Question: Math and Risk Applicants - Case Study Sam's Portfolio Date 2021-01-17 Long Company Name Ticker Industry Sector CSX Corp CSX US Equity Industrial Chevron Corp

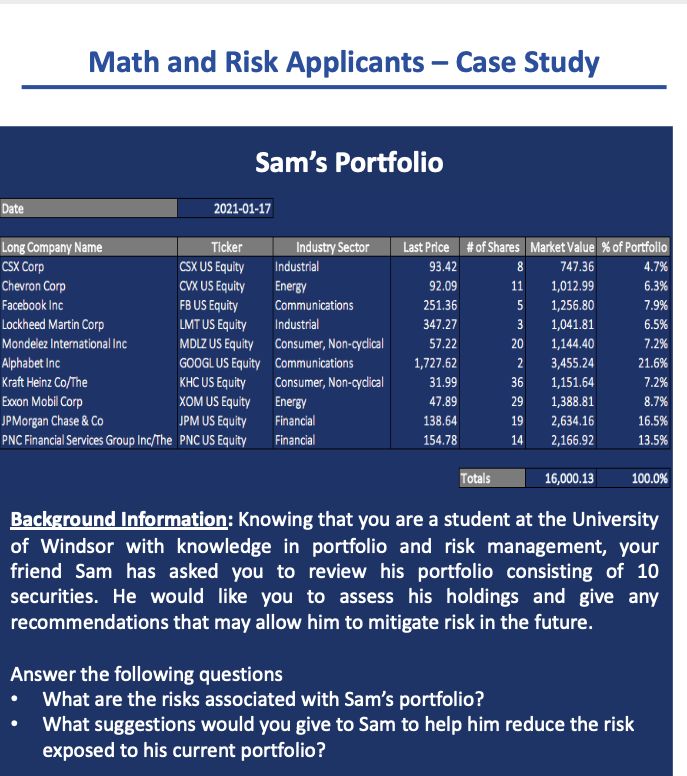

Math and Risk Applicants - Case Study Sam's Portfolio Date 2021-01-17 Long Company Name Ticker Industry Sector CSX Corp CSX US Equity Industrial Chevron Corp CVX US Equity Energy Facebook Inc FB US Equity Communications Lockheed Martin Corp LMT US Equity Industrial Mondelez International Inc MDLZ US Equity Consumer, Non-cyclical Alphabet Inc GOOGL US Equity Communications Kraft Heinz Co/The KHC US Equity Consumer, Non-cyclical Exxon Mobil Corp XOM US Equity Energy JPMorgan Chase & Co JPM US Equity Financial PNC Financial Services Group Inc/The PNC US Equity Financial Last Price # of Shares Market Value % of Portfolio 93.42 8 747.36 4.7% 92.09 11 1,012.99 6.3% 251.36 5 1,256.80 7.9% 347.27 3 1,041.81 6.5% 57.22 20 1,144.40 7.2% 1,727.62 2 3,455.24 21.6% 31.99 36 1,151.64 7.2% 47.89 29 1,388.81 8.7% 138.64 19 2,634.16 16.5% 154.78 14 2,166.92 13.5% Totals 16,000.13 100.0% Background Information: Knowing that you are a student at the University of Windsor with knowledge in portfolio and risk management, your friend Sam has asked you to review his portfolio consisting of 10 securities. He would like you to assess his holdings and give any recommendations that may allow him to mitigate risk in the future. Answer the following questions What are the risks associated with Sam's portfolio? What suggestions would you give to Sam to help him reduce the risk exposed to his current portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts