Question: Match the bond described with the correct category (based on the relationship between the bond's yield and its coupon rate). Responses may be used more

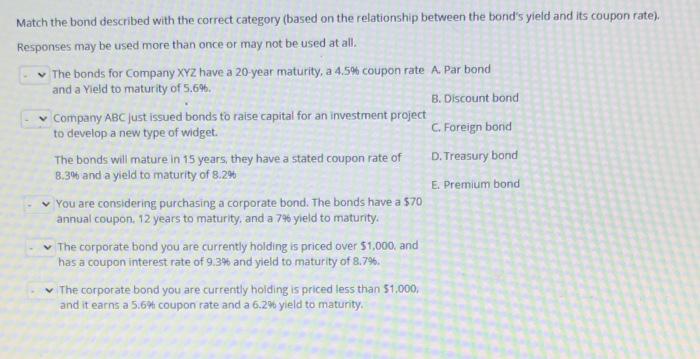

Match the bond described with the correct category (based on the relationship between the bond's yield and its coupon rate). Responses may be used more than once or may not be used at all. The bonds for Company XYZ have a 20-year maturity, a 4,5% coupon rate A. Par bond and a Yield to maturity of 5.6%. B. Discount bond Company ABC just issued bonds to raise capital for an investment project to develop a new type of widget. C. Foreign bond D. Treasury bond The bonds will mature in 15 years, they have a stated coupon rate of 8.3% and a yield to maturity of 8.2% E. Premium bond You are considering purchasing a corporate bond. The bonds have a 570 annual coupon 12 years to maturity, and a 74 yield to maturity The corporate bond you are currently holding is priced over $1,000, and has a coupon interest rate of 9.34 and yield to maturity of 8.7%. The corporate bond you are currently holding is priced less than 51,000, and it earns a 5.6 coupon rate and a 6.2% yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts