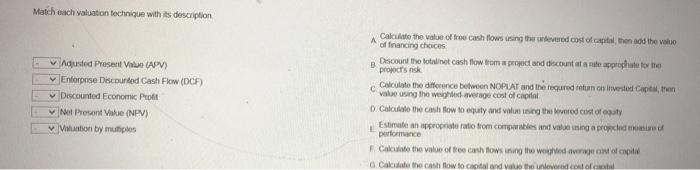

Question: Match each valuation technique with its description - Adjusted Present Value (APV) Enterprise Discounted Cash Flow (DCF) Discounted Economic Profit Not Present Value (NPV) v

Match each valuation technique with its description - Adjusted Present Value (APV) Enterprise Discounted Cash Flow (DCF) Discounted Economic Profit Not Present Value (NPV) v aluation by multiples Calculate the value of free cash flows using the unlevered cost of capital, then add the value A of financing choices Discount the total net cash flow from a project and discount at a rate approphate for the project's risk Calculate the difference between NOPLAT and the required return on invested Capital, then "value using the weighted average cost of capital Calculate the cash flow to equity and value using the lovered cost of equity Estimate an appropriate ratio from comparables and value using a projected measure of performance F Calculate the value of free cash flows using the woghted average cost of capital Calculate the cash flow to cool and value the univered contact E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts