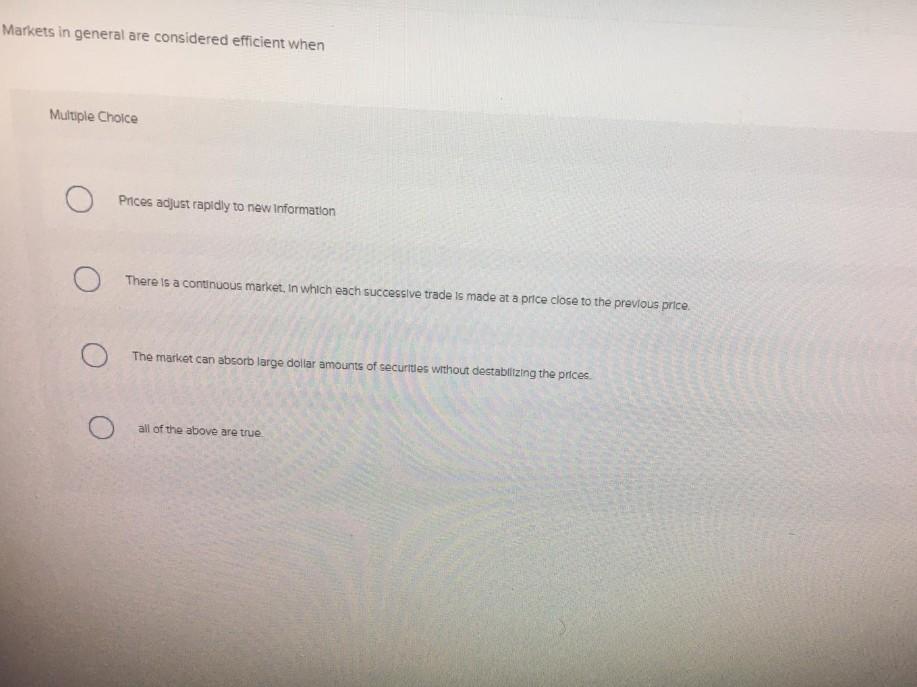

Question: Markets in general are considered efficient when Multiple Choice Prices adjust rapidly to new information There is a continuous market, in which each successive trade

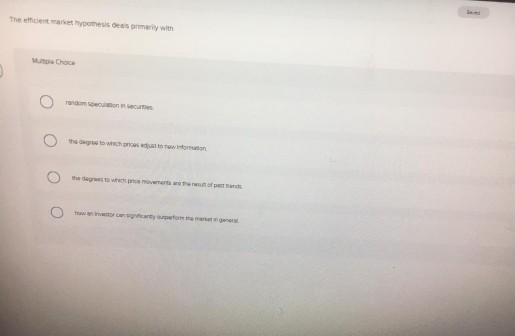

Markets in general are considered efficient when Multiple Choice Prices adjust rapidly to new information There is a continuous market, in which each successive trade is made at a price close to the previous price. The market can absorb large dollar amounts of securities without destabilizing the prices all of the above are true Secure Chic The etticient market hypothesis deals primarily with Multiple Choice random speculation in securities the degree to which prices ad ust to new information the degrees to which once movements are the result of past trends how an investor can significancy outperform the market in general

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts