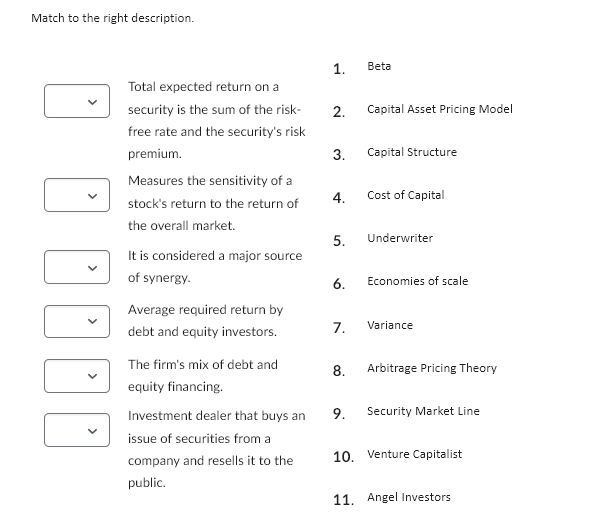

Question: Match to the right description. 1. Beta Total expected return on a security is the sum of the risk- 2. Capital Asset Pricing Model free

Match to the right description. 1. Beta Total expected return on a security is the sum of the risk- 2. Capital Asset Pricing Model free rate and the security's risk premium. 3. Capital Structure Measures the sensitivity of a stock's return to the return of 4. Cost of Capital the overall market. It is considered a major source 5. Underwriter of synergy. 6. Economies of scale Average required return by debt and equity investors. 7. Variance The firm's mix of debt and equity financing. 8. Arbitrage Pricing Theory Investment dealer that buys an 9. Security Market Line issue of securities from a company and resells it to the 10. Venture Capitalist public. 11. Angel Investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts