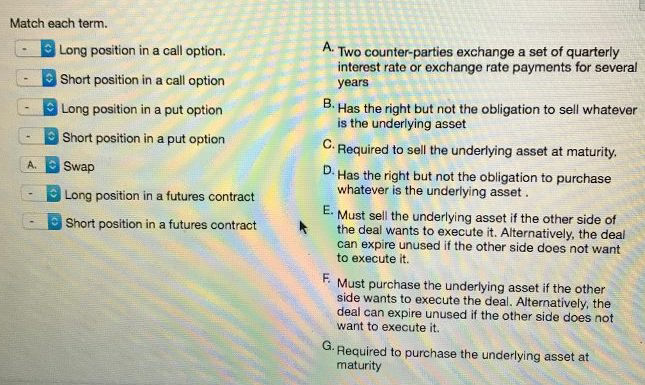

Question: Match each term. A. Long position in a call option. Short position in a call option Long position in a put option Short position in

Match each term. A. Long position in a call option. Short position in a call option Long position in a put option Short position in a put option Two counter-parties exchange a set of quarterly interest rate or exchange rate payments for several years 5. Has the right but not the obligation to sell whatever is the underlying asset Required to sell the underlying asset at maturity. whatever is the underlying asset ASwap . Has the right but not the obligation to purchase Long position in a futures contract E. Must sell the underlying asset if the other side of the deal wants to execute it. Alternatively, the deal can expire unused if the other side does not want to execute it. Short position in a futures contract k F Must purchase the underlying asset if the other side wants to execute the deal. Alternatively, the deal can expire unused if the other side does not want to execute it. Required to purchase the underlying asset at maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts