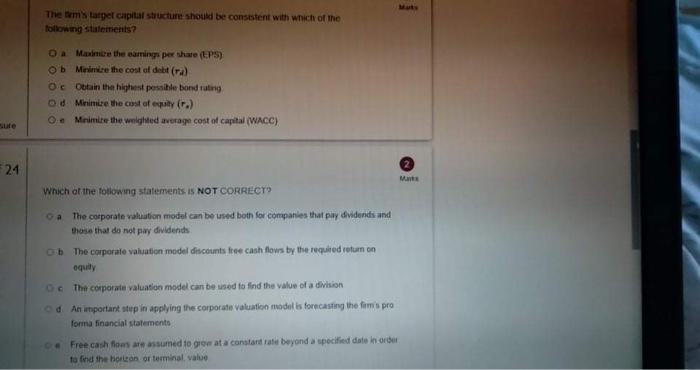

Question: Mat The tem's target capital structure should be consistent with which of the following statements? Da Marmere the samnings per whate (EPS) Ob Meine the

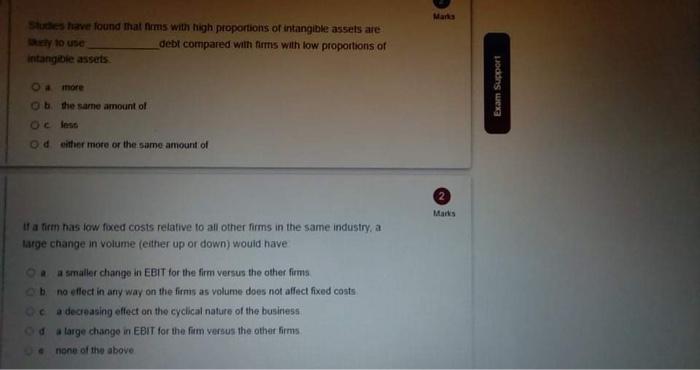

Mat The tem's target capital structure should be consistent with which of the following statements? Da Marmere the samnings per whate (EPS) Ob Meine the cost of debt (ra) Oe Obtain the highest possible bonding Od Minimize the cost of pay (r.) O Minimize the weighted average cost of capital (WACC) sute 24 Mare Which of the following statements is NOT CORRECTO oa The corporate valuation model can be used both for companies that pay dividends and those that do not pay dividends ob The corporate valuation model discounts free cash flows by the required return on equily O The corporate valuation model can be used to find the value of a division od An important step in applying the corporate Valuation models forecasting the fom's pro forma financial statements Free cash flows are assumed to grow at a constante beyond a specified date in order to find the horizon or terminal value Mans Suces have found that mms with high proportions or intangible assets are By to use debt compared with firms with low proportions of intangible assets Oamore Ob the same amount of Exam Support Odless Od other more or the same amount of Marks If a firm has low foxed costs relative to all other firms in the same industry, a large change in volume (either up or down) would have O a smaller change in EBIT for the firm versus the other firms b. no effect in any way on the firms as volume does not affect fixed costs a decreasing effect on the cyclical nature of the business da large change in EBIT for the firm versus the other firms none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts