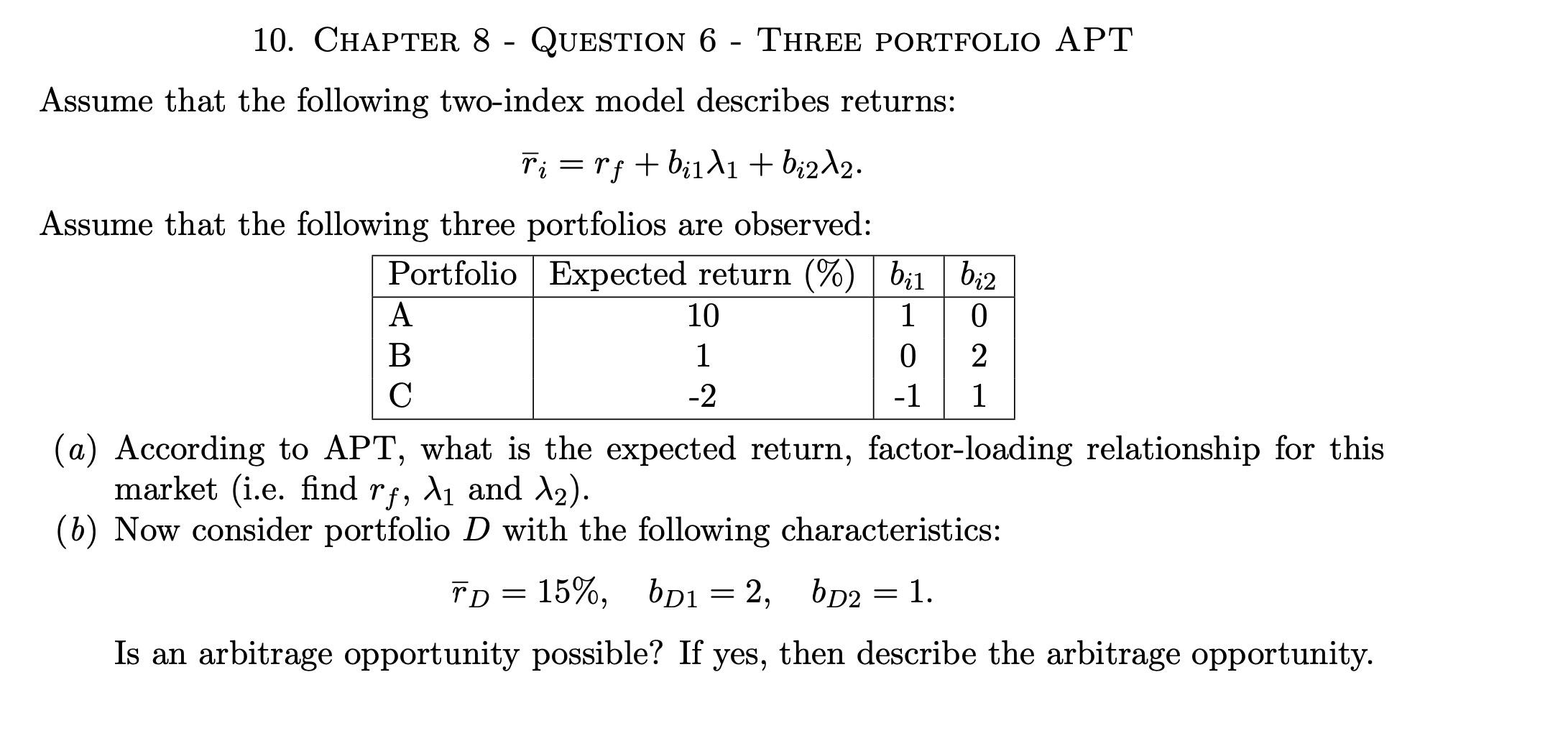

Question: - - 10. CHAPTER 8 - QUESTION 6 - THREE PORTFOLIO APT Assume that the following two-index model describes returns: Ti = rf + billi

- - 10. CHAPTER 8 - QUESTION 6 - THREE PORTFOLIO APT Assume that the following two-index model describes returns: Ti = rf + billi + biz 12. = A C Assume that the following three portfolios are observed: Portfolio Expected return (%) bil biz 10 1 0 B 1 0 2 -2 -1 1 (a) According to APT, what is the expected return, factor-loading relationship for this market (i.e. find rf, l1 and 12). 11 (6) Now consider portfolio D with the following characteristics: ro= 15%, bp1 = 2, bp2 = 1. = = - > Is an arbitrage opportunity possible? If yes, then describe the arbitrage opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts