Question: Match the terms relating to the basic terminology and concepts of personal finance on the left with the descriptions of the terms on the right.

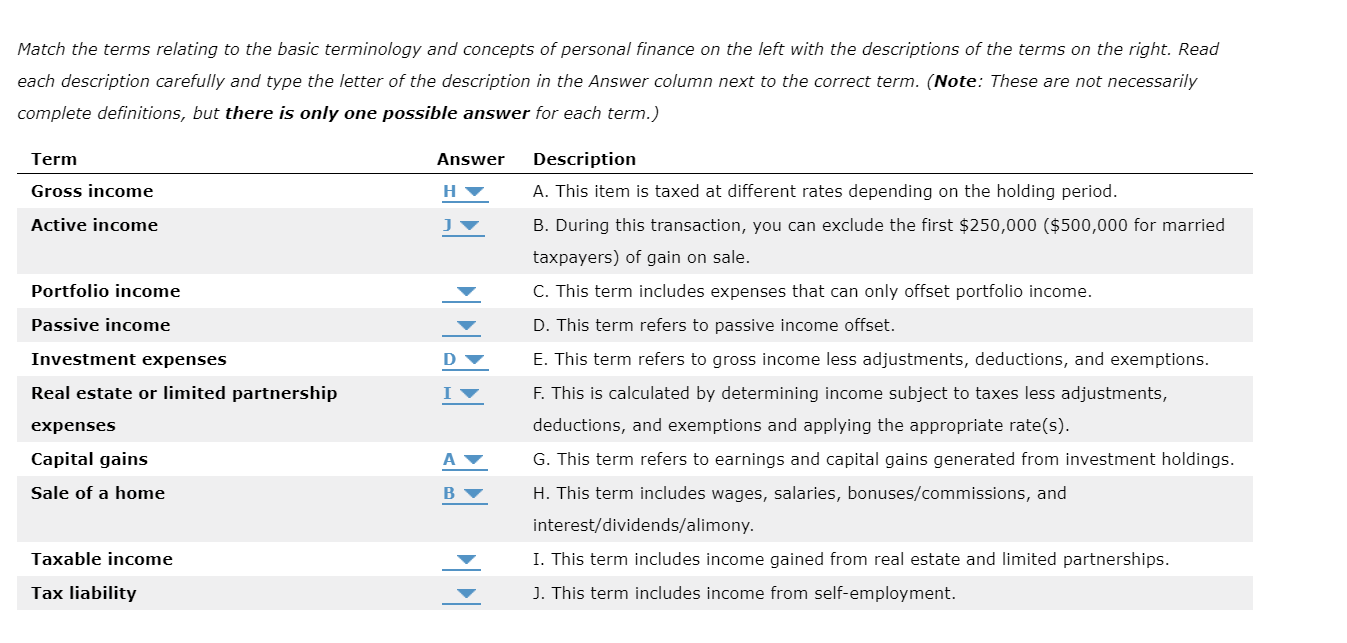

Match the terms relating to the basic terminology and concepts of personal finance on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term. (Note: These are not necessarily complete definitions, but there is only one possible answer for each term.) Term Answer Gross income Active income Portfolio income Passive income Investment expenses D Description A. This item is taxed at different rates depending on the holding period. B. During this transaction, you can exclude the first $250,000 ($500,000 for married taxpayers) of gain on sale. C. This term includes expenses that can only offset portfolio income. D. This term refers to passive income offset. E. This term refers to gross income less adjustments, deductions, and exemptions. F. This is calculated by determining income subject to taxes less adjustments, deductions, and exemptions and applying the appropriate rate(s). G. This term refers to earnings and capital gains generated from investment holdings. H. This term includes wages, salaries, bonuses/commissions, and interest/dividends/alimony. I. This term includes income gained from real estate and limited partnerships. J. This term includes income from self-employment. Real estate or limited partnership expenses Capital gains A Sale of a home B Taxable income Tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts