Question: Markman & Sons is considering Projects S and L. These projects are mutually exclusive, equally risky, and not repeatable and their cash flows are

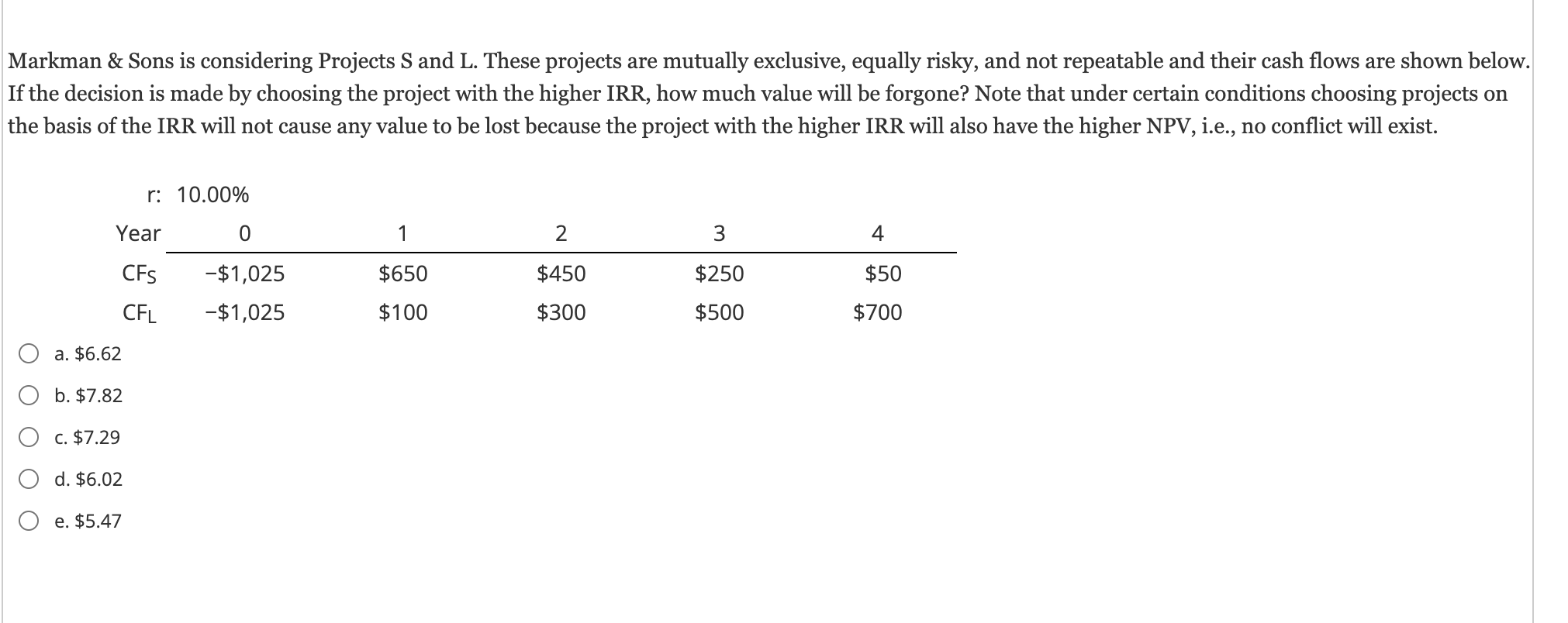

Markman & Sons is considering Projects S and L. These projects are mutually exclusive, equally risky, and not repeatable and their cash flows are shown below. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, i.e., no conflict will exist. r: 10.00% Year 0 1 2 3 4 CFs -$1,025 $650 $450 $250 $50 CFL -$1,025 $100 $300 $500 $700 a. $6.62 b. $7.82 c. $7.29 d. $6.02 e. $5.47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts