Question: Match the terms with the definition or description. - Private firms that are used by the Fed to carry out open market operations - Open

Match the terms with the definition or description.

|

|

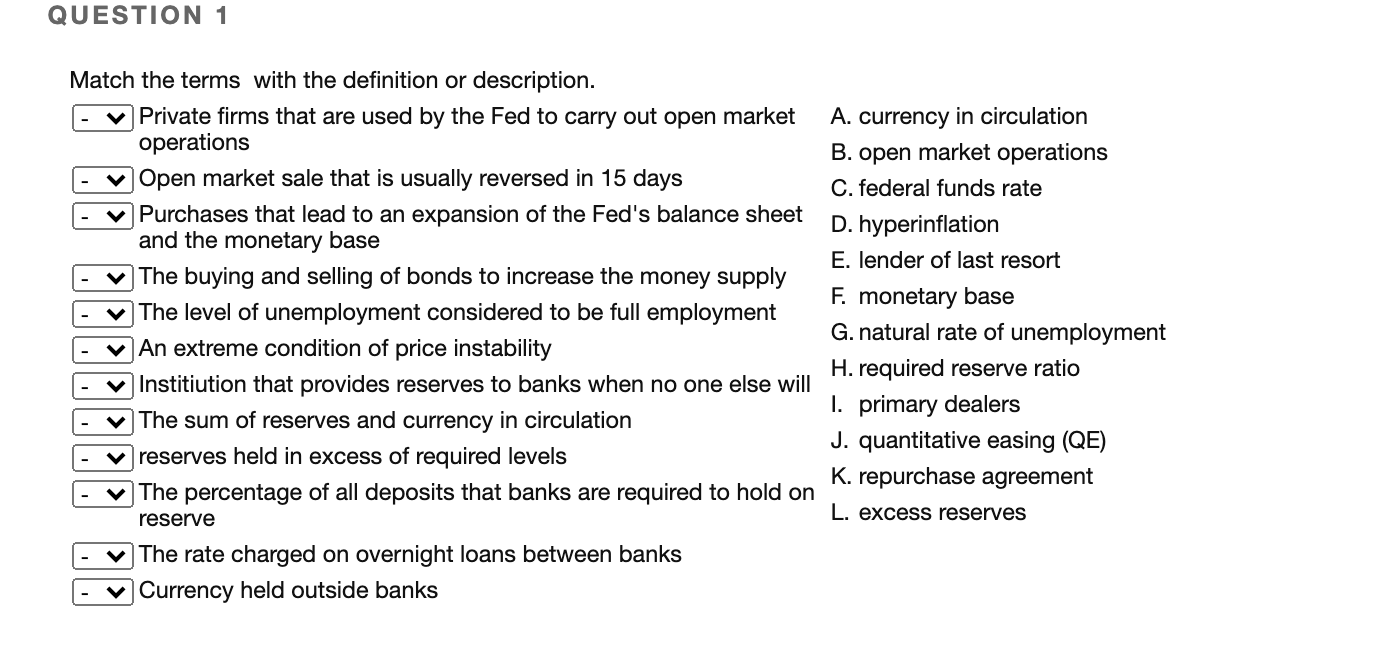

QUESTION 1 Match the terms with the definition or description. Private firms that are used by the Fed to carry out open market operations Open market sale that is usually reversed in 15 days Purchases that lead to an expansion of the Fed's balance sheet and the monetary base The buying and selling of bonds to increase the money supply The level of unemployment considered to be full employment v An extreme condition of price instability v Institiution that provides reserves to banks when no one else will The sum of reserves and currency in circulation V reserves held in excess of required levels The percentage of all deposits that banks are required to hold on A. currency in circulation B. open market operations C. federal funds rate D. hyperinflation E. lender of last resort F. monetary base G. natural rate of unemployment H. required reserve ratio I. primary dealers J. quantitative easing (QE) K. repurchase agreement L. excess reserves reserve The rate charged on overnight loans between banks Currency held outside banks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts