Question: match the following items: Select 1 -14 for this section only. Long-term interest rates reflect the average of expected short-term rates over the life of

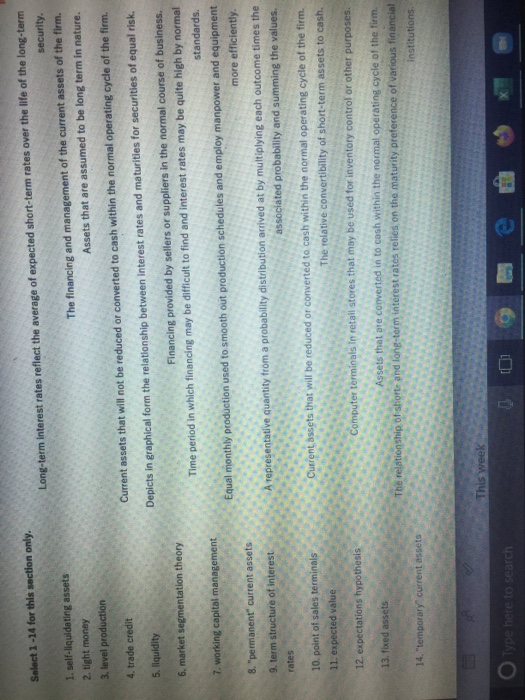

Select 1 -14 for this section only. Long-term interest rates reflect the average of expected short-term rates over the life of the long-term security. The financing and management of the current assets of the firm, Assets that are assumed to be long term in nature. 1. self-liquidating assets 2. tight money 3. level production Current assets that will not be reduced or converted to cash within the normal operating cycle of the firm 4. trade credit Depicts in graphical form the relationship between interest rates and maturities for securities of equal risk 5. liquidity 6. market segmentation theory 7. working capital management Financing provided by sellers or suppliers in the normal course of business Time period in which financing may be difficult to find and interest rates may be quite high by normal standards. Equal monthly production used to smooth out production schedules and employ manpower and equipmen. more efficiently. representative quantity from a probability distribution arrived at by multiplying each outcome times the associated probability and summing the values. 8. "permanent current assets 9. term structure of interest rates 10. point of sales terminals 11. expected value Current assets that will be reduced or converted to cash within the normal operating cycle of the firm. The relative convertibility of short-term assets to cash. Computer terminals in retail stores that may be used for inventory control or other purposes. 12. expectations hypothesis 13. fixed assets Assets that are converted in to cash within the normal operating cycle of the firm. The relationship of short and long-term interest rates relies on the maturity preference of various financial institutions. 14. "temporary current assets This week O type here to search 009

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts