. This manifests in support for the employees and their families. A trust fund was established in the 1950s to support the families of employees suffering the effects of long-term illness or disability In Amman - where management office, two large stores and a distribution centre are located HM provides social clubs, including sporting facilities. Focusing on employees, HM has also organized an employee volunteering scheme in which members of staff in its Amman Head Quarter are able to take up to two days a year of working time in order to either volunteer for a local charity or participate in a group project (eg. re-innovation of local universities). In the past, HM has supported local and national charities; although because of poor profits there have been no company donations made since 2008. Collections are held in store and the choice of charity and proportion of the total donations allocated reflect employee choices as expressed in an annual survey of senior management