Question: ( $ ) ( mathbf { x } ) Feedback v Check My Work To reduce the tax savings

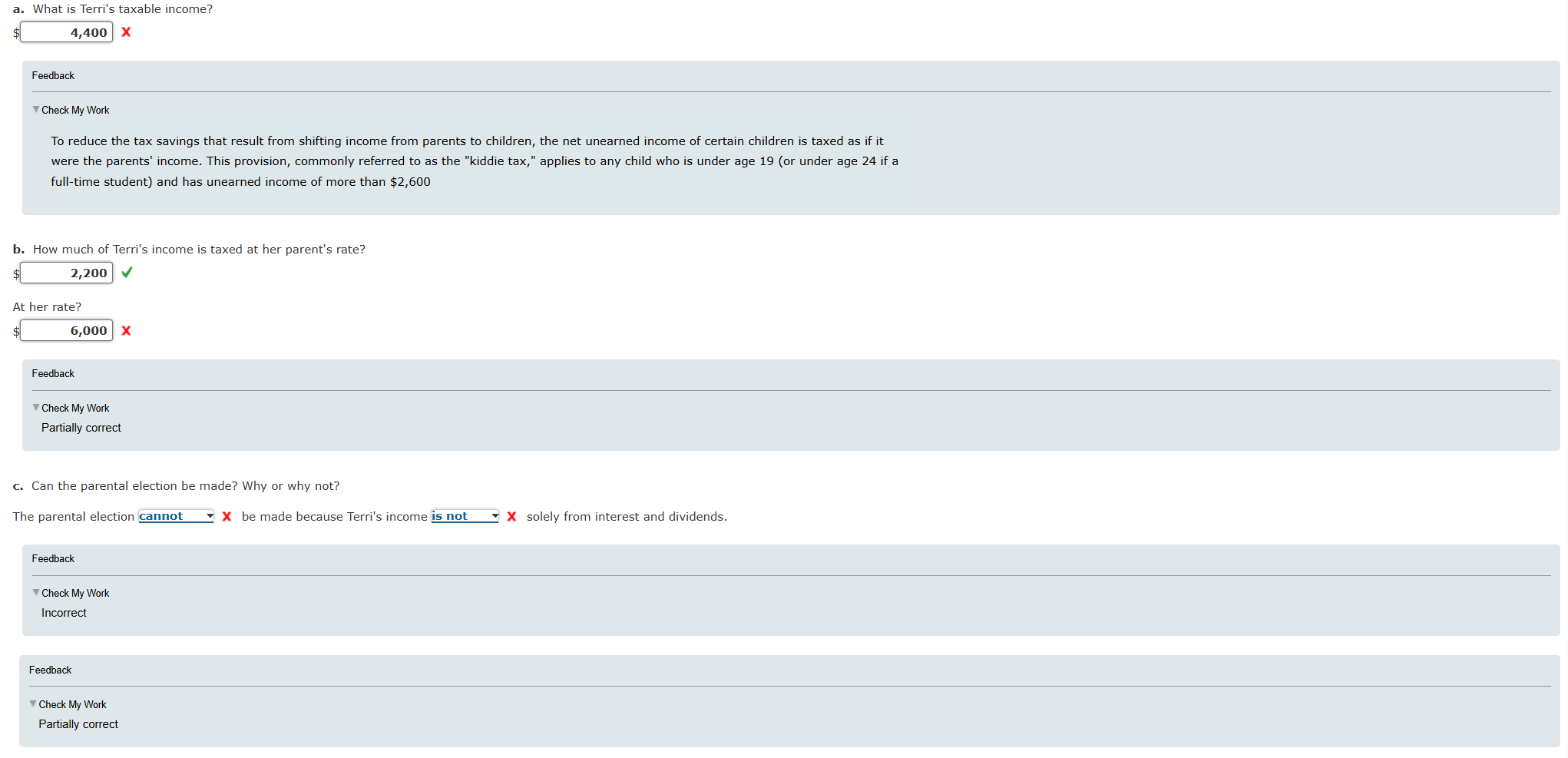

$ mathbfx Feedback v Check My Work To reduce the tax savings that result from shifting income from parents to children, the net unearned income of certain children is taxed as if it were the parents' income. This provision, commonly referred to as the "kiddie tax," applies to any child who is under age or under age if a fulltime student and has unearned income of more than $ b How much of Terri's income is taxed at her parent's rate? $ At her rate? Feedback v Check My Work Partially correct c Can the parental election be made? Why or why not? The parental election cannot boldsymbolX be made because Terri's income is not mathbfX solely from interest and dividends. Feedback T Check My Work Incorrect Feedback Vheck My Work Partially correct

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock