Question: Master Budget Spring 2020 - Compatibility Mode - Saved to my Mac nces Mailings Review View Tell me AO E 21 . AESE Empat Heading

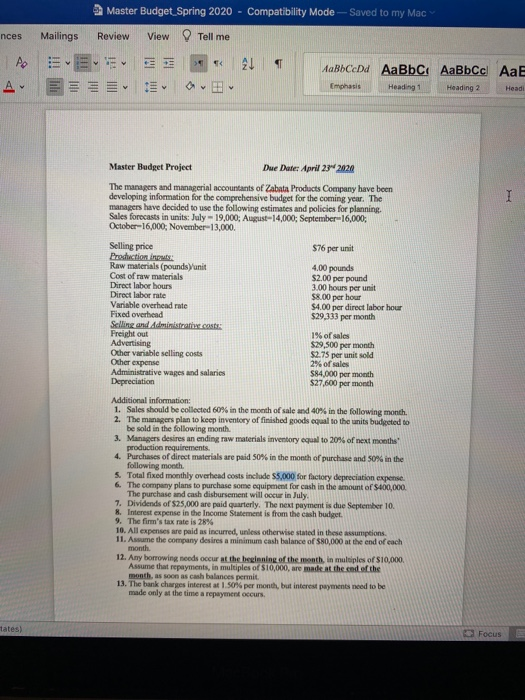

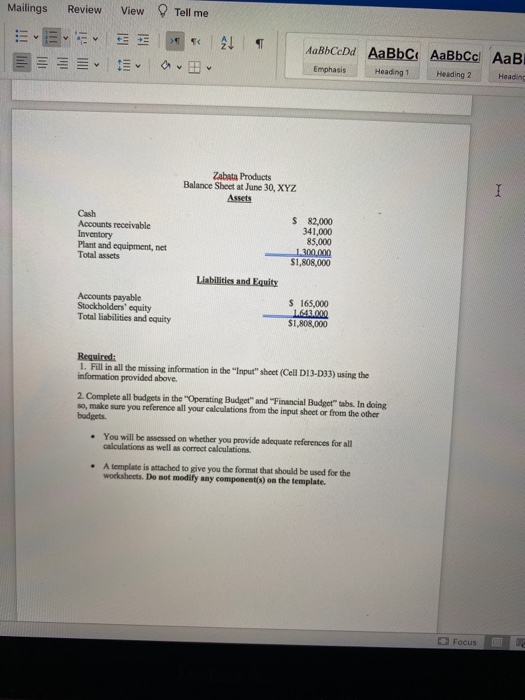

Master Budget Spring 2020 - Compatibility Mode - Saved to my Mac nces Mailings Review View Tell me AO E 21 . AESE Empat Heading 1 Heading 2 Head Master Budget Project Due Date: April 2302020 The managers and managerial accountants of Zabala Products Company have been developing information for the comprehensive budget for the coming year. The managers have decided to use the following estimates and policies for planning Sales forecasts in units: July - 19,000, August 14,000: September 16,000 October 16,000, November 13,000 $76 per unit Selling price Protection Raw materials (pounds unit Cost of raw materials Direct labor hours Direct laborate Variable overhead rate Fixed overhead Selling and Admini st Freight out Advertising Other variable selling costs Oxher expense Administrative wages and salaries Depreciation 4.00 pounds $2.00 per pound 100 hours per unit SK 00 per hour $400 per direct labor hour $29,333 per month 1% of sales $29,500 per month 52.75 per unit sold 2% of sales $84.000 per month $27.600 per month Additional information: 1. Sales should be collected 60% in the month of sale and 40% in the following month 2. The managers plan to keep inventory of finished goods equal to the units budgeted to be sold in the following month 3. Manger desires an ending raw materials inventory equal to 20% of next months production requirements 4 Purchases of direct materials are paid 50% in the month of purchase and in the following month Tocal fixed monthly overhead costs include 55.000 for factory depreciate expense 6. The company plan to purchase some equipment for cash in the mount of $400,000 The purchased cash disbursement will occur in July 1. Dividends of $25,000 are paid quarterly. The next payment is due September 10, & Interest expense in the Income Statement is from the cash budget 9. The firm's tax rate is 28% 10. All expenses we paid as incurred, unless otherwise stated in these assumptions 11. Assume the company desires a minimum cash balance of $80,000 at the end of each 12. Any borrowing needs occur at the beginning of the month. In multiples of S10,000 Assume that repayments in multiples of $10,000, are made at the code of the month, as soon as cash balances permit 13. The bank charges interest at 150 per month, but interest payments need to be made only at the time a repayment occurs. Focus Mailings Review View Tell me * 2! 1 AaBbCcDd AaBbC AaBbCcl AaB Emphasis Heading 1 Heading 2 Heading Zabata Products Balance Sheet at June 30, XYZ Assets Cash Accounts receivable Inventory Plant and equipment, net Total assets $ 82,000 341,000 85.000 1.300.000 $1,808,000 Liabilities and Equity Accounts payable Stockholders' equity Total liabilities and equity $ 165,000 1.643.000 $1,808,000 Required: 1. Fill in all the missing information in the "Input" sheet (Cell D13-033) using the information provided above. 