Question: Martian Accounting Homework Project 2 ( 7 5 points ) Submission date: due in Module 1 0 . Submit an electronic version to the Canvas

Martian Accounting Homework Project points

Submission date: due in Module Submit an electronic version to the Canvas HW Project Dropbox by

Sunday

In prior classes, we discussed worldwide accounting diversity, but what about

accounting on other planets? Marvin the Martian has contacted you asking for

help in preparing his company's financial statements. After reviewing Earth's

accounting literature, he is confused about whether to prepare his financial

statements in accordance with US GAAP or IFRS.

As Mars does not have a regulatory framework for accounting, its companies are free to prepare

their financial statements using any form of GAAP. Marvin Company operates a fully automated

manufacturing company located on Mars, and it has just completed its first year of trading. Marvin

wants to prepare 'relevant' and 'faithfully representative' financials to attract new investors. The

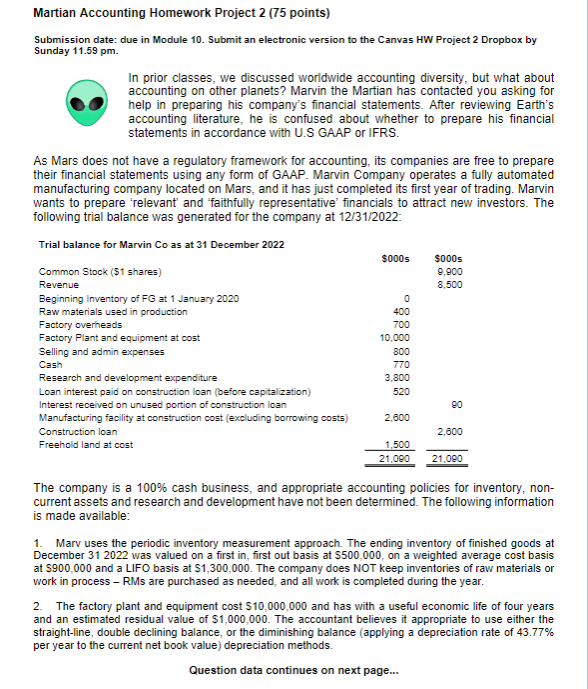

following trial balance was generated for the company at

Trial balance for Marvin Co as at December

The company is a cash business, and appropriate accounting policies for inventory, non

current assets and research and development have not been determined. The following information

is made available:

Marv uses the periodic inventory measurement approach. The ending inventory of finished goods at

December was valued on a first in first out basis at $ on a weighted average cost basis

at $ and a LIFO basis at $ The company does NOT keep inventories of raw materials or

work in process RMs are purchased as needed, and all work is completed during the year.

The factory plant and equipment cost $ and has with a useful economic life of four years

and an estimated residual value of $ The accountant believes it appropriate to use either the

straightline, double declining balance, or the diminishing balance applying a depreciation rate of

per year to the current net book value depreciation

On January the company signed a contract for the construction of a new factory. To finance

this expansion, the company obtained a specific $ construction loan at an annual interest rate of

per year. The factory was completed on December The total construction cost excluding

borrowing and interest costs was $ and this amount was paid to the contractor in installments.

The loan financed the construction costs of the factory. Construction fees of $ were paid to the

construction on January with a further $ paid to the contractor on October st The

unused portion of this loan was invested in the money markets at a rate of return equal to per year.

The interest income and loan interest are already included in the ending trial balance.

Research $ and development expenditure $ were incurred researching,

developing, and completing a new manufacturing process. The process is expected to be completed and

made operational on March and is expected to have a useful economic life of ten years and have

no residual value. The companys engineers are sure of the technical and commercial viability of the project

as it is expected to significantly reduce production costs for the company. The company also has the

resources to complete the project, and the costs can be measured reliably.

Due to price increases, the fair value of the freehold land increased to $ on

As a result of a meteor hitting Mars on the companys factory plant and equipment must

be tested for impairment. The following data is made available:

Net book value of plant and equipment ie carrying value at

Use your calculations, after accounting

for annual depreciation

Fair value ie selling price $

Cost of asset disposal $

Expected future cash flows from use $

Present value of expected future cash flows from use $

Note: any impairment was not accounted for in the trial balance at Account for this after

depreciating the factory PPE for the year ended Any impairment loss must be expensed

as an impairment loss in the income statement and also added to the accumulated depreciation in

the balance sheet.

Dr impairment loss

Cr Accumulated depreciation

Use Excel and appropriate journal entries to prepare answers to the following:

a Using accounting practices allowed under US GAAP, prepare an income statement for Marvin

Company for the year ending December and a statement of financial position at that date

that achieve the companys aim of impressing potential inOn January the company si

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock