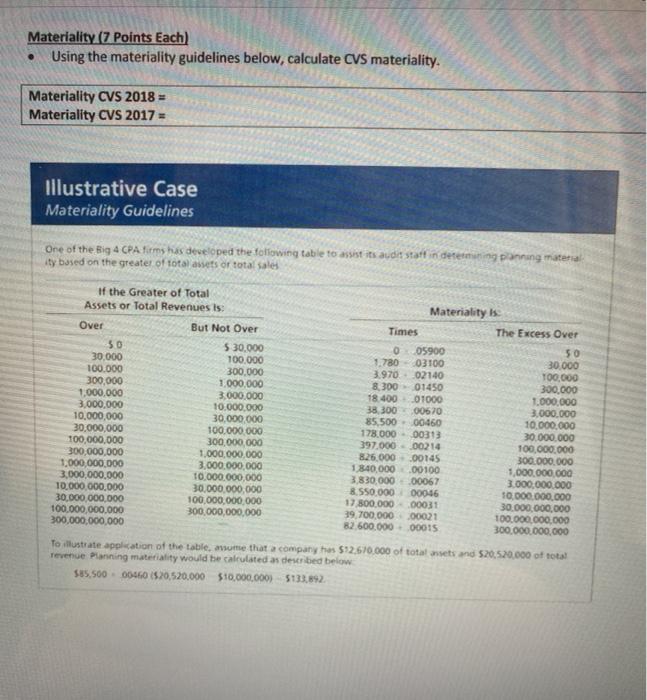

Question: Materiality (7 Points Each) Using the materiality guidelines below, calculate CVS materiality. . Materiality CVS 2018 = Materiality CVS 2017 = Illustrative Case Materiality Guidelines

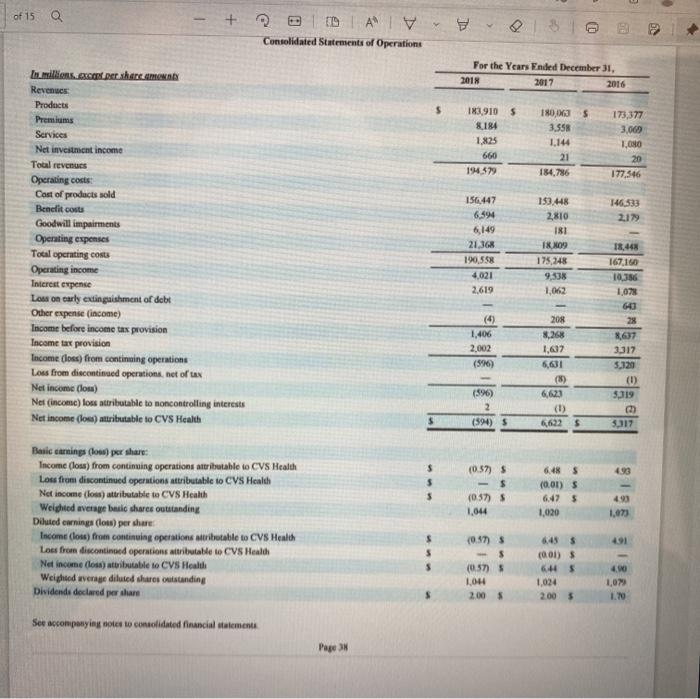

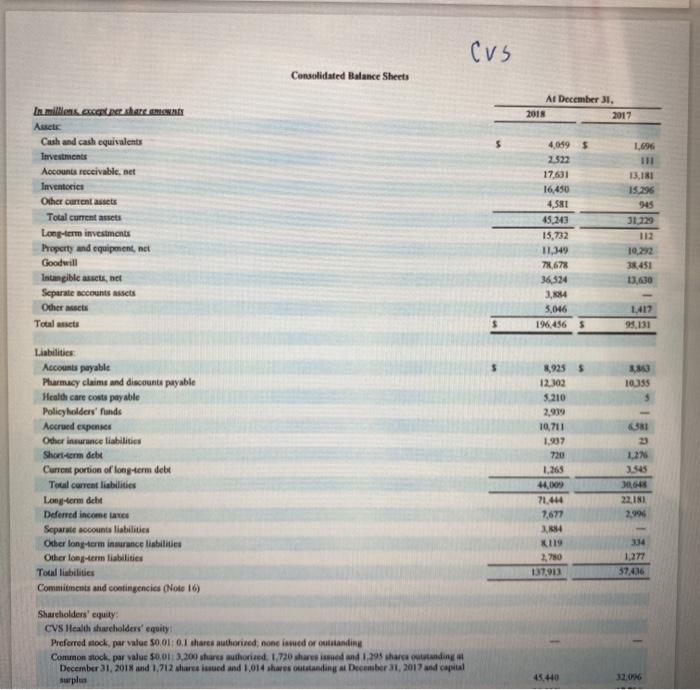

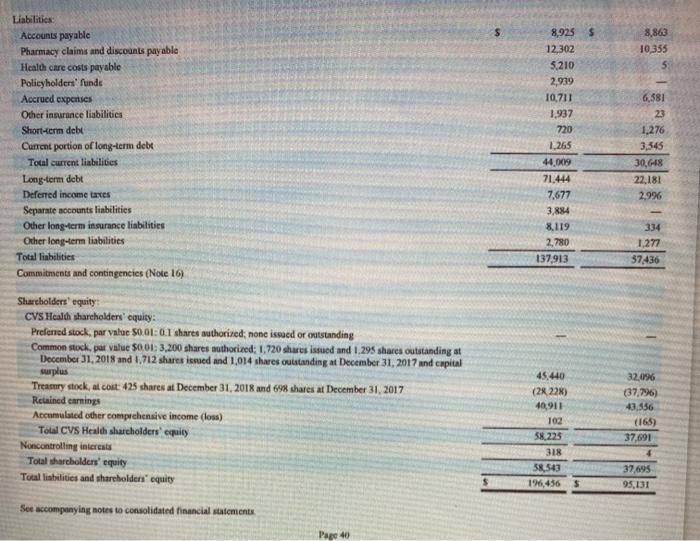

Materiality (7 Points Each) Using the materiality guidelines below, calculate CVS materiality. . Materiality CVS 2018 = Materiality CVS 2017 = Illustrative Case Materiality Guidelines One of the Big 4 CPA firms has developed the following table to assist its audio staff in determining paning material ity based on the greater of total asets or total sales If the Greater of Total Assets or Total Revenues is: Over But Not Over 50 30.000 100.000 300,000 1,000,000 3.000.000 10,000,000 30,000,000 100,000,000 300,000,000 1.000.000.000 3,000,000,000 10.000.000.000 30.000.000.000 100.000.000.000 300,000,000,000 5 30.000 100.000 300.000 1.000.000 3.000.000 10.000.000 30.000.000 100.000 000 300,000,000 1.000.000.000 3.000.000.000 10.000.000.000 30,000,000,000 100,000,000,000 300,000,000,000 Materiality is Times The Excess Over 05900 50 1.780 03100 30.000 3.970 02140 100.000 8.30001450 300,000 18.400 01000 1.000.000 38.300 00670 3.000.000 85.500- 00460 10.000.000 178.000 00313 30.000.000 397,000-00214 100.000.000 826.000.00145 300 000 000 1840.000 .00100 1.000.000.000 3,830.000.00067 3.000.000.000 8.550.000 00046 10,000,000,000 17 800.000 00031 30,000,000,000 39,700,00000021 100.000.000.000 82.600.000 - 00015 300.000.000.000 To illustrate application of the table, anume that a company has $12,670.000 of total anses and 520,520,000 of total revenue Planning materiality would be calculated as described below 585,500.00460 ($20,520.000 $10,000,000) $133,892 cus Consolidated Balance Sheets At December 31. 2018 2017 1,696 13,181 15.296 In million cente Act Cash and cash equivalents Investments Accounts receivable, net Inventories Other current assets Total current assets Long-term investments Property and equipment, net Goodwill Intangible assets, net Separate accounts assets Others Total assets 4,0595 2322 17,631 16,450 4,581 45,243 15,732 11,349 7,67 36,324 3.884 5,046 196.456 5 31.129 112 19,232 38.451 13,60 1,411 95,131 1055 Liabilities Accounts payable Plurmacy claims and discounts payable Health care costs payable Policyholders' funds Accrued expenses Other insurance liabilities Shortcm dcbe Current portion of long-term debt Toul current liabilities Long-term dicht Deferred Incomeans Separate accounts liabilities Other long-term insurance liabilities Other long-term liabilities Toul liabilities Commitments and contingencies (Noto 16) 8,9255 12.302 3.210 2,939 10.711 1.907 720 1,263 44,00 71.444 7,677 UN 1545 3,645 2218 2,99 119 2.70 137.913 334 1,277 57.06 Shareholders' equity CVS Health shareholders' equity Preferred sock, par value 0.01 0.1 shares authorized: none isvuod eranding Common stock. par value $0,011 3.200 shares authorized: 1,720 share med and 1.195 share and December 31, 2018 and 1.712 shares inued and 1.014 sharescottanding December 31, 2017 and capital surplus 45.440 32.096 $ 8,863 10,355 Liabilities Accounts payable Pharmacy claims and discounts payable Health care costs payable Policyholders' funds Accrued expenses Other insurance liabilities Short-term debt Carrent portion of long-term debt Total current liabilities Long-term debt Deferred income taxes Separate accounts liabilities Other long-term insurance liabilities Other long-term liabilities Total liabilities Commitments and contingencies (Note 16) 8,925 12,302 5.210 2,939 10,711 1,937 720 1.265 44.0619 71.444 7,677 3,884 8.119 2,780 137,913 6,581 23 1,276 3,545 30,648 22,181 2946 334 1,277 57,436 Shareholders' equity CVS Health shareholders' equity: Preferred stock, par value 50.01: 0.1 shares authorized: none issued or cutstanding Common stock par value 5001: 3.200 shares authorized: 1,720 shares issued and 1.295 shares outstanding at December 31, 2018 and 1,712 shares issued and 1.014 shares outstanding at December 31, 2017 and capital surplus Treamry stock, al cost: 425 shares at December 31, 2018 and 69% shares at December 31, 2017 Retained earnings Accumulated other comprehensive income (los) Toll CVS Health shareholders' cquity Noncontrolling interests Total shareholders' equity Total liabilities and shareholders equity 32,06 (37,746) 43,536 45,440 (28.228) 40,911 102 58.225 318 38,543 14,456 5 37,691 4 37,695 95,131 See accompanying notes to consolidated financial statements Page 40 Materiality (7 Points Each) Using the materiality guidelines below, calculate CVS materiality. . Materiality CVS 2018 = Materiality CVS 2017 = Illustrative Case Materiality Guidelines One of the Big 4 CPA firms has developed the following table to assist its audio staff in determining paning material ity based on the greater of total asets or total sales If the Greater of Total Assets or Total Revenues is: Over But Not Over 50 30.000 100.000 300,000 1,000,000 3.000.000 10,000,000 30,000,000 100,000,000 300,000,000 1.000.000.000 3,000,000,000 10.000.000.000 30.000.000.000 100.000.000.000 300,000,000,000 5 30.000 100.000 300.000 1.000.000 3.000.000 10.000.000 30.000.000 100.000 000 300,000,000 1.000.000.000 3.000.000.000 10.000.000.000 30,000,000,000 100,000,000,000 300,000,000,000 Materiality is Times The Excess Over 05900 50 1.780 03100 30.000 3.970 02140 100.000 8.30001450 300,000 18.400 01000 1.000.000 38.300 00670 3.000.000 85.500- 00460 10.000.000 178.000 00313 30.000.000 397,000-00214 100.000.000 826.000.00145 300 000 000 1840.000 .00100 1.000.000.000 3,830.000.00067 3.000.000.000 8.550.000 00046 10,000,000,000 17 800.000 00031 30,000,000,000 39,700,00000021 100.000.000.000 82.600.000 - 00015 300.000.000.000 To illustrate application of the table, anume that a company has $12,670.000 of total anses and 520,520,000 of total revenue Planning materiality would be calculated as described below 585,500.00460 ($20,520.000 $10,000,000) $133,892 cus Consolidated Balance Sheets At December 31. 2018 2017 1,696 13,181 15.296 In million cente Act Cash and cash equivalents Investments Accounts receivable, net Inventories Other current assets Total current assets Long-term investments Property and equipment, net Goodwill Intangible assets, net Separate accounts assets Others Total assets 4,0595 2322 17,631 16,450 4,581 45,243 15,732 11,349 7,67 36,324 3.884 5,046 196.456 5 31.129 112 19,232 38.451 13,60 1,411 95,131 1055 Liabilities Accounts payable Plurmacy claims and discounts payable Health care costs payable Policyholders' funds Accrued expenses Other insurance liabilities Shortcm dcbe Current portion of long-term debt Toul current liabilities Long-term dicht Deferred Incomeans Separate accounts liabilities Other long-term insurance liabilities Other long-term liabilities Toul liabilities Commitments and contingencies (Noto 16) 8,9255 12.302 3.210 2,939 10.711 1.907 720 1,263 44,00 71.444 7,677 UN 1545 3,645 2218 2,99 119 2.70 137.913 334 1,277 57.06 Shareholders' equity CVS Health shareholders' equity Preferred sock, par value 0.01 0.1 shares authorized: none isvuod eranding Common stock. par value $0,011 3.200 shares authorized: 1,720 share med and 1.195 share and December 31, 2018 and 1.712 shares inued and 1.014 sharescottanding December 31, 2017 and capital surplus 45.440 32.096 $ 8,863 10,355 Liabilities Accounts payable Pharmacy claims and discounts payable Health care costs payable Policyholders' funds Accrued expenses Other insurance liabilities Short-term debt Carrent portion of long-term debt Total current liabilities Long-term debt Deferred income taxes Separate accounts liabilities Other long-term insurance liabilities Other long-term liabilities Total liabilities Commitments and contingencies (Note 16) 8,925 12,302 5.210 2,939 10,711 1,937 720 1.265 44.0619 71.444 7,677 3,884 8.119 2,780 137,913 6,581 23 1,276 3,545 30,648 22,181 2946 334 1,277 57,436 Shareholders' equity CVS Health shareholders' equity: Preferred stock, par value 50.01: 0.1 shares authorized: none issued or cutstanding Common stock par value 5001: 3.200 shares authorized: 1,720 shares issued and 1.295 shares outstanding at December 31, 2018 and 1,712 shares issued and 1.014 shares outstanding at December 31, 2017 and capital surplus Treamry stock, al cost: 425 shares at December 31, 2018 and 69% shares at December 31, 2017 Retained earnings Accumulated other comprehensive income (los) Toll CVS Health shareholders' cquity Noncontrolling interests Total shareholders' equity Total liabilities and shareholders equity 32,06 (37,746) 43,536 45,440 (28.228) 40,911 102 58.225 318 38,543 14,456 5 37,691 4 37,695 95,131 See accompanying notes to consolidated financial statements Page 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts