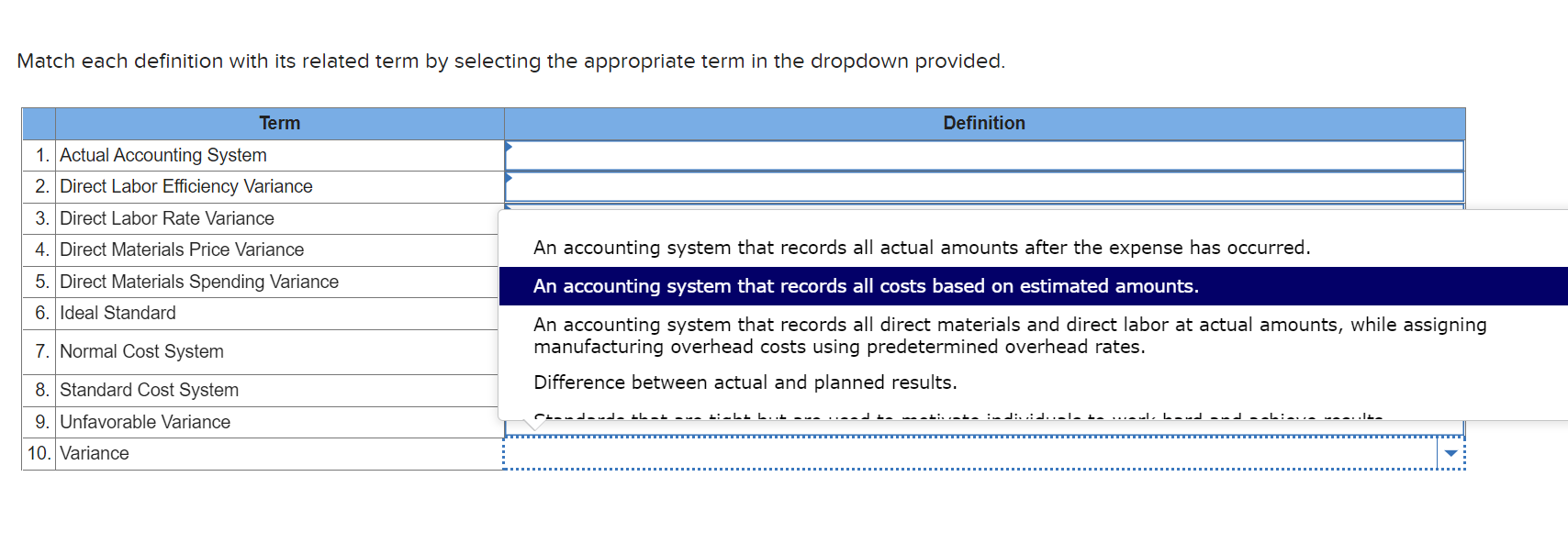

Question: Match each definition with its related term by selecting the appropriate term in the dropdown provided. 1. Actual Accounting System Term 2. Direct Labor

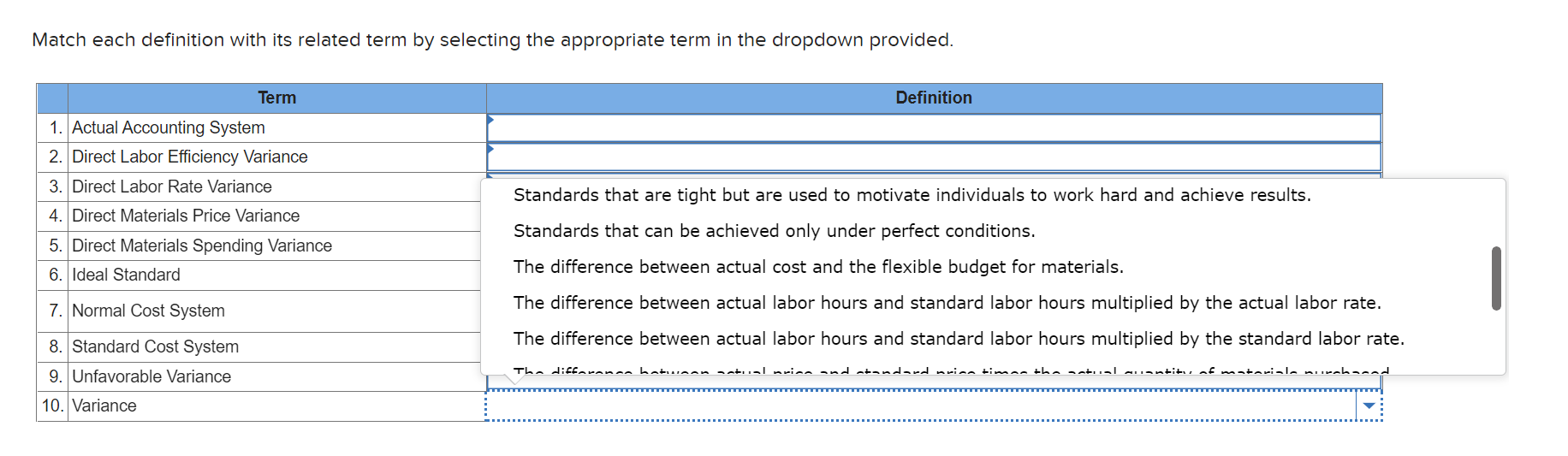

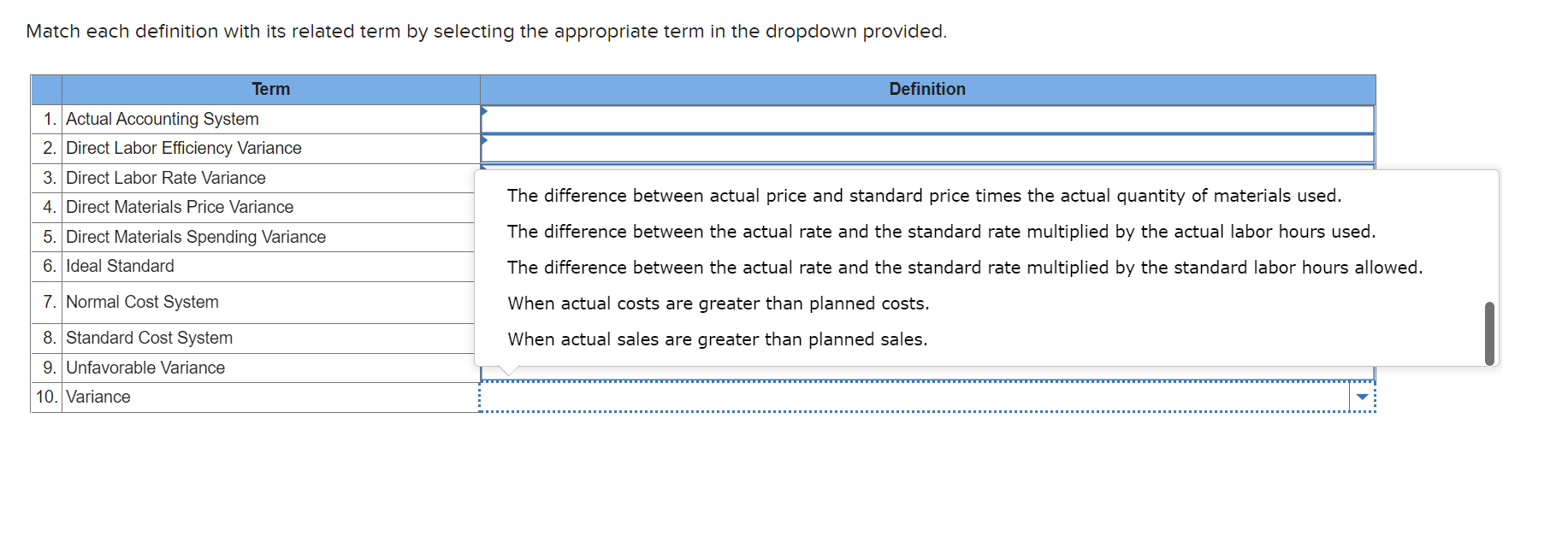

Match each definition with its related term by selecting the appropriate term in the dropdown provided. 1. Actual Accounting System Term 2. Direct Labor Efficiency Variance 3. Direct Labor Rate Variance 4. Direct Materials Price Variance 5. Direct Materials Spending Variance 6. Ideal Standard 7. Normal Cost System 8. Standard Cost System 9. Unfavorable Variance 10. Variance Definition An accounting system that records all actual amounts after the expense has occurred. An accounting system that records all costs based on estimated amounts. An accounting system that records all direct materials and direct labor at actual amounts, while assigning manufacturing overhead costs using predetermined overhead rates. Difference between actual and planned results. Match each definition with its related term by selecting the appropriate term in the dropdown provided. Term Definition 1. Actual Accounting System 2. Direct Labor Efficiency Variance 3. Direct Labor Rate Variance 4. Direct Materials Price Variance 5. Direct Materials Spending Variance 6. Ideal Standard 7. Normal Cost System 8. Standard Cost System 9. Unfavorable Variance 10. Variance Standards that are tight but are used to motivate individuals to work hard and achieve results. Standards that can be achieved only under perfect conditions. The difference between actual cost and the flexible budget for materials. The difference between actual labor hours and standard labor hours multiplied by the actual labor rate. The difference between actual labor hours and standard labor hours multiplied by the standard labor rate. The differanca batuan ial price and standard nrica timan the quantity of materiale Match each definition with its related term by selecting the appropriate term in the dropdown provided. Term Definition 1. Actual Accounting System 2. Direct Labor Efficiency Variance 3. Direct Labor Rate Variance 4. Direct Materials Price Variance 5. Direct Materials Spending Variance 6. Ideal Standard 7. Normal Cost System 8. Standard Cost System 9. Unfavorable Variance 10. Variance The difference between actual price and standard price times the actual quantity of materials used. The difference between the actual rate and the standard rate multiplied by the actual labor hours used. The difference between the actual rate and the standard rate multiplied by the standard labor hours allowed. When actual costs are greater than planned costs. When actual sales are greater than planned sales.

Step by Step Solution

There are 3 Steps involved in it

Actual Accounting System An accounting system that records all actual amounts after the expense has ... View full answer

Get step-by-step solutions from verified subject matter experts