2. Complete all budgets in the "Operating Budget" and "Financial Budget" tabs. In doing so, make sure you reference all your calculations from the input sheet or from the other budgets. You will be assessed on whether you provide adequate references for all calculations as well as correct calculations A template is attached to give you the format that should be used for the worksheets. Do not modify any component(s) on the template. Focus Master Budget Spring 2020 - Compatibility Mode - Saved to my Mac nces Mailings Review View Tell me AO E 21 . AESE Empat Heading 1 Heading 2 Head Master Budget Project Due Date: April 2302020 The managers and managerial accountants of Zabala Products Company have been developing information for the comprehensive budget for the coming year. The managers have decided to use the following estimates and policies for planning Sales forecasts in units: July - 19,000, August 14,000: September 16,000 October 16,000, November 13,000 $76 per unit Selling price Protection Raw materials (pounds unit Cost of raw materials Direct labor hours Direct laborate Variable overhead rate Fixed overhead Selling and Admini st Freight out Advertising Other variable selling costs Oxher expense Administrative wages and salaries Depreciation 4.00 pounds $2.00 per pound 100 hours per unit SK 00 per hour $400 per direct labor hour $29,333 per month 1% of sales $29,500 per month 52.75 per unit sold 2% of sales $84.000 per month $27.600 per month Additional information: 1. Sales should be collected 60% in the month of sale and 40% in the following month 2. The managers plan to keep inventory of finished goods equal to the units budgeted to be sold in the following month 3. Manger desires an ending raw materials inventory equal to 20% of next months production requirements 4 Purchases of direct materials are paid 50% in the month of purchase and in the following month Tocal fixed monthly overhead costs include 55.000 for factory depreciate expense 6. The company plan to purchase some equipment for cash in the mount of $400,000 The purchased cash disbursement will occur in July 1. Dividends of $25,000 are paid quarterly. The next payment is due September 10, & Interest expense in the Income Statement is from the cash budget 9. The firm's tax rate is 28% 10. All expenses we paid as incurred, unless otherwise stated in these assumptions 11. Assume the company desires a minimum cash balance of $80,000 at the end of each 12. Any borrowing needs occur at the beginning of the month. In multiples of S10,000 Assume that repayments in multiples of $10,000, are made at the code of the month, as soon as cash balances permit 13. The bank charges interest at 150 per month, but interest payments need to be made only at the time a repayment occurs. Focus Mailings Review View Tell me * 2! 1 AaBbCcDd AaBbC AaBbCcl AaB Emphasis Heading 1 Heading 2 Heading Zabata Products Balance Sheet at June 30, XYZ Assets Cash Accounts receivable Inventory Plant and equipment, net Total assets $ 82,000 341,000 85.000 1.300.000 $1,808,000 Liabilities and Equity Accounts payable Stockholders' equity Total liabilities and equity $ 165,000 1.643.000 $1,808,000 Required: 1. Fill in all the missing information in the "Input" sheet (Cell D13-033) using the information provided above. 2. Complete all budgets in the "Operating Budget" and "Financial Budget" tabs. In doing so, make sure you reference all your calculations from the input sheet or from the other budgets. You will be assessed on whether you provide adequate references for all calculations as well as correct calculations A template is attached to give you the format that should be used for the worksheets. Do not modify any component(s) on the template. Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts