Question: Mathematical solutions needed Consider the following problem, (based on William Poole, 1970. Optimal choice of monetary policy instruments in a simple stochastic macro model, Quar-

Mathematical solutions needed

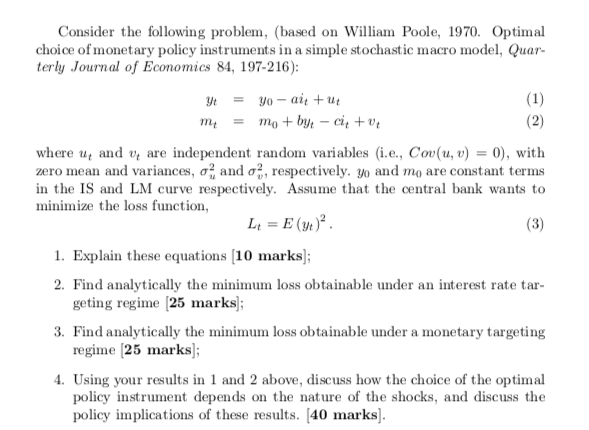

Consider the following problem, (based on William Poole, 1970. Optimal choice of monetary policy instruments in a simple stochastic macro model, Quar- terly Journal of Economics 84, 197-216): y m = = yo - ait u mo + by - ci + (2) where u and u are independent random variables (i.e., Cov(u, v) = 0), with zero mean and variances, and o, respectively. 3 and mo are constant terms in the IS and LM curve respectively. Assume that the central bank wants to minimize the loss function, L = E(91) 1. Explain these equations (10 marks); 2. Find analytically the minimum loss obtainable under an interest rate tar- geting regime 25 marks); 3. Find analytically the minimum loss obtainable under a monetary targeting regime [25 marks); 4. Using your results in 1 and 2 above, discuss how the choice of the optimal policy instrument depends on the nature of the shocks, and discuss the policy implications of these results. [40 marks). Consider the following problem, (based on William Poole, 1970. Optimal choice of monetary policy instruments in a simple stochastic macro model, Quar- terly Journal of Economics 84, 197-216): y m = = yo - ait u mo + by - ci + (2) where u and u are independent random variables (i.e., Cov(u, v) = 0), with zero mean and variances, and o, respectively. 3 and mo are constant terms in the IS and LM curve respectively. Assume that the central bank wants to minimize the loss function, L = E(91) 1. Explain these equations (10 marks); 2. Find analytically the minimum loss obtainable under an interest rate tar- geting regime 25 marks); 3. Find analytically the minimum loss obtainable under a monetary targeting regime [25 marks); 4. Using your results in 1 and 2 above, discuss how the choice of the optimal policy instrument depends on the nature of the shocks, and discuss the policy implications of these results. [40 marks)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock