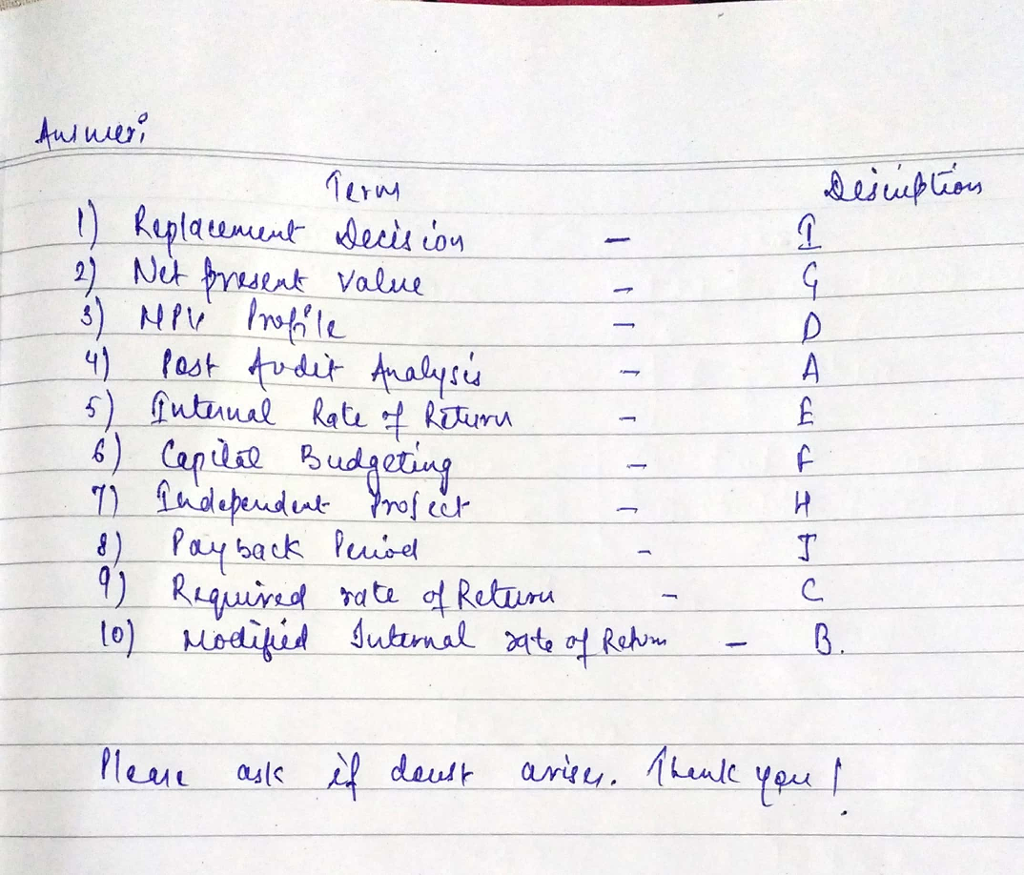

Question: Matching terms needed? A curve showing the relationship between a projectss net present value (NPV) and various discount rates. This analysis is conducted following the

Matching terms needed?

| A curve showing the relationship between a projectss net present value (NPV) and various discount rates. | |

| This analysis is conducted following the implementation of an accepted capital project and is intended to improve a firms forecasting process and to improve the firms operations. | |

| The discount rate that equates the present value of a capital projects expected cash inflows and its initial cost. | |

| A term used to describe a firms required rate of return; this value is used as the hurdle against which a projects internal rate of return is compared to ascertain whether a project is acceptable. | Post-audit analysis |

| A capital budgeting analysis that determines whether a capital asset should take the place of an existing asset to maintain or improve a firms existing operations. | Replacement decision |

| The decision rule for this capital budgeting method states a project should be considered acceptable if its calculated return is greater than or equal to the firms required rate of return. | |

| The acceptance or rejection decision made for this type of project does not affect the acceptance or rejection of another proposed capital project. | |

| A capital budgeting method whose key value is calculated as the difference between the discounted value of an assets future cash inflows and its purchase price. | |

| This value is calculated by summing a projects expected annual cash inflows until their cumulative value equals the projects initial cost. | |

| The process of analyzing projects and deciding which are acceptable investments and which actually should be purchased. |

Terms to use.:

uwer Loy 2) Nut enk Value rata of Reti

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts