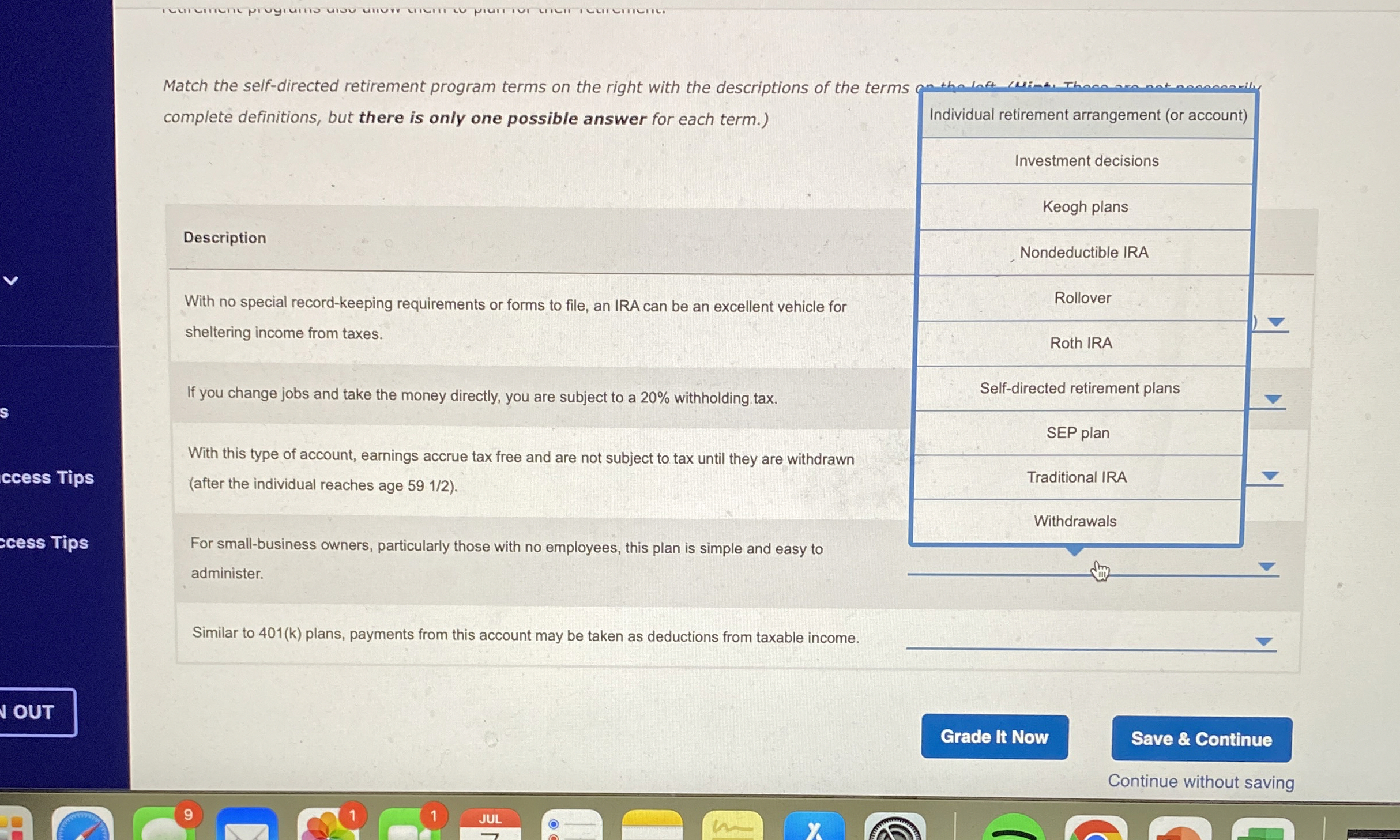

Question: Match the self - directed retirement program terms on the right with the descriptions of the terms complete definitions, but there is only one possible

Match the selfdirected retirement program terms on the right with the descriptions of the terms complete definitions, but there is only one possible answer for each term.

With no special recordkeeping requirements or forms to file, an IRA can be an excellent vehicle for sheltering income from taxes.

If you change jobs and take the money directly, you are subject to a withholding tax.

With this type of account, earnings accrue tax free and are not subject to tax until they are withdrawn after the individual reaches age

For smallbusiness owners, particularly those with no employees, this plan is simple and easy to administer.

Similar to plans, payments from this account may be taken as deductions from taxable income.

Continue without saving

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock