Question: Pathep Words:0 QUESTION 3 Match each valuation technique with its description. - - - Adjusted Present Value (APV) Enterprise Discounted Cash Flow (DCF) Discounted Economic

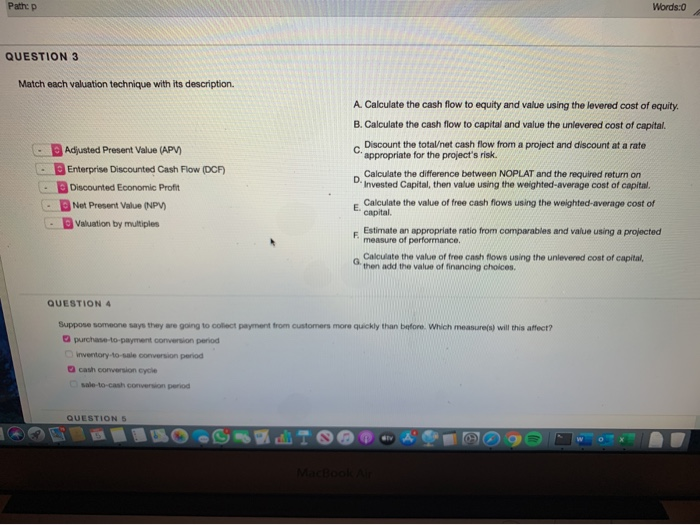

Pathep Words:0 QUESTION 3 Match each valuation technique with its description. - - - Adjusted Present Value (APV) Enterprise Discounted Cash Flow (DCF) Discounted Economic Profit Net Present Value (NPV) Valuation by multiples A. Calculate the cash flow to equity and value using the levered cost of equity B. Calculate the cash flow to capital and value the unlevered cost of capital. Discount the total net cash flow from a project and discount at a rate We appropriate for the project's risk. Calculate the difference between NOPLAT and the required return on . Invested Capital, then value using the weighted average cost of capital. Calculate the value of free cash flows using the weighted average cost of E capital - Estimate an appropriate ratio from comparables and value using a projected measure of performance. Calculate the value of free cash flows using the unlevered cost of capital, G.then add the value of financing choices. QUESTION 4 Suppose someone says they are going to collect payment from customers more quickly than before. Which measure(s) will this affect? purchase-to-payment conversion period inventory-to-sale conversion period cathcorersion cycle sale-to-cash conversion period QUESTIONS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts