Question: Martha uses a structure that is near, but structurally separate from, her main home for business purposes. In which of the following situati may she

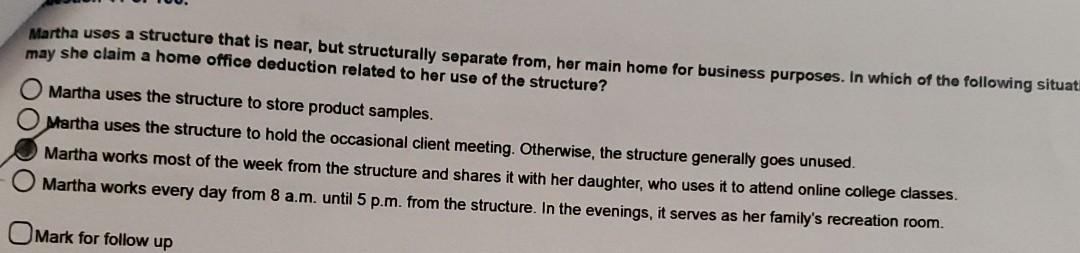

Martha uses a structure that is near, but structurally separate from, her main home for business purposes. In which of the following situati may she claim a home office deduction related to her use of the structure? Martha uses the structure to store product samples. Martha uses the structure to hold the occasional client meeting. Otherwise, the structure generally goes unused. Martha works most of the week from the structure and shares it with her daughter, who uses it to attend online college classes. Martha works every day from 8 a.m. until 5 p.m. from the structure. In the evenings, it serves as her family's recreation room. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts