Question: Consider the following problem, based on a simplified version of Poole (1970), (William Poole, 1970. Optimal choice of monetary policy instruments in a simple stochastic

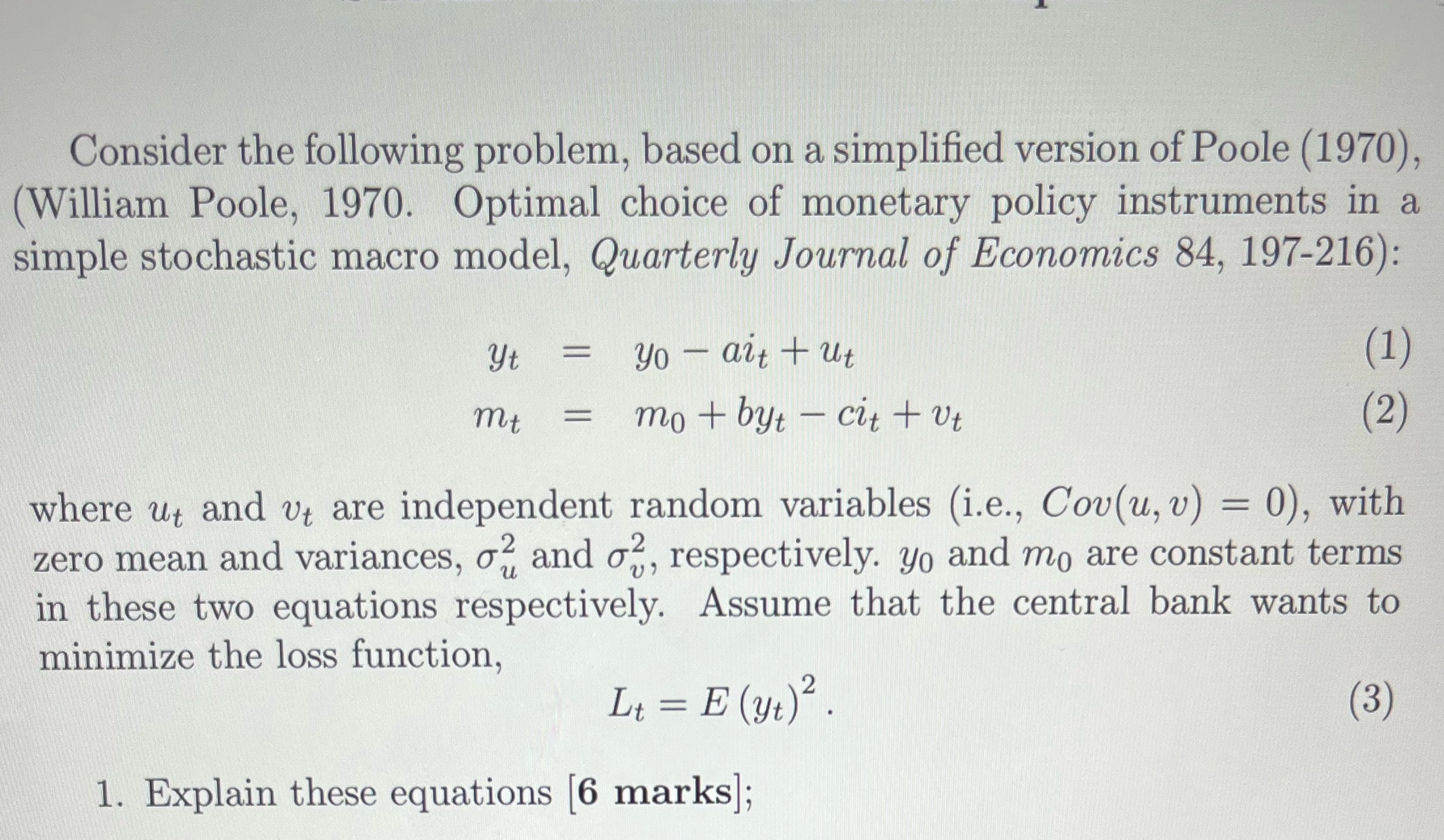

Consider the following problem, based on a simplified version of Poole (1970), (William Poole, 1970. Optimal choice of monetary policy instruments in a simple stochastic macro model, Quarterly Journal of Economics 84, 197-216): yt = yo - art + ut (1) mt = mo + byt - cit + ut (2 ) where ut and vt are independent random variables (i.e., Cov(u, v) = 0), with zero mean and variances, o, and o?, respectively. yo and mo are constant terms in these two equations respectively. Assume that the central bank wants to minimize the loss function, Lt = E (yt) 2 . (3) 1. Explain these equations 6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts