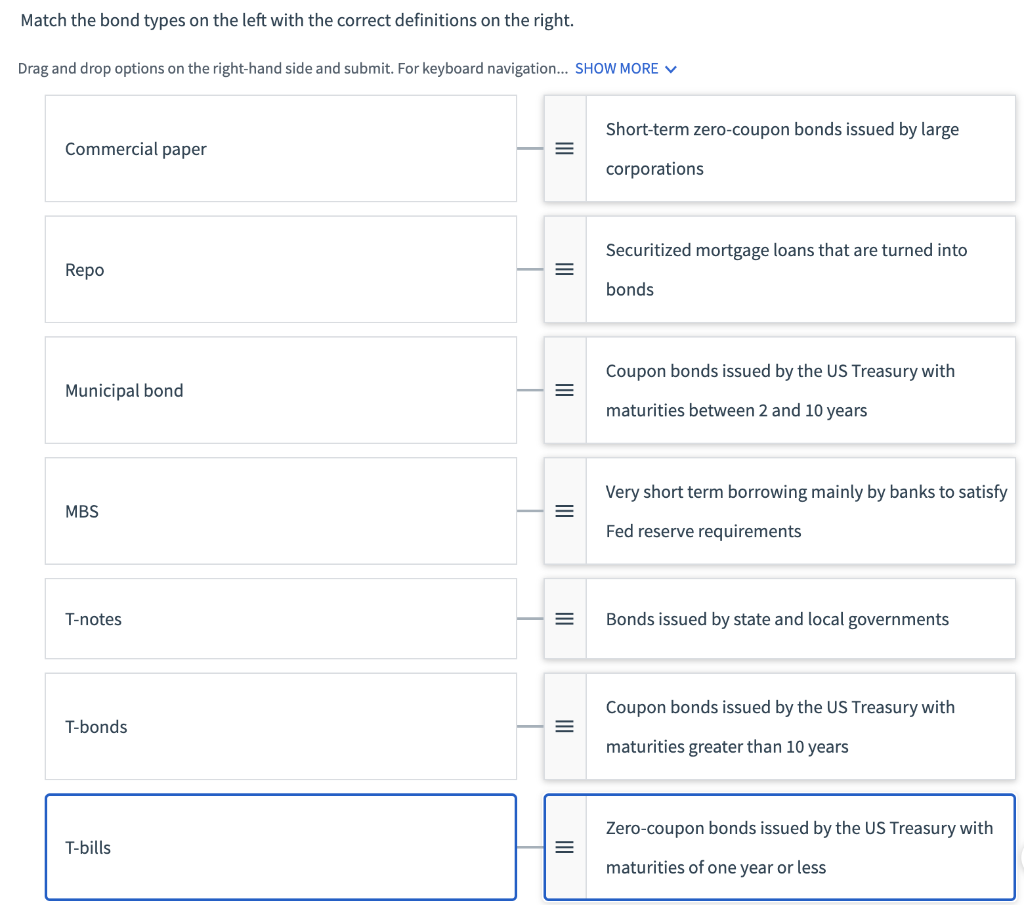

Question: Match the bond types on the left with the correct definitions on the right. Drag and drop options on the right-hand side and submit. For

Match the bond types on the left with the correct definitions on the right. Drag and drop options on the right-hand side and submit. For keyboard navigation... SHOW MORE Short-term zero-coupon bonds issued by large Commercial paper = corporations Securitized mortgage loans that are turned into Repo = bonds Coupon bonds issued by the US Treasury with Municipal bond III maturities between 2 and 10 years Very short term borrowing mainly by banks to satisfy MBS = Fed reserve requirements T-notes III Bonds issued by state and local governments Coupon bonds issued by the US Treasury with T-bonds = maturities greater than 10 years Zero-coupon bonds issued by the US Treasury with T-bills = maturities of one year or less Match the bond types on the left with the correct definitions on the right. Drag and drop options on the right-hand side and submit. For keyboard navigation... SHOW MORE Short-term zero-coupon bonds issued by large Commercial paper = corporations Securitized mortgage loans that are turned into Repo = bonds Coupon bonds issued by the US Treasury with Municipal bond III maturities between 2 and 10 years Very short term borrowing mainly by banks to satisfy MBS = Fed reserve requirements T-notes III Bonds issued by state and local governments Coupon bonds issued by the US Treasury with T-bonds = maturities greater than 10 years Zero-coupon bonds issued by the US Treasury with T-bills = maturities of one year or less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts