Question: Multiple choice Joe holds an option. Before the option expires, Joe might have to buy the underlying asset from the counterparty of the option contract.

Multiple choice

-

Joe holds an option. Before the option expires, Joe might have to buy the underlying asset from the counterparty of the option contract. However, Joe does not have the right to decide when and whether to buy from the counterparty A)Joe has Long position in American call option. B) Long position in European put option. C)Short position in American put option. D)Short position in European call option.

-

An investor has an exchange-traded long put option to sell 100 shares for $20. There is a 2 for 3 stock split. Which of the following is the position of the investor after the stock split? A. Put option to sell 67 shares for $30/share. B. Put option to sell 100 shares for $20/share.

C. Put option to sell 150 shares for $13.33/share. D. Put option to sell 200 shares for $10/share.

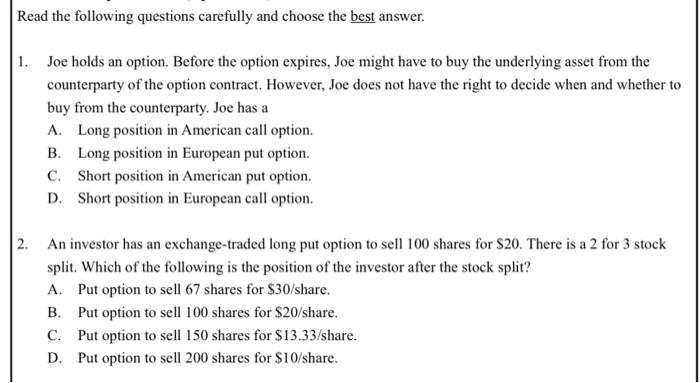

Read the following questions carefully and choose the best answer. 1. Joe holds an option. Before the option expires, Joe might have to buy the underlying asset from the counterparty of the option contract. However, Joe does not have the right to decide when and whether to buy from the counterparty. Joe has a A. Long position in American call option. B. Long position in European put option. C. Short position in American put option. D. Short position in European call option. 2. An investor has an exchange-traded long put option to sell 100 shares for $20. There is a 2 for 3 stock split. Which of the following is the position of the investor after the stock split? A. Put option to sell 67 shares for $30/share. B. Put option to sell 100 shares for $20/share. C. Put option to sell 150 shares for $13.33/share. D. Put option to sell 200 shares for $10/share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